SEC Crypto Enforcement Actions Reach Eight Year Low Under Atkins Leadership

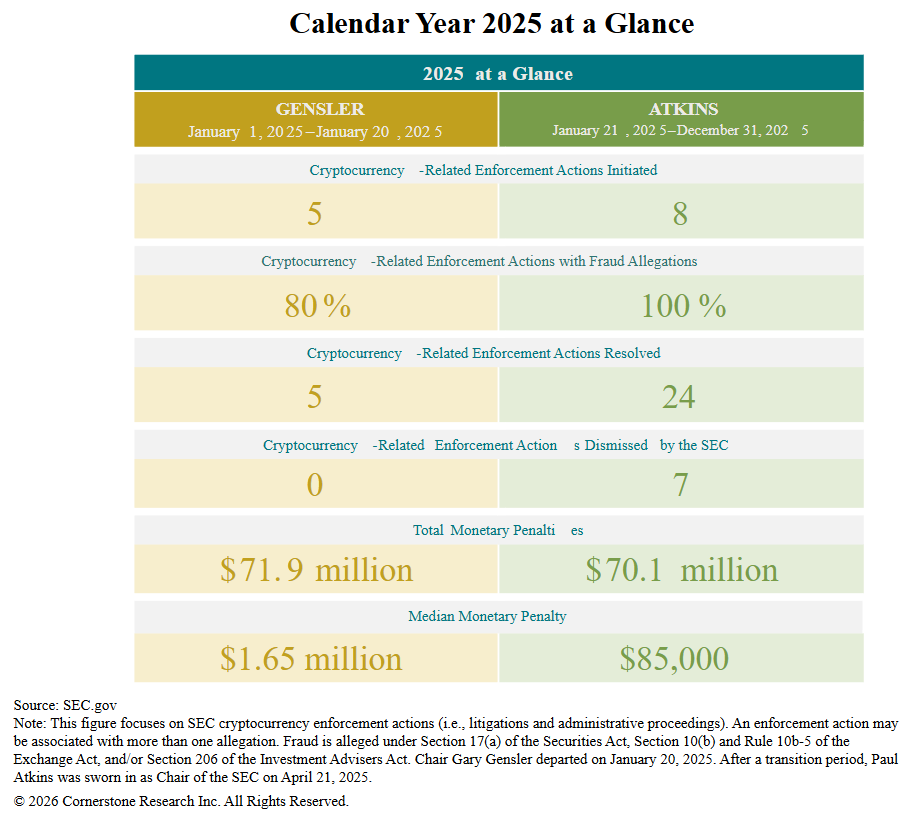

The U.S. Securities and Exchange Commission has dramatically scaled back its cryptocurrency enforcement activity during the 2025 year, marking the lowest level in eight years. A new 2026 report covering last year from Cornerstone Research, shows the agency initiated only 13 crypto-related actions during the year, a 60% drop from the 33 actions filed in 2024. This sharp reduction signals a clear departure from the aggressive approach that defined the prior Biden administration and suggests a new era of regulatory restraint is taking hold.

The crypto industry has long criticized the SEC’s previous strategy of “regulation by enforcement” for creating uncertainty and driving innovation overseas. Under Chair Paul Atkins, who assumed leadership in early 2025, the Commission appears to be prioritizing fraud prevention over broad jurisdictional claims. Of the eight actions initiated after Atkins took office, every case included allegations of fraud rather than novel theories about crypto token classification.

Harmonization Takes Center Stage

The decline in enforcement activity coincides with a broader push to align SEC and Commodity Futures Trading Commission oversight of digital assets. Chairman Paul Atkins and CFTC Chairman Michael Selig announced they will host a joint public event on January 27, 2026, at SEC headquarters to discuss ongoing coordination efforts. The agencies aim to reduce overlapping and conflicting requirements that have frustrated market participants for years.

In a joint statement released this week, Atkins and Selig emphasized the need to replace outdated jurisdictional divisions with a unified framework. They described current regulatory boundaries as unclear and misaligned, often forcing companies to navigate conflicting rules based on legacy distinctions rather than economic reality. The upcoming event builds on earlier commitments to support President Trump’s goal of establishing the United States as the global leader in cryptocurrency and blockchain technology, as the crypto capital of the world.

Monetary penalties collected from digital asset participants also fell sharply in 2025, totaling just $142 million compared to billions in prior years. Seven enforcement cases were voluntarily dismissed by the SEC under Atkins, further illustrating the agency’s reduced appetite for prolonged litigation. Cornerstone Research principal Robert Letson noted that the 2025 actions reflect a deliberate shift consistent with the priorities Atkins outlined upon taking office.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishThis appears to be a welcomed the change in direction, viewed as a step toward greater legal certainty. Companies and investors have repeatedly argued that clear rules, rather than case-by-case enforcement, provide the foundation for responsible growth. The planned SEC-CFTC dialogue next week offers the first detailed public look at how the agencies intend to deliver that clarity.

The 2025 data underscores a pivotal moment for U.S. digital asset regulation. After years of intensive enforcement that targeted everything from initial coin offerings to DeFi protocols, the SEC now appears focused on addressing clear misconduct while working collaboratively with its sister agency. Whether this measured approach will continue throughout 2026 remains a key question for the entire cryptocurrency ecosystem.