November 2025 Bitcoin and Crypto Market Sees Volatility Tempered by Institutional Growth

The markets have traversed a challenging yet resilient November, as Bitcoin and other crypto assets grappled with downward pressures while institutional interest continued to build momentum. We have released our latest monthly Bitcoin and Crypto Insights report, offering a detailed recap of the past month that highlights an environment defined by caution and opportunity. Published during the first week of each month exclusively for paid subscribers, this comprehensive analysis captures the key events shaping Bitcoin and other major cryptocurrencies including the broader ecosystem.

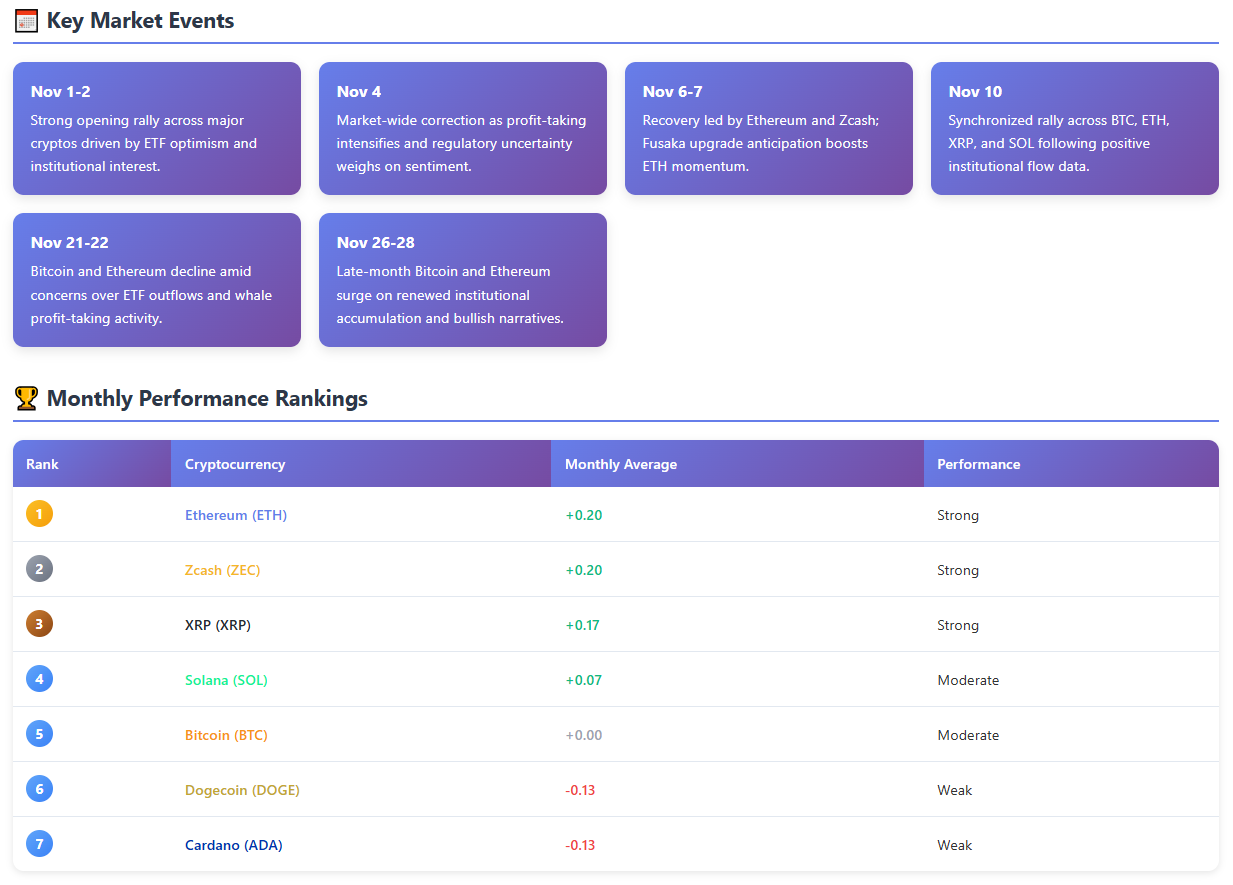

November delivered a mix of setbacks and promising signals that kept traders and investors on edge. Regulatory scrutiny intensified across multiple jurisdictions, several high-profile security incidents rattled confidence on DeFi platforms, and most major cryptocurrencies recorded price corrections that tested recent support levels. Despite these headwinds, fresh exchange-traded fund launches, growing institutional accumulation, and meaningful protocol upgrades provided counterbalancing forces that prevented a deeper rout.

Institutional Adoption Offers Bright Spots Amid Price Struggles

Bitcoin spent much of the month under bearish control, repeatedly failing to break key resistance zones and experiencing sharp breakdowns that erased earlier gains. Brief rebounds fueled by reported institutional buying offered temporary relief, yet the dominant trend remained downward as sellers maintained the upper hand. We watched closely as large holders appeared to absorb some of the selling pressure, creating pockets of stabilization that hinted at underlying demand even in a risk-off environment.

Ethereum presented a similar picture of short-term weakness paired with longer-term potential. On-chain metrics and valuation models pointed to the network trading at historically undervalued levels, while exchange-traded funds registered consistent outflows throughout the period. At the same time, progress on the Fusaka upgrade and quiet accumulation by institutions signaled that smart money continues to position for an eventual recovery once macro conditions improve.

XRP encountered stubborn price suppression and multiple rejections at overhead resistance, frustrating holders who expected stronger follow-through after earlier legal victories. The launch of dedicated XRP exchange-traded funds and announcements of new financial partnerships, however, underscored rising institutional appetite and laid groundwork for potential breakouts if sentiment shifts. These developments served as a reminder that regulatory clarity and traditional finance integration can drive interest independent of short-term price action.

Solana demonstrated the sharp disconnect that sometimes emerges between institutional flows and spot market performance. Significant inflows into newly available Solana ETFs contrasted with ongoing price declines, illustrating that large investors remain willing to build exposure despite retail caution. The network's speed and cost advantages continue to attract attention from both traditional funds and decentralized application developers looking for scalable infrastructure.

Privacy-focused coins and leading stablecoins quietly gained market share as uncertainty encouraged users to prioritize capital preservation and transaction confidentiality. These assets benefited from rotation out of higher-beta tokens, reinforcing their role as defensive plays during periods of elevated risk. Overall sentiment for November settled into neutral territory with a clear bearish tilt, reflecting the tug-of-war between persistent challenges and incremental progress on adoption fronts.

Bitcoin and Crypto Insights November 2025 Report

Read the report & see what's driving growthLooking toward December, several catalysts could determine whether the market extends its consolidation or finds fresh direction. Performance of recently launched ETFs for XRP, Solana, and select altcoins will reveal how strongly institutions intend to commit capital heading into year-end. Regulatory developments in the United States and coordinated global frameworks remain wildcard events capable of swinging sentiment dramatically in either direction. Additionally, the speed and effectiveness of security improvements across major DeFi protocols following recent exploits will play a crucial role in restoring broader confidence.

The Bitcoin and Crypto Insights report for November 2025 delivers the detailed charts, on-chain data, and contextual analysis that subscribers rely on to make sense of these complex conditions. Available only to paid members, the full report provides the depth and clarity needed to separate signal from noise in an often emotional and volatile market. Make sure to check it out or any of our other previous months reports.