Hong Kong Securities and Futures Commission Grants First Crypto Trading Licenses in 2025

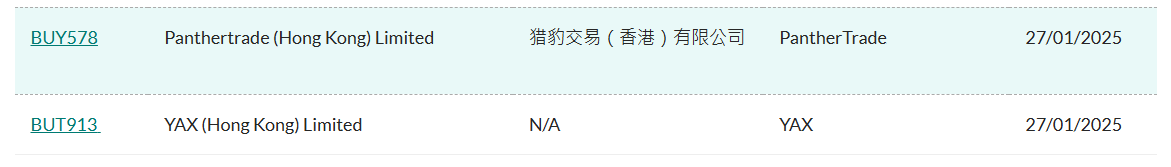

Hong Kong's Securities and Futures Commission (SFC) has taken it's first step forward in the regulation of the digital asset market by issuing its operational licenses for crypto exchange platforms in 2025. Two Hong Kong based crypto exchanges PantherTrade and YAX were the first to receive these licenses this year, increasing the total number of crypto licenses issued by the SFC to seven since mid-2024.

This initiative underscores Hong Kong's commitment to regulating the crypto industry. Both PantherTrade and YAX are now registered under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO), aligning with the SFC's efforts to maintain financial integrity and compliance. Since 2020, ten crypto exchanges have managed to secure registration, allowing them to operate virtual asset trading platforms legally within the city.

The journey to this point has not been without its challenges. In October 2024, SFC CEO Julia Leung expressed ambitions to license eleven crypto service providers by year's end. However, this goal was not achieved, leading to a delay in the licensing of new crypto entities. This setback highlighted the complexities of balancing rapid market growth with stringent regulatory requirements.

Regulatory Measures and Future Outlook

The SFC has been meticulous in its approach, conducting thorough on-site reviews to ensure client asset protection, robust Know Your Customer (KYC) processes, and strong cybersecurity measures. Eric Yip, the executive director of intermediaries at the SFC, emphasized the importance of engaging directly with senior management of virtual asset trading platforms (VATPs) to elevate regulatory standards and streamline the licensing process.

Currently, the trading landscape in Hong Kong is somewhat restricted, with only four cryptocurrencies—Bitcoin, Ethereum, Avalanche, and Chainlink—approved for trading. This limitation reflects the cautious approach taken by regulators to safeguard investors while fostering an environment conducive to innovation.

Despite these efforts, Hong Kong faces stiff competition from other financial hubs like Singapore in becoming a leading crypto hub. The SFC's strategic roadmap for 2024-2026 outlines plans to enhance market integrity, attract more investors, and secure the financial sector, all while encouraging technological advancement in the crypto space.