Bitcoin ETFs Face Record Outflows Amid November Price Slump

Bitcoin wrapped up November 2025 on a challenging note, with its price settling around $86,000 after starting the month near $110,000. This marked a roughly 24% decline over the 30 days, erasing significant gains from earlier in the year and raising questions about the cryptocurrency's short-term trajectory. The downturn came as broader market pressures, including uncertainty over Federal Reserve interest rate decisions, weighed on risk assets and triggered a wave of selling.

The slump followed a peak above $126,000 in October, driven by initial enthusiasm for institutional adoption and speculation around nation-state involvement in Bitcoin. However, as global economic indicators showed signs of cooling, investors pulled back from volatile holdings like cryptocurrencies. This shift not only impacted Bitcoin's spot price but also amplified outflows from exchange-traded funds designed to track its value, highlighting the interconnectedness of institutional flows and market sentiment.

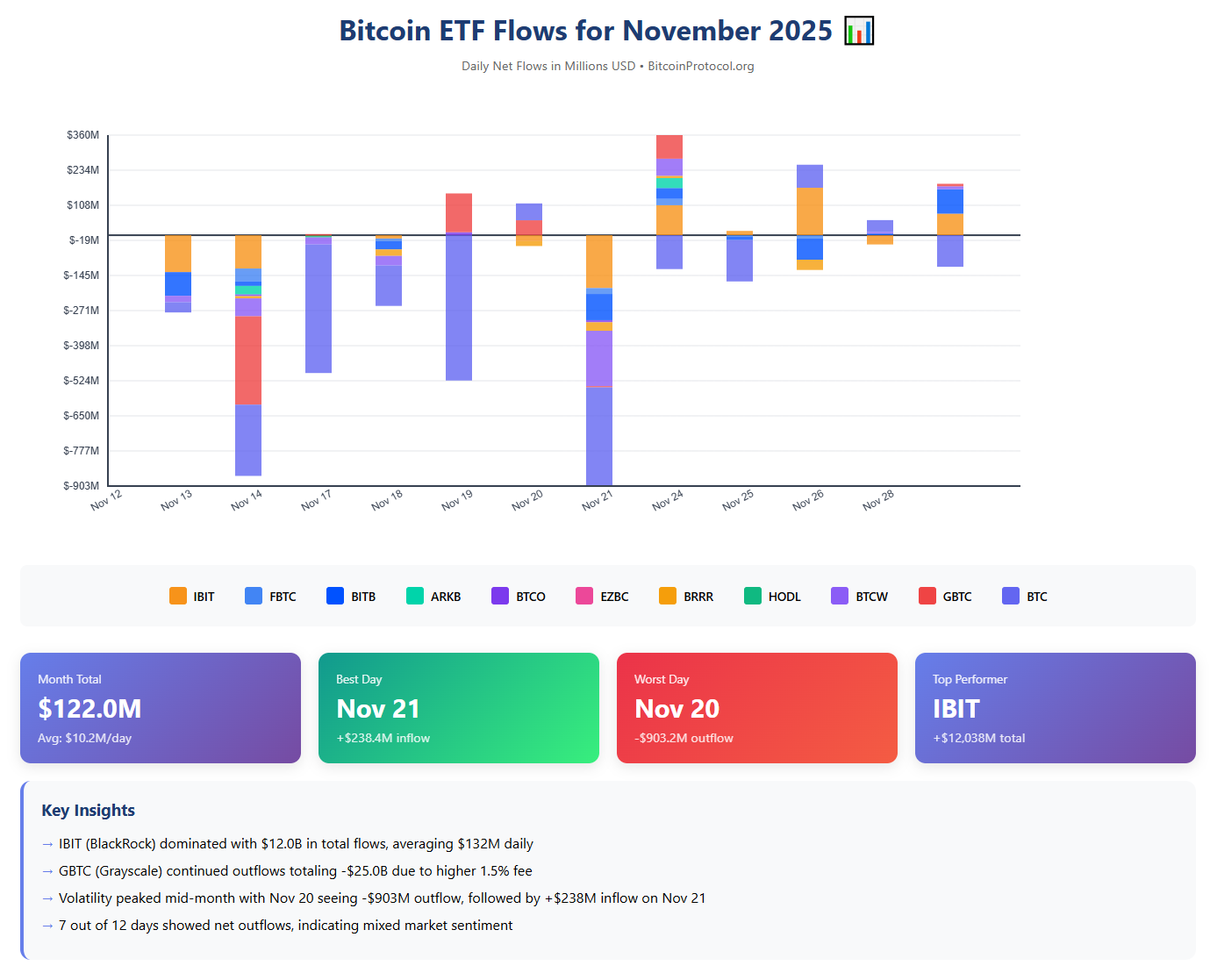

Spot Bitcoin ETFs in the United States recorded net outflows totaling about $3.5 billion for the full month, the largest monthly withdrawal since early 2025. Data from trackers like Farside Investors revealed seven major outflow days that overshadowed smaller inflows, with the heaviest redemptions occurring mid-month. On November 20, for instance, funds saw $903 million in exits, followed by $866 million the previous week, as redemption pressures forced on-chain Bitcoin sales and exacerbated the price drop.

Institutional Shifts Reshape ETF Landscape

Grayscale's GBTC emerged as the primary source of these outflows, hemorrhaging nearly $25 billion in assets over a two-week period in mid-to-late November. The fund's 1.5% management fee stood out starkly against competitors charging 0.25% or less, prompting investors to rotate capital toward lower-cost alternatives. This exodus from GBTC, which once dominated the space, has accelerated since its conversion to an ETF earlier in the year, reducing its holdings by over 60% and underscoring the premium institutions now place on fee efficiency.

In contrast, BlackRock's IBIT maintained its position as the market leader despite facing $2.34 billion in outflows for the month, its worst since launch. The fund still commands over $70 billion in assets and has generated more than $245 million in annual fees by October, making Bitcoin products BlackRock's highest-revenue category. Executives at the firm described the withdrawals as typical rebalancing by retail investors during price dips, noting that inflows resumed late in the month as Bitcoin stabilized above $90,000.

Other low-fee ETFs also showed resilience. Fidelity's FBTC added about $2.25 billion in cumulative flows, while Bitwise's BITB and Invesco's BTC secured $1.83 billion and $1.94 billion, respectively, over similar periods. Combined, the six major funds with fees at or below 0.25 percent attracted roughly $19.6 billion in a three-week window, far outpacing GBTC's losses. This pattern illustrates a broader rotation within the ETF complex, where capital moves from high-cost legacy products to more competitive newcomers without abandoning Bitcoin exposure altogether.

The overall U.S. spot Bitcoin ETF market grew by $57.7 billion in assets under management during the observed period, even after accounting for GBTC's drain. Excluding Grayscale, the remaining eleven funds posted $82.7 billion in net inflows, led by BlackRock and Fidelity. This net positive trend suggests institutions view the November pullback as a tactical adjustment rather than a fundamental retreat, with on-chain data showing steady accumulation by long-term holders.

Fee structures have become the decisive factor in this evolving landscape, as evidenced by the performance gap between top performers and laggards. Funds like Valkyrie's BRRR, with a 0.20% fee, punched above their weight by drawing $1.2 billion, while Grayscale's higher charges act as a deterrent in a maturing market. Analysts tracking these flows point to this fee compression as a sign of healthy competition, which could stabilize the sector by attracting more conservative capital over time.

Looking ahead, the data points to a market in transition rather than decline. With GBTC's outflows showing signs of slowing and potential Federal Reserve rate cuts on the horizon for December, renewed inflows could support a rebound. Most analysts anticipate Bitcoin reclaiming $100,000 in the first quarter of 2026, potentially pushing higher as the overhang from high-fee products fades. This rotation sets the stage for sustained growth in ETF adoption, reinforcing Bitcoin's role as a core asset in diversified portfolios.