Why Solana Price Is Down 8% Today, Unpacking the Reasons Behind the Drop

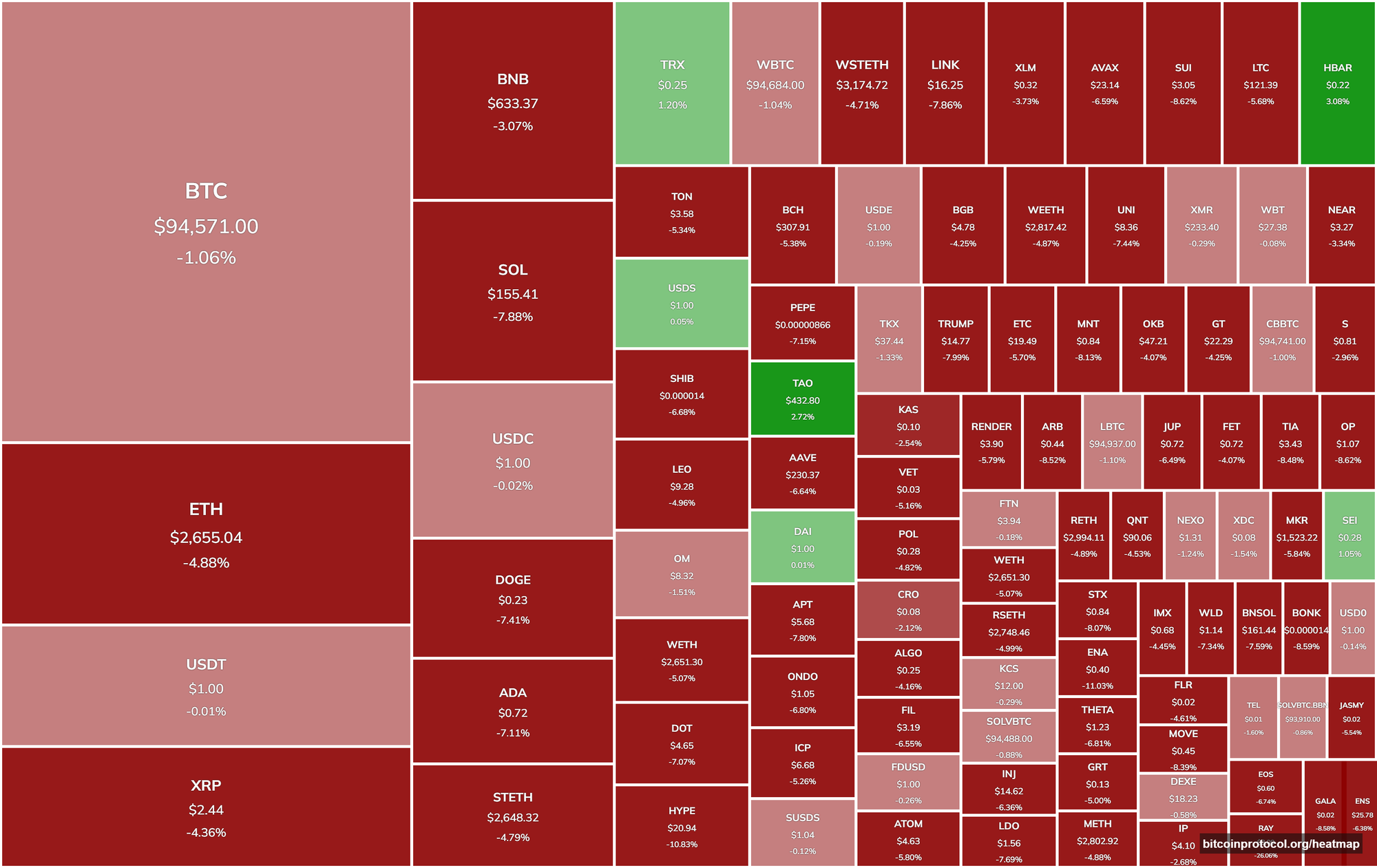

Solana (SOL) is taking a beating today, with its price dropping significantly nearly 8% in a matter of hours. Investors are scrambling to figure out what’s driving this steep decline, and the answer seems to lie in a messy mix of broader market trends and Solana specific woes. The crypto space is no stranger to volatility, but this drop stands out, especially since overall in the last 30 days Solana is down 39% overall.

The crypto market often moves as a pack, and today’s downturn aligns with a possible correction rippling through the space. Bitcoin and Ethereum have been showing signs of fatigue lately as well, and when they stumble, smaller coins like Solana tend to follow suit. This could be tied to a risk-off mood sweeping through global markets, perhaps triggered by macroeconomic shifts or geopolitical headlines nudging investors toward safer assets. Previously we had talked about the global tariff wars with the United States and other countries, which indeed pushed some investors out of Solana and crypto all-together when it happened, pushing down the price some at the time. However, today's drop isn't related to tariffs.

Solana, with its high-growth reputation, feels these swings harder as traders pull back from riskier bets. Beyond that, Solana faces its own unique pressures amplifying the sell-off. Network activity has been sliding, with fewer active users and a noticeable dip in decentralized exchange volumes compared to the peaks of late 2024. The memecoin frenzy that once fueled Solana’s hype machine, pumping tokens to absurd heights, has cooled off, leaving the ecosystem quieter than it’s been in months. High-profile scams haven’t helped either. The LIBRA memecoin collapse earlier this month, where insiders vanished with millions, still lingers in investors’ minds, chipping away at trust.

The FTX Token Unlock Shadow

Adding fuel to the fire, upcoming token unlocks linked to the FTX bankruptcy estate are looming. The big one hits March 1, 2025, when 11.2 million SOL tokens, worth about 1.78 billion dollars, flood into circulation. These tokens trace back to FTX’s 2022 implosion, when the exchange’s hoard of 41 million locked SOL was sold off cheap to firms like Galaxy and Pantera Capital.

Smaller unlocks might even be trickling out today and later this week, though the March 1 event overshadows them. In total, over 15 million SOL could hit the market through April, a hefty chunk of the circulating supply. Traders are spooked, with some selling now to dodge the anticipated dump. Social media posts hint at market makers moving large SOL batches, stoking fears of coordinated pressure. While bulls argue Solana’s daily trading volume can soak this up, the short-term vibe screams panic.

Today’s price drop blends these threads into a perfect storm. A jittery market, fading network buzz, scam fallout, and the specter of unlocks paint a grim picture for SOL holders. Whether this dip signals a buying opportunity or a deeper slide remains anyone’s guess, but for now, Solana’s price is paying the price of uncertainty.