Whale Allegedly Manipulates $7 Million Bet in Polymarket Governance Attack

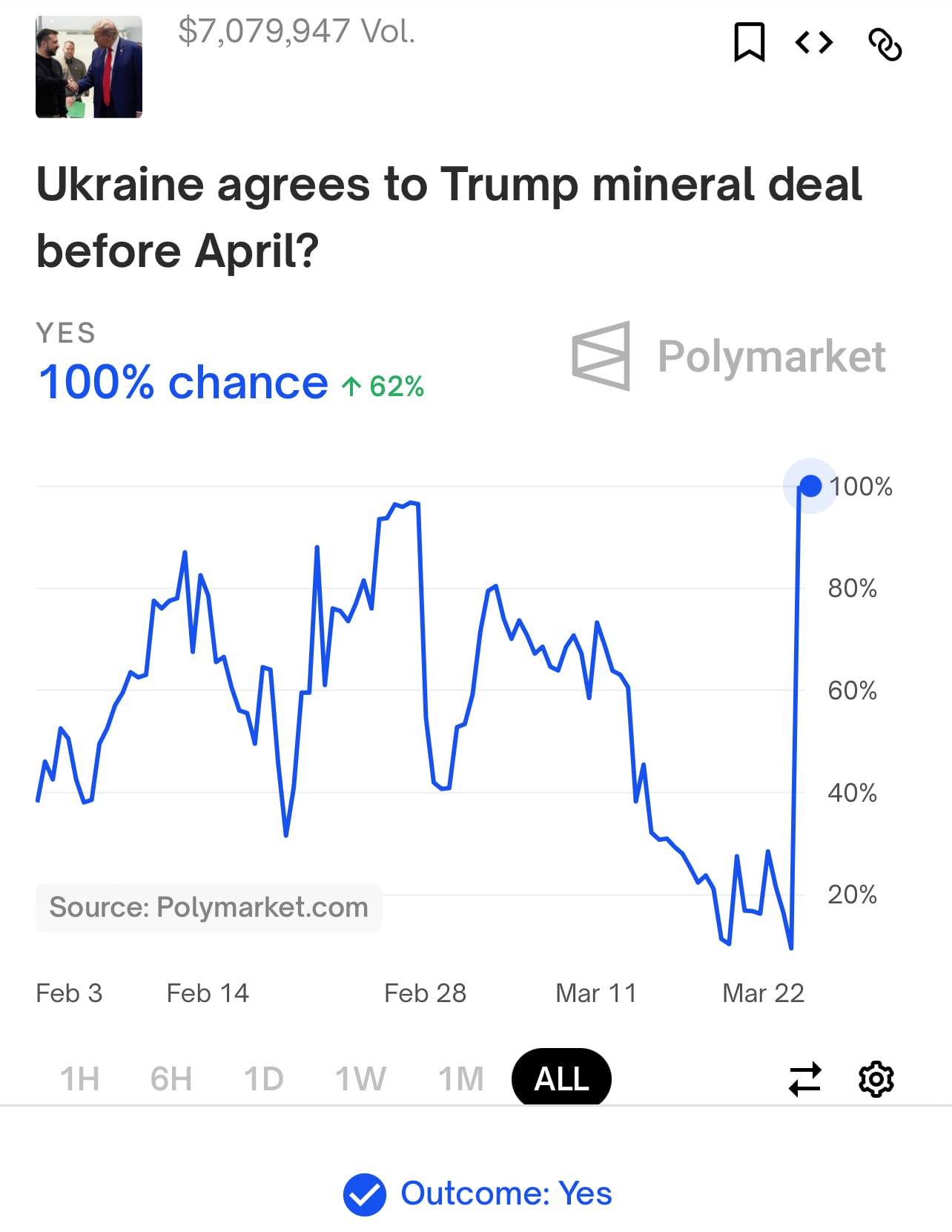

The crypto based prediction market platform Polymarket has found itself at the center of controversy following what it describes as an unprecedented governance attack. The incident, which unfolded between March 24 and 25, involved a $7 million bet titled “Ukraine agrees to Trump mineral deal before April?”

The wager saw a dramatic shift, surging from a modest 9% probability of a “yes” outcome to a full 100% in a matter of hours. This abrupt change has sparked widespread speculation about coordinated manipulation, allegedly tied to Polymarket’s oracle provider, UMA, and its voting system.

The bet in question resolved affirmatively despite no official confirmation that Ukraine had agreed to a deal proposed by U.S. President Donald Trump to access the country’s critical mineral resources. This unexpected resolution prompted an outcry from users across social media platforms where many pointed fingers at a so-called “UMA whale”—a term referring to an individual or entity holding a substantial amount of UMA tokens, which are used to vote on Polymarket’s market outcomes. Critics allege that this large token holder leveraged their voting power to sway the result in their favor, regardless of the real-world situation.

Polymarket acknowledged the issue in a statement on its Discord server, admitting that the market’s resolution defied expectations. They wrote:

“We are aware of the situation regarding the Ukraine Rare Earth Market. This market resolved against the expectations of our users and our clarification. Unfortunately, because this wasn't a market failure, we are not able to issue refunds.

This is an unprecedented situation, and we have been in war rooms all day internally and with the UMA team to make sure this won't happen again. This is not a part of the future we want to build: we will build up systems, monitoring, and more to make sure this doesn't repeat itself. More details to come as we better understand the situation and begin to build solutions for clearer rules, as well as a more defined and timely clarification system.”

Polymarket has stood firm on its decision not to issue refunds, asserting that the event did not constitute a market failure. A team member noted on Wednesday that the situation had triggered intense internal discussions, with Polymarket collaborating closely with the UMA team to address the vulnerability. The company emphasized its commitment to ensuring such an incident would not recur, describing it as a first-of-its-kind challenge for the platform.

How Polymarket’s Oracle System Became a Flashpoint

At the heart of this controversy lies Polymarket’s use of UMA, or Universal Market Access, an optimistic oracle designed to determine the outcomes of prediction markets.

The system allows anyone to propose a resolution by staking a $750 bond in USDC.e, which can then be challenged by others. If disputes arise, UMA token holders step in to vote on the final result, a process intended to decentralized decision-making. However, this mechanism has come under scrutiny as users argue it leaves room for manipulation by those with significant token holdings. Some users have warned that the system undermines Polymarket’s promise of being a “decentralized truth machine,” suggesting that anonymous whales can override factual outcomes at will.

The backlash has not been limited to this single event. Polymarket has faced prior criticism for subjective resolutions in high-profile markets. Last year, for instance, the platform overturned a UMA decision on a bet concerning Barron Trump’s involvement with the Solana based DJT memecoin. Despite UMA token holders resolving the market as “No,” Polymarket intervened to reverse the outcome, fueling speculation about the influence of powerful token holders.

Such incidents have drawn attention from regulators as well, with the U.S. Commodity Futures Trading Commission previously highlighting the risks of manipulation in unregulated prediction markets like Polymarket during its legal case against competitor Kalshi.

More Bitcoin and Crypto News:

- Litecoins Early Days Under Charlie Lee And Wash Trading Allegations

- Michael Saylor Says Quantum Computing Threat Will Trigger Bitcoin Hard Fork

- Hong Kong Greenlights First Solana Spot Etf For October Launch

- Pump Fun Shuts Down Livestream Feature Amid Controversy

- Coinbase Boosts Solana Infrastructure With Major Performance Upgrades