Venezuela Embraces USDT Stablecoin as Trump Oil Tanker Seizures Add New Challenges

Venezuela has increasingly turned to stablecoins, particularly Tether (USDT), to facilitate its oil exports as U.S. sanctions continue to restrict traditional financial channels. Economist Asdrúbal Oliveros recently highlighted this shift on the Tertulia y Dinero podcast, noting that nearly 80% of the country's crude oil sales are now settled in USDT. This development reflects the government's efforts to maintain revenue streams despite ongoing restrictions, with major buyers like China absorbing a significant portion of exports. Oil production has shown signs of recovery, exceeding 1 million barrels per day in recent periods, marking a notable increase from earlier lows.

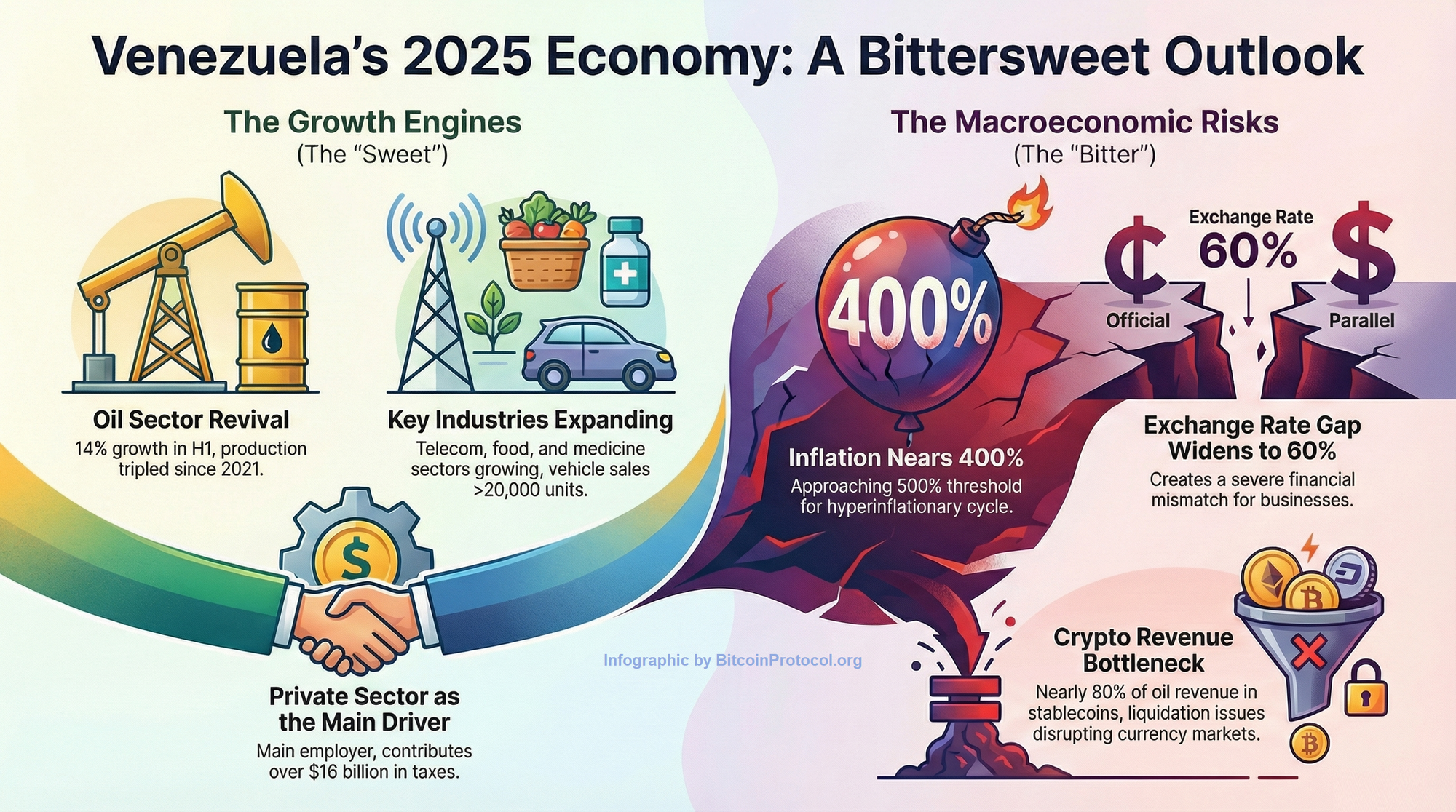

The reliance on stablecoins shows their role as a practical alternative in a sanctioned environment. Venezuela's oil sector generates over $12 billion annually, and the use of USDT allows the government to bypass barriers in international banking. However, challenges persist in converting these digital assets into usable funds for domestic needs. Oliveros pointed out that bureaucratic hurdles and controls slow the liquidation process, creating bottlenecks in the foreign exchange market.

These difficulties contribute to broader economic pressures, including a widening gap between official and parallel exchange rates. Inflation has accelerated, reaching levels that raise concerns about a potential return to hyperinflationary conditions. Businesses face added strain as they navigate these imbalances.

Stablecoins Drive Oil Strategy While Exposing Economic Vulnerabilities

The integration of stablecoins into Venezuela's oil policy highlights their growing importance in global commodity trade. With traditional payment systems limited, USDT has become essential for securing payments from international buyers. This approach has helped sustain exports, particularly to China, which remains a key market. Yet the accumulation of digital assets has not fully translated into economic relief, as conversion processes remain inefficient.

Oliveros described the situation as a "clogged" system, where funds intended to support the economy face delays. This blockage intensifies pressure on the currency market, pushing up demand for foreign exchange and exacerbating rate disparities. The resulting instability affects businesses, which must contend with higher costs for inputs while facing limits on pricing flexibility.

The private sector has demonstrated resilience despite these headwinds. It serves as the primary engine of growth, employing the majority of workers and contributing substantial tax revenue. Recent estimates suggest private businesses pay around $16 billion in taxes annually, representing a significant share of GDP. Sectors like telecommunications and automotive sales have expanded, reflecting adaptation to new realities.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishThis growth occurs amid broader challenges. Businesses encounter a financial mismatch, buying supplies at parallel market rates while selling goods closer to official levels. Such dynamics erode profitability and threaten sustainability. Oliveros warned that poor management of stablecoins could become a major risk by 2026, as more companies incorporate USDT into daily operations.

The shift toward cryptocurrencies in Venezuela's oil sector illustrates both innovation and limitation. While stablecoins provide a workaround for sanctions, the inability to efficiently deploy these resources underscores persistent structural issues. As the economy balances recovery in oil output with ongoing inflation and exchange rate pressures, the role of digital assets will likely expand further. Businesses and policymakers must address these hurdles to harness the potential benefits without amplifying existing vulnerabilities.