US Government Set to Liquidate Massive Silk Road Bitcoin Stash as Trump Comes into Office

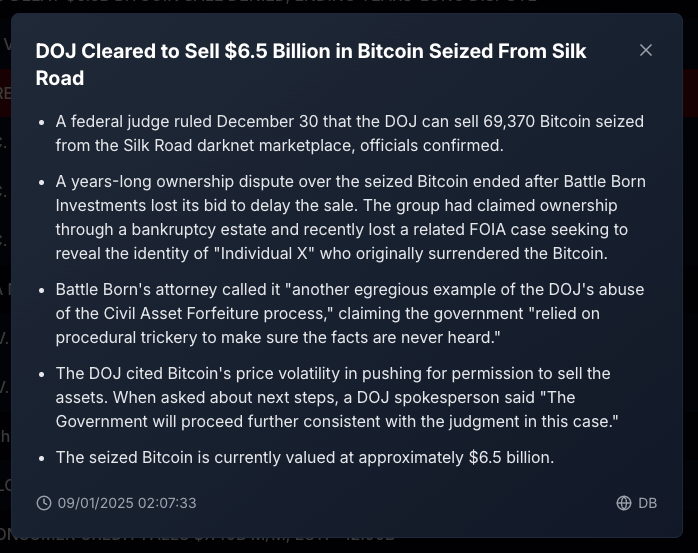

In a surprising turn of events, the US government has received authorization to liquidate a staggering 69,000 Bitcoins, valued at approximately $6.5 billion, that were seized from the infamous Silk Road marketplace. This decision comes amidst a politically charged atmosphere, with the timing being particularly notable as it is less than two weeks before the new Trump admin takes office, an administration that has vowed to refrain from such sales.

The Silk Road, once a bustling online black market for illegal goods, was shut down by federal authorities back in 2013, leading to the seizure of vast amounts of Bitcoin. Since then, the government has occasionally sold off portions of these seized assets. According to recent developments reported by DB News, the Department of Justice (DOJ) has now been given the green light to proceed with this significant sale.

This move by the DOJ has stirred a mix of reactions. The decision to sell off such a substantial amount of Bitcoin at this juncture could potentially influence market dynamics, especially given the recent volatility in cryptocurrency prices.

Implications of the Sale

The sale of these Bitcoins is not just a financial transaction; it carries significant implications for both the crypto market and the incoming political administration. Critics are quick to point out the contradiction in the government's actions, especially since the new administration had campaigned on a platform that included promises not to engage in the sale of seized cryptocurrencies. This has led to public outcry on social media platforms, with users expressing their disappointment and skepticism about the government's integrity regarding its commitments.

Moreover, the sale process itself, as highlighted in previous instances, involves public auctions conducted by the U.S. Marshals Service. Historical sales have shown mixed results; for instance, in 2015, the average sale price was significantly lower than current market rates, leading to discussions on the efficiency and timing of government sales in the volatile crypto market. The last known sale was in March 2023, where the government managed to sell a smaller batch for $216 million, which didn't impact the market significantly but did raise eyebrows regarding the transaction fees involved.

The upcoming liquidation of 69,000 Bitcoins could be a test of the market's resilience and the government's strategy in handling digital assets. With Bitcoin prices currently valued at around $94,000, the potential sale could either stabilize or further disrupt the market, depending on how and when the government decides to execute the transaction.