US Government Orders Return of Seized Bitcoin to Bitfinex from 2016 Hack

The United States government has mandated the return of over 94,000 Bitcoins, seized after the infamous 2016 Bitfinex exchange hack, back to the exchange itself. This decision comes as part of an "in-kind restitution" process, highlighting a significant development in the legal treatment of digital assets. A recent court filing has confirmed this ruling, which addresses the restitution of assets despite guilty pleas related to money laundering and conspiracy charges.

In 2016, Bitfinex fell victim to one of the largest cryptocurrency heists in history, with hackers making off with approximately 120,000 Bitcoins. When the Department of Justice seized these assets in 2022, they were valued at around $3.6 billion. However, with the dramatic rise in Bitcoin's value, these same Bitcoins are now worth $9.3 billion.

The recovery process was meticulous, involving key U.S. agencies like the FBI, IRS Criminal Investigation, and Homeland Security Investigations. According to a report by Chainalysis from 2023, initial efforts recovered over 94,000 BTC. Subsequent recovery operations from August 2022 to January 2023 increased the total amount of Bitcoin retrieved to over 108,068 BTC by June 2023.

Bitfinex has been actively engaged in recovering assets lost in the 2016 hack. In July 2023, they announced the receipt of $312,219 in cash and 6.917 Bitcoin Cash (BCH) from the U.S. Department of Homeland Security. These funds are earmarked for the redemption of Recovery Right Tokens, which were issued to compensate those affected by the security breach.

US Government Identifies Bitfinex as Primary Victim

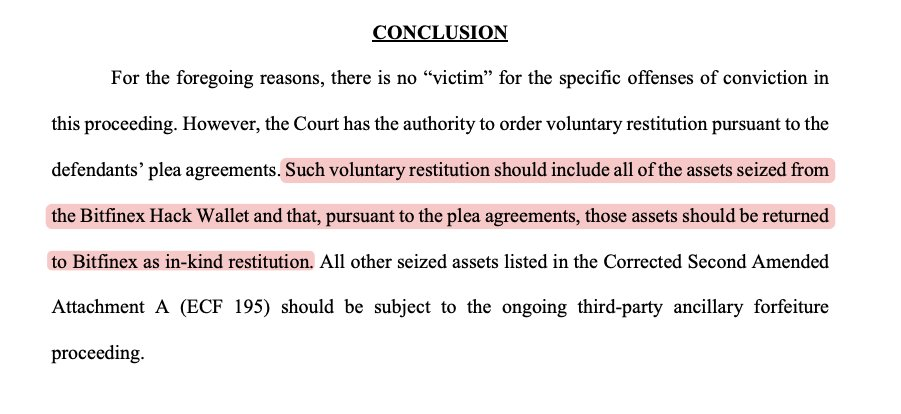

The legal proceedings have moved forward with the U.S. Attorney’s Office for the District of Columbia filing a motion in October 2024, declaring Bitfinex as potentially the only entity eligible for restitution from the 2016 hack. This decision underscores the complexity of identifying victims in digital theft cases, with the government expressing caution about the absence of other qualifying victims under the Crime Victims’ Rights Act (CVRA) and the Mandatory Victim Restitution Act (MVRA).

The filing noted, "The government is not aware of any person who qualifies as a victim under the CVRA or for restitution under the MVRA, beyond perhaps Bitfinex, the Victim Virtual Currency Exchange." This statement reflects the government's effort to rectify the situation, ensuring that the digital assets are returned to where they rightfully belong, while also exploring alternative methods to notify potential victims of their rights to restitution.

This case sets a precedent for how digital assets are treated in legal contexts, emphasizing the recognition of Bitcoin and other cryptocurrencies as legitimate forms of property with rights that need protection and restoration upon theft. The decision to return the Bitcoins in-kind rather than converting them to fiat currency at the time of seizure also acknowledges the volatile nature of cryptocurrency markets and the potential for significant value appreciation over time.