US Government Bitcoin and Crypto Holdings Surge $1 Billion Amid Delayed Audit

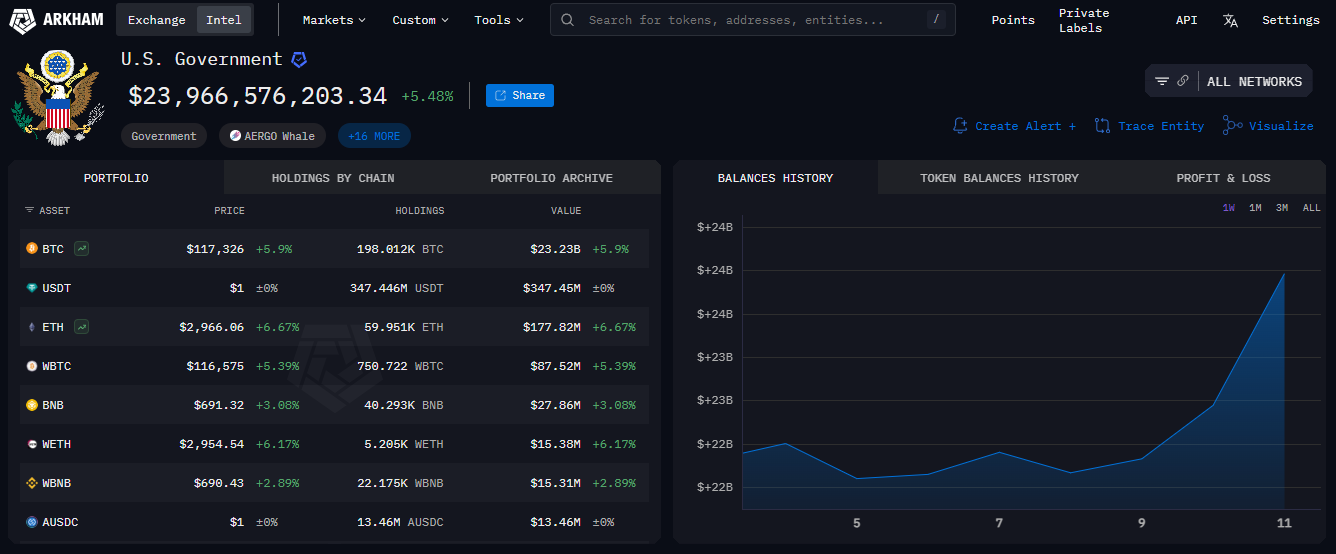

The United States government’s crypto portfolio, primarily composed of Bitcoin, Ethereum, and USDT, has seen a significant increase in value, according to data from Arkham Intelligence. The government’s holdings, which include approximately 198,012 Bitcoin, 59,951 Ethereum, and $347 million in USDT on the Ethereum blockchain, are now valued at $24 billion, with a $1 billion increase reported in the last 24 hours from July 10 to July 11, 2025. This surge highlights the growing financial significance of the nation’s digital asset reserves, even as transparency around these holdings remains uncertain due to a delayed audit initially promised for April 2025.

Arkham Intelligence reports that the government’s 198K Bitcoin, representing 97% of its crypto portfolio, is currently valued at $23.23 billion. The remaining 3% includes 59K Ethereum, worth $177.82 million, and $347 million USDT, a stablecoin pegged to the U.S. dollar. Small amounts of other cryptocurrencies, such as Wrapped Bitcoin (WBTC) and Binance Coin (BNB), make up a negligible portion of the portfolio. The recent $1 billion increase in the portfolio’s value, driven largely by Bitcoin’s price appreciation, underscores the volatility and potential of these assets as a store of value. This growth aligns with broader market trends, as Bitcoin’s price has rebounded from a low of $77,800 in April 2025 to higher levels, reflecting renewed investor confidence.

The government’s crypto holdings stem primarily from civil and criminal forfeiture actions, including high-profile seizures from operations like the Silk Road and the Bitfinex hack. Over the past decade, the U.S. has amassed significant digital assets, with Arkham estimating that the government once held 400,000 Bitcoin, half of which was sold for $366 million. Had those assets been retained, their value today would exceed $17 billion, highlighting the strategic shift under President Trump’s administration to retain rather than liquidate these holdings. This policy, formalized through a March 2025 executive order, aims to position Bitcoin as a “digital gold” reserve asset, akin to traditional stores of value like gold or oil.

Audit Delays and Transparency Concerns

In March 2025, President Trump signed an executive order mandating federal agencies to report their digital asset holdings to the Treasury Department by April 7, 2025, as part of establishing a Strategic Bitcoin Reserve and a Digital Asset Stockpile. An audit, initially slated for public disclosure on April 5, 2025, was expected to provide a comprehensive accounting of these assets, potentially clarifying whether cryptocurrencies like XRP, Solana, and Cardano, mentioned by Trump in a March 2 Truth Social post, which are supposed to be included in the stockpile. However, the deadline passed without the release of the audit, raising questions about the administration’s commitment to transparency.

In late June 2025, Bo Hines, senior advisor to President Trump on digital asset policy, indicated that the administration was considering voluntarily publishing the Treasury’s report on Bitcoin holdings, despite the executive order not mandating public disclosure. Hines emphasized that his team was evaluating whether to disclose other digital asset holdings, such as Ethereum and USDT, to foster greater transparency. This statement contrasted with earlier assurances of an imminent audit, suggesting internal deliberations over the strategic and political implications of revealing the full scope of the government’s crypto reserves.

The delay has drawn mixed reactions. Proponents of transparency argue that public disclosure would enhance trust in the government’s management of digital assets and signal confidence in cryptocurrencies as a legitimate asset class. Critics, however, contend that revealing the exact holdings could make the government a target for cyberattacks or market manipulation, given its status as one of the largest institutional Bitcoin holders, controlling nearly 1% of the total Bitcoin supply.