US and Mexico Pause Tariffs Amid Border Cooperation Agreement, Crypto Markets Begin to Surge

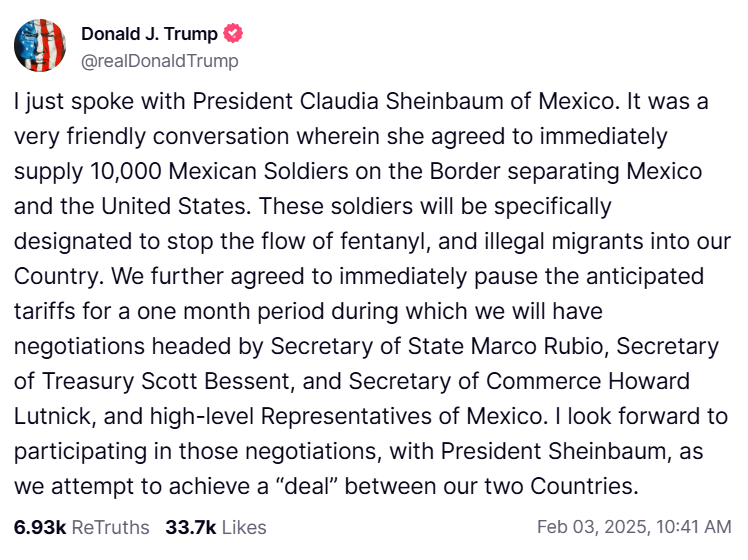

In a significant development in international relations, US President Donald Trump just announced a friendly conversation with Mexican President Claudia Sheinbaum, leading to a notable agreement that impacts both trade and border security. The conversation, which took place on February 3, 2025, resulted in Mexico committing to deploy 10,000 soldiers to the US-Mexico border with the specific aim of curbing the flow of fentanyl and illegal migrants. In response, the US has agreed to temporarily pause anticipated tariffs for a month, setting the stage for high-level negotiations between the two countries.

This pause in tariffs reflects a strategic maneuver by Trump, known for leveraging economic policies in diplomatic negotiations. The decision to involve key figures like Secretary of State Marco Rubio, Secretary of Treasury Scott Bessent, and Secretary of Commerce Howard Lutnick in these talks underscores the importance placed on resolving issues through dialogue and cooperation. The agreement aims to foster a productive environment for discussions, potentially leading to a more comprehensive deal that could benefit both nations economically and in terms of security.

Simultaneously, the financial markets have reacted positively to this news, particularly the cryptocurrency sector. Bitcoin, the leading cryptocurrency, has seen a remarkable rebound from its low of $93K yesterday to reaching $99K today. This upward trend is not isolated; Ethereum has also climbed from $2500 to $2700, while Solana has risen from $183 to $207. The surge in these digital assets suggests a renewed investor confidence, possibly influenced by the stability and optimism brought by the US-Mexico agreement.

This development on the border, coupled with the crypto market's response, indicates a ripple effect of international cooperation on global financial markets. As the negotiations proceed, the world watches closely, hoping for outcomes that not only enhance security and trade relations between the US and Mexico but also contribute to a broader economic stability. The crypto market's positive reaction highlights the interconnectedness of political decisions and market sentiment, showcasing how international relations can influence investment climates across various sectors.