US and Canada Pause Tariffs Following Border Cooperation Deal, Crypto Markets Continue to Rally

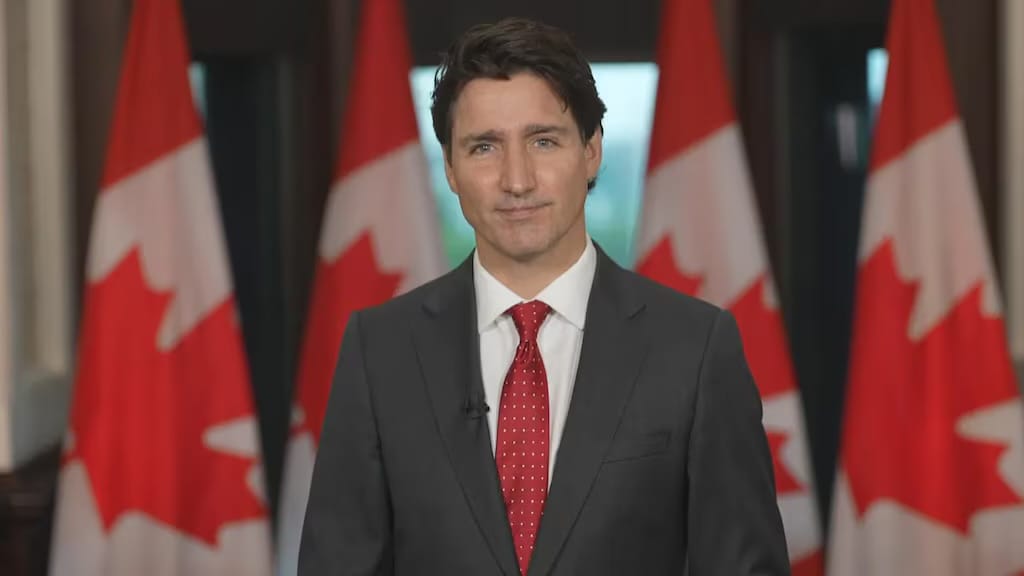

In a significant diplomatic move, Canadian Prime Minister Justin Trudeau has announced a pause on proposed tariffs after a constructive dialogue with U.S. President Donald Trump. This decision comes as part of Canada's commitment to a $1.3 billion border security enhancement plan, aimed at strengthening cooperation with the U.S. to tackle issues like drug trafficking, particularly the flow of fentanyl.

The agreement includes deploying new technology, helicopters, and additional personnel to fortify border protection, alongside the appointment of a 'Fentanyl Czar' to oversee the drug crisis. This cooperative stance has led to a temporary halt in tariffs, providing a breather to the ongoing trade tensions between the two nations.

In the wake of this diplomatic breakthrough, financial markets have responded with enthusiasm, particularly the crypto sector. Bitcoin has rebounded impressively, reaching $102K after hitting a recent low of $93K. This surge reflects investor confidence in the stability that such international agreements can bring. Ethereum has also seen gains, now trading at $2900, signaling a broader market optimism. Meanwhile, Solana has witnessed a significant increase, climbing to $218 from $183, showcasing the market's bullish sentiment towards lesser-known but promising digital assets.

Crypto Markets Respond to Stability

The pause in tariffs between the U.S. and Canada, following a similar agreement with Mexico, has created a ripple effect in the crypto markets. Investors seem to be reacting positively to the notion of reduced trade friction, which historically has led to market volatility. The stability suggested by these diplomatic efforts appears to be a catalyst for the recent surge in crypto values.

Bitcoin and other cryptocurrencies climb back are not just numbers but indicators of a broader market confidence in the face of international cooperation. This trend might suggest that as geopolitical tensions ease, digital currencies could benefit from a more predictable and favorable economic environment, attracting more investment into this innovative sector.