Uptober Rally Drives Billion Dollar Inflows to Bitcoin ETFs as Price Surpasses $120,000

Bitcoin exchange-traded funds recorded a three-day net inflow streak that surpassed $1 billion on Thursday, aligning with the cryptocurrency's climb back above $120,000 for the first time since August. This surge reflects renewed investor confidence as the seasonal "Uptober" pattern takes hold in the market. The influx underscores a broader recovery in digital assets following summer volatility.

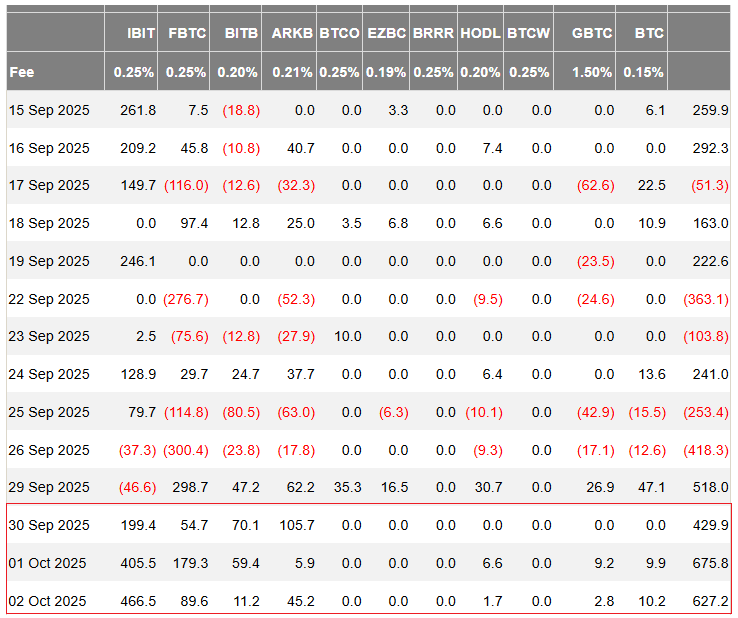

Providers like BlackRock's IBIT experienced outflows of $46.6 million on Monday but quickly rebounded with strong subsequent gains. This performance helped push the total U.S. Bitcoin ETFs' weekly haul to $2.25 billion, including notable contributions from Fidelity's FBTC at $622.3 million, Ark Invest's ARKB at $219 million, and Bitwise's BITB at $187.9 million. Since their launch in January 2024, cumulative inflows for these funds now hover near $60 billion, signaling sustained institutional adoption.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishTrading Volumes Spike and Broader Market Gains

BlackRock's IBIT stood out on Thursday with elevated trading volume, capturing $4.3 billion out of the sector's total $5.6 billion activity. This placed it among the top 10 ETFs by daily volume, rubbing shoulders with established names like SPY, QQQ, and GLD. Earlier in the week, the fund also cracked the top 20 by assets under management, surpassing $90 billion, though it trails the top 10 by about $50 billion.

The ETF momentum arrives alongside robust price action across the crypto space. Bitcoin jumped nearly 10% over the past week to eclipse $120,000, reigniting optimism tied to October's historical tendency for gains, often dubbed Uptober by traders. This pattern has roots in past years where the month delivered average returns of around 30% for the asset, drawing in both retail and professional investors.

Ethereum has mirrored this upward trajectory, trading at $4,487 after a 14% weekly increase that highlights growing interest in layer-one networks. Solana followed suit, reaching $230.28 with a 17% rise over the same period, bolstered by its speed and ecosystem expansions. The overall crypto market has advanced in tandem, with total capitalization climbing steadily as regulatory clarity and technological upgrades fuel participation.

These developments come at a pivotal time for Bitcoin ETFs, which have transformed access to the asset for traditional investors. Launched less than two years ago, the funds have amassed holdings equivalent to a significant portion of Bitcoin's circulating supply, estimated at over 3% as of recent data. This concentration amplifies their influence on price discovery and liquidity. As inflows accelerate, analysts point to potential for further appreciation if macroeconomic factors like interest rate adjustments remain supportive.

Institutional players continue to drive the narrative, with firms like BlackRock and Fidelity expanding their crypto offerings. IBIT's recent daily inflow of $466.55 million on Thursday pushed its total to $61.84 billion, outpacing many peers in growth rate. Such figures illustrate how ETFs serve as a bridge between conventional finance and digital innovation. Meanwhile, Ethereum ETFs added over $300 million in inflows on the same day, broadening the appeal beyond Bitcoin.

Looking at the week's flows, spot Bitcoin ETFs drew more than $600 million on Thursday alone, contributing to a four-day total exceeding $2.25 billion. This pace outstrips earlier months, with third-quarter net inflows hitting $7.8 billion for the year to date. The streak builds on October 1 and 2 figures of $405.5 million and $466.5 million, respectively, setting a strong foundation for the month. As Uptober unfolds, these trends suggest a market poised for continued expansion.

More Bitcoin and Crypto News:

- Sec Gathers Coinbase Uniswap Labs And Cumberland Drw For Insightful Crypto Roundtable Discussion

- U S Department Of Housing Explores Blockchain And Stablecoin Experiment For Grant Management

- Argentina And El Salvador Join Forces In Crypto Regulation

- Grayscale Bets Big On Dogecoin With New Investment Trust Launch

- Binance Founder Changpeng Zhao Takes On Advisory Role In Pakistans Crypto Council