Trump’s Tariffs Spark Global Trade Tensions, Bitcoin and Crypto Prices Fall

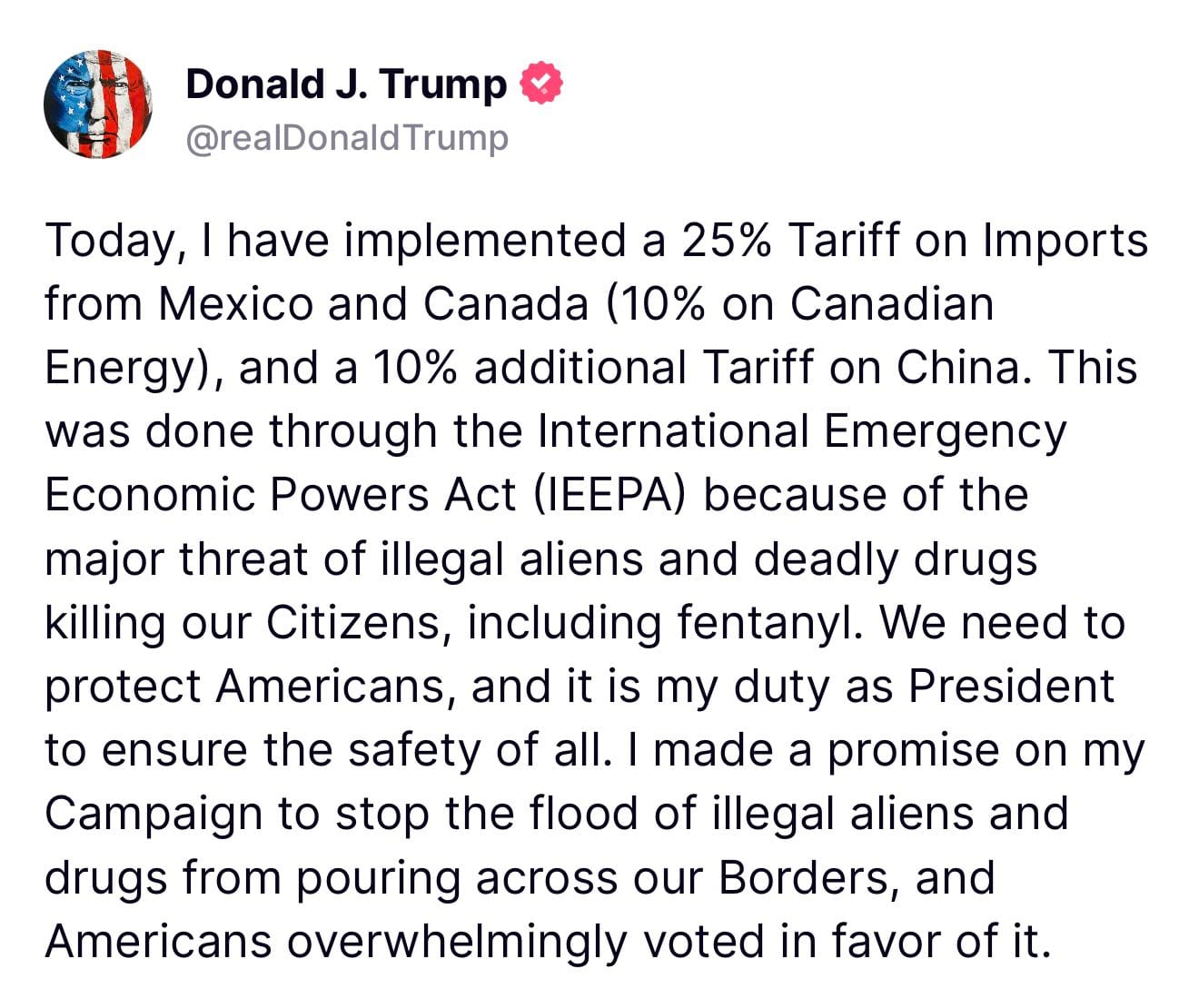

The global economic landscape is once again in upheaval, and President Donald Trump is at the center of the storm. Just weeks into his second term, Trump has made good on his campaign promise to impose aggressive tariffs on America’s largest trading partners, Canada, Mexico, and China.

Effective February 1, 2025, the United States has slapped a hefty 25% tariff on imports from Canada and Mexico, while Chinese goods face a 10% duty. Trump’s stated rationale is to pressure these nations into curbing illegal immigration and the smuggling of fentanyl precursors, but the move has ignited fears of a broader trade war with far-reaching consequences. Economists and industry leaders warn that these tariffs could disrupt nearly $1.6 trillion in North American trade, raise consumer prices, and destabilize global supply chains. From avocados to automobiles, the ripple effects are already being felt, and the stakes couldn’t be higher.

Canada Strikes Back as Markets Reel

Canada, under Prime Minister Justin Trudeau, wasted no time in responding. Trudeau announced retaliatory tariffs on $155 billion worth of U.S. goods, starting with $30 billion immediately and escalating over the next three weeks. The targeted items include everyday staples like beer, wine, fruits, vegetables, and household appliances, as well as luxury goods like bourbon and sports equipment.

Trudeau’s message was clear: Canada will not be bullied. He urged Canadians to support local businesses, suggesting they opt for Canadian rye over Kentucky bourbon and rethink their U.S. vacation plans. Meanwhile, the financial markets are already feeling the heat. With traditional stock exchanges closed for the weekend, the cryptocurrency market has taken the brunt of the panic.

Trudeau announcing retaliatory tariffs

Bitcoin has tumbled, barely hovering around $99,000 after a sharp 5% drop, while Ethereum and Solana have plummeted by as much as 8%. The broader crypto market is down, reflecting a growing risk-off sentiment among investors. Some analysts point to the potential for higher energy costs, especially if Canada retaliates on energy exports, which could further squeeze U.S.-based Bitcoin mining operations and exacerbate market volatility.

The economic implications are stark. Trump’s tariffs are not just a political statement; they’re a high-stakes gamble. Economists warn of stagflation, a toxic mix of stagnant growth and rising inflation, as supply chain disruptions drive up costs for manufacturers and consumers alike.

Canada and Mexico, key suppliers of everything from crude oil to auto parts, are bracing for the fallout, with Trudeau cautioning that the tariffs could have disastrous consequences for U.S. jobs and prices. China, while less vocal, has signaled its willingness to engage in dialogue but warned that trade wars benefit no one. As the world watches, one thing is clear: the path to peace and prosperity has rarely seemed more uncertain.

The coming weeks will test the resilience of global trade and the patience of consumers already stretched thin. In the meantime, the markets remain on edge, and the idea of a prolonged trade conflict looms.