Trump’s National Crypto Reserve Announcement Sparks $330 Billion Market Jump

Over the weekend, the market saw a significant upswing, adding roughly $330 billion to its total value following an announcement from U.S. President Donald Trump about establishing a national crypto reserve. This development sent ripples through the financial world, driving a swift and substantial increase in market activity. According to Coin Market Cap, the total value climbed nearly 10% after Trump’s statement, peaking at $3.08 trillion from a previous level of $2.83 trillion.

This surge, while a boon for many investors, also brought considerable turbulence. Within a single day, the market recorded over $960 million in liquidations, a clear sign of the intense pressure felt by traders caught off guard. The scale of these losses underscores how quickly sentiment can shift in the crypto space, especially when influenced by high-profile policy announcements.

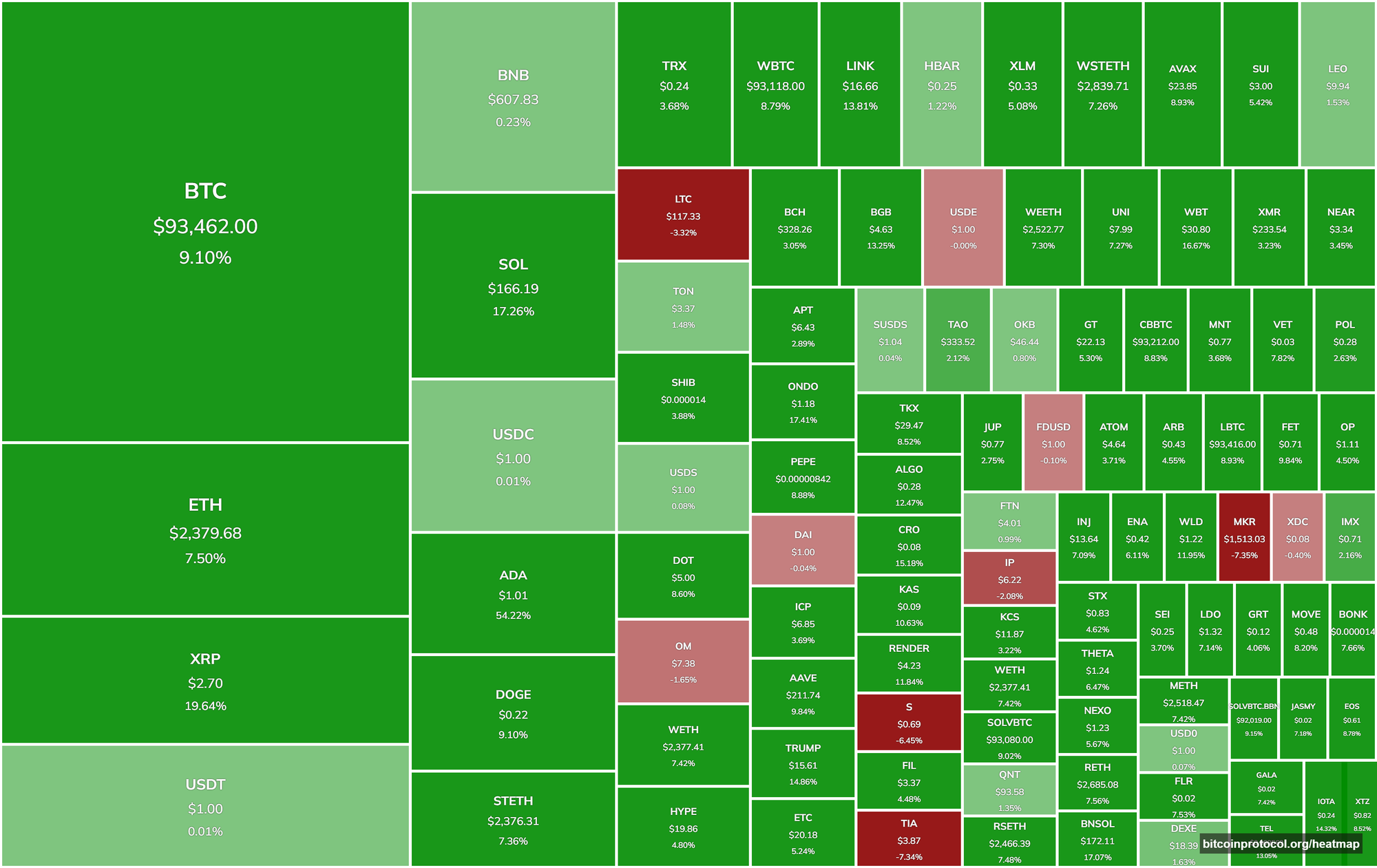

Price Movements Across Major Crypto Assets

The influence of Trump’s crypto reserve plan lifted prices across a range of digital assets, with Bitcoin at the forefront. The leading cryptocurrency saw its value climb sharply, contributing heavily to the market’s overall $330 billion gain and reinforcing its central role in the sector. Ethereum also experienced a notable rise, with its price jumping alongside Bitcoin as investor confidence swelled.

Beyond these two powerhouses, other widely traded cryptocurrencies like XRP, Solana, and Cardano enjoyed substantial increases as well. The collective strength of these assets fueled the market’s rapid ascent, reflecting a widespread positive response to the announcement. This broad rally demonstrates how sensitive the crypto sector remains to influential signals, particularly from a figure like the U.S. president, and highlights the potential for policy shifts to drive tangible growth.

The announcement itself points to a growing intersection between government policy and digital finance. Trump’s proposal for a national crypto reserve suggests a strategic move to integrate cryptocurrencies into the broader economic framework, potentially signaling a shift in how the U.S. approaches this technology. For market participants, the immediate effect was a powerful rally, but the accompanying liquidations serve as a reminder of the risks tied to such volatility. As the market continues to digest this news, its trajectory will likely depend on further details about the reserve and how it might shape the regulatory landscape. This Friday, March 7, Trump plans to host the first ever White House Crypto Summit, which will undoubtedly further fuel speculation and price swings.