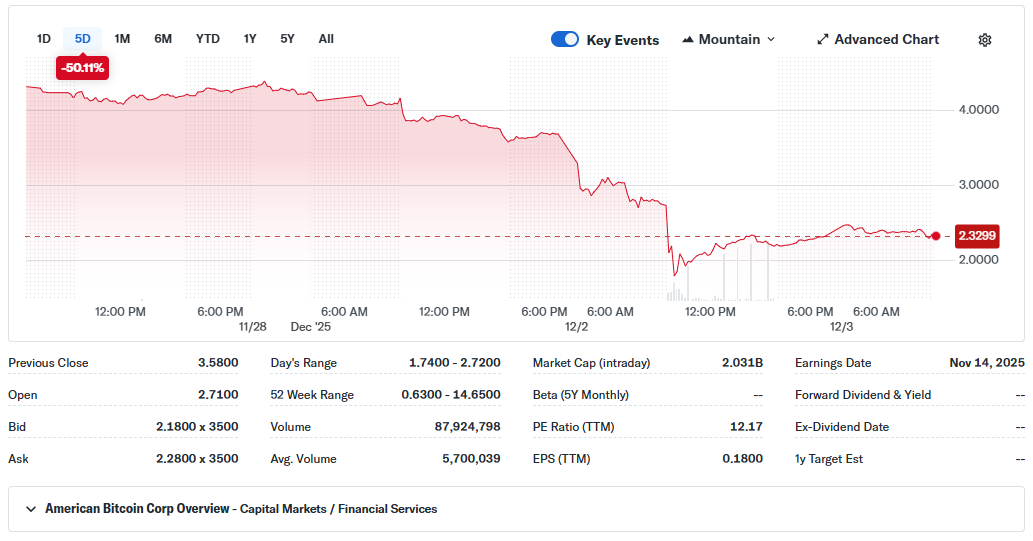

Trump Sons' American Bitcoin Venture Declines 50% Amid Market Volatility

Shares in American Bitcoin, a cryptocurrency mining company backed by President Donald Trump's sons, fell sharply on Tuesday, December 2, 2025, as early investors rushed to sell following the expiration of a lock-up period. The stock closed 38.8% lower at $1.90, erasing about $1 billion from the company's market value in a single day. Trading volume surged to nearly 40 times the daily average, leading to multiple halts on the Nasdaq exchange. The stock is currently down over 50% in just the past week as indicated on Yahoo Finance.

Eric Trump, co-founder and chief strategy officer, addressed the downturn directly on X, explaining that investors from a $215 million private placement in June were finally able to realize gains. He emphasized the company's strong fundamentals, noting that such events naturally introduce short-term fluctuations in share prices. Trump also reaffirmed his personal stake, stating he plans to hold all his shares and remains fully dedicated to advancing the Bitcoin mining sector.

Company Origins and Broader Crypto Context

American Bitcoin emerged from a rebranding of American Data Centers in late March 2025, forming a joint venture with Hut 8, another prominent crypto miner. Under the agreement, Hut 8 transferred its mining equipment in return for a majority stake, positioning the company to focus on building an efficient Bitcoin accumulation platform. The firm went public in September through a reverse merger with Nasdaq-listed Gryphon Digital Mining.

The backdrop is a turbulent past month and a half for cryptocurrencies, with Bitcoin dropping around 34% from its early October record above $126,000. The pullback reflects investor caution toward riskier holdings, influenced by signals from the Federal Reserve about potentially slower interest rate cuts. Yet, signs of stabilization appeared by Wednesday, as Bitcoin climbed 6% over the week to hover near $93,000, buoyed by developments like Vanguard's shift toward approving more cryptocurrency exchange-traded funds.

Matt Prusak, president of American Bitcoin, downplayed the lock-up expiration's long-term impact according to the Financial Times; pointing out that it only alters who can trade shares without affecting the underlying operations or the team's daily efforts in mining and reserve management. The company now holds over 3,000 Bitcoins, acquired through mining and strategic buys, supporting third-quarter revenue of $64.2 million and net income of $3.5 million. Hut 8's shares also dipped 13.5% on Tuesday, underscoring the interconnected pressures within the mining industry.

President Trump's return to office has brought notable shifts in cryptocurrency policy, including eased regulations aimed at positioning the United States as a global leader in digital currencies. This contrasts with his earlier skepticism, when he once likened crypto's value to "thin air." Such changes have encouraged family-linked ventures, though they have also drawn scrutiny from Democrats on the House Judiciary Committee, who released a report alleging the administration leveraged executive authority to aid these businesses, citing $800 million in token sales earlier in the year.

American Bitcoin represents one thread in a wider tapestry of Trump family involvement in crypto. Donald Trump Jr. served as an early investor in the firm, while the brothers co-founded World Liberty Financial, a platform that has issued billions in tokens and lists the president as co-founder emeritus. That project's WLFI token has lost 86% of its value over the past year, trading recently around $0.16 after peaking higher amid volatility and allegations of market manipulation. The token's struggles highlight broader challenges for decentralized finance initiatives tied to high-profile figures, including debates over centralized control despite promises of openness.

Adding to the family's crypto footprint, Trump Media & Technology Group, which operates the Truth Social app and remains under family control, outlined plans earlier in 2025 to raise $2.5 billion-$1.5 billion in equity and $1 billion in convertible bonds, for a dedicated Bitcoin treasury. By July, the company had amassed about $2 billion in Bitcoin and related securities, held alongside $759 million in cash equivalents, with custody from platforms like Anchorage Digital and Crypto.com. As of September, holdings reached $1.3 billion, integrated into long-term financial planning and even used as collateral for notes. However, the company's shares have declined nearly 70% this year, mirroring the sector's uneven performance.