Trump Picks Bitcoin Advocate Stephen Miran for Chief Economic Role

President-elect Donald Trump has made a strategic move by selecting Stephen Miran, a known advocate for Bitcoin and cryptocurrency, to head his Council of Economic Advisers. This decision underscores Trump's commitment to innovative economic policies that could potentially integrate digital currencies into the mainstream financial system.

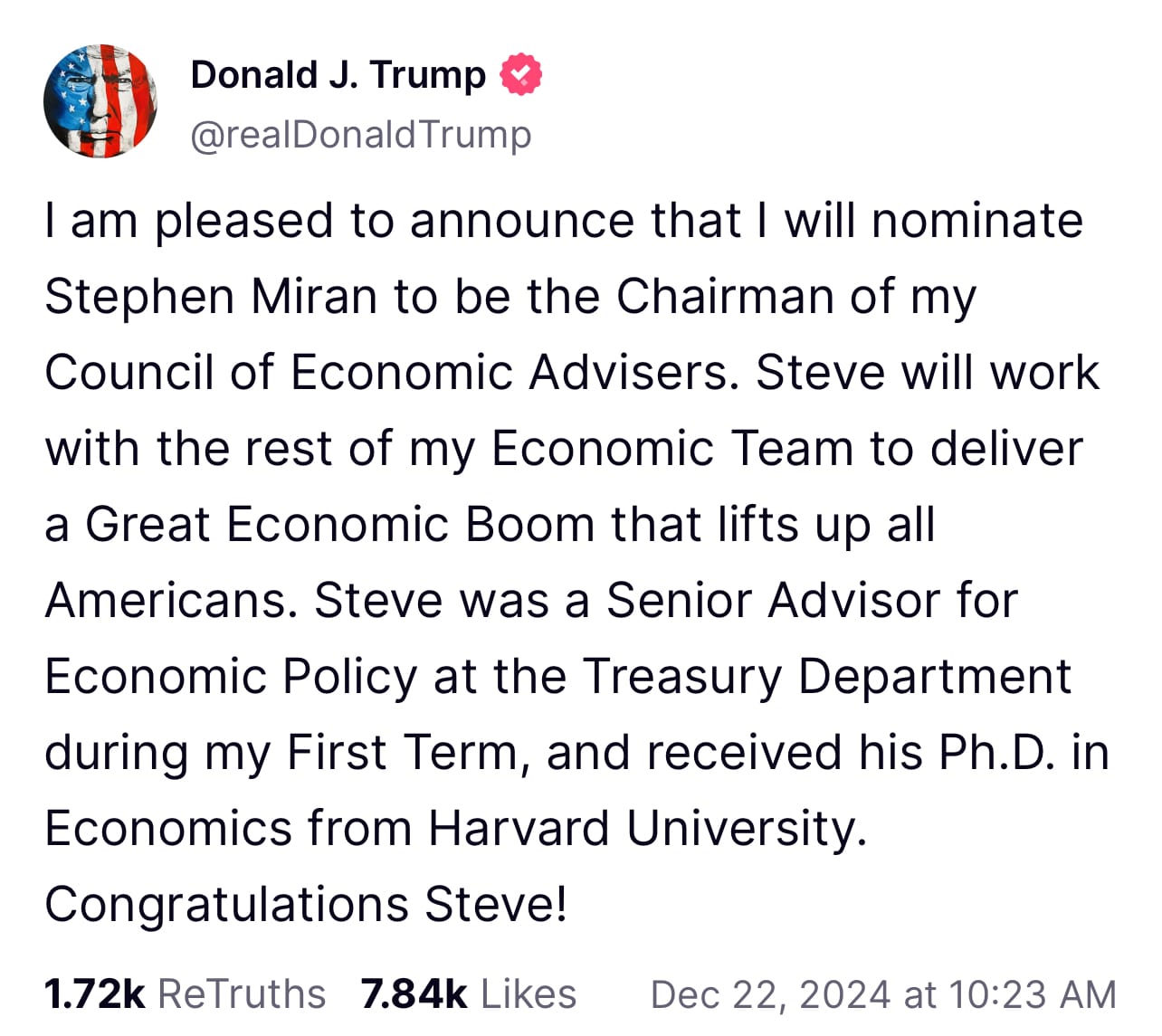

Miran, who previously served as a senior economic policy adviser at the Treasury Department during Trump's first administration, is now poised to shape the economic landscape of the future. Trump announced this nomination via his Truth Social platform, stating, "Steve will work with the rest of my economic team to deliver a great economic boom that lifts up all Americans." This statement not only reflects a promise of prosperity but hints at a significant shift towards embracing technologies like Bitcoin that could redefine economic interactions.

Bitcoin and Economic Policy

Stephen Miran's role will be critical in advising Trump on economic policy, particularly in areas where digital currencies can play a transformative role. His pro-Bitcoin stance suggests a potential policy direction that might favor decentralized finance, possibly leading to regulatory changes that could benefit the cryptocurrency sector. Miran's task will include not just policy formulation but also communicating these complex ideas to the public, ensuring that Americans understand the benefits and innovations that Bitcoin could bring to their economic lives.

Trump's agenda includes renewing expiring tax cuts and introducing new ones aimed at alleviating the financial pressures felt by U.S. households due to high prices. His approach also involves imposing sweeping tariffs on foreign trading partners to encourage domestic manufacturing. Critics, including many economists, argue that these actions could inflate consumer prices and increase national debt. However, Miran's expertise might be key in navigating these criticisms, especially by leveraging Bitcoin's deflationary properties and its potential to bypass traditional economic pitfalls.

The economic landscape leading up to the election on November 5 was dominated by concerns over inflation and economic stability, issues that played a significant role in voter decisions, leading to Trump's re-election and a Republican sweep in Congress. With this backdrop, Miran's appointment could steer the conversation towards how cryptocurrencies could mitigate inflation or offer alternative investment opportunities free from traditional market manipulations.

During Trump's first term, the economic advisory roles were notably influential, with figures like Kevin Hassett, Tomas Philipson, and Tyler Goodspeed in key positions. Hassett, in particular, was a visible defender of Trump's economic strategies on various media platforms. Now, with Hassett heading the National Economic Council for Trump's second term, Miran joins a robust team focused on economic resurgence and possibly, the integration of Bitcoin into national economic strategies.

As Miran awaits Senate confirmation, the implications of his appointment are vast. His influence could lead to policies that not only recognize Bitcoin's potential as a currency but also as a tool for economic policy, potentially marking a historic shift in how economic growth is pursued in the U.S. His appointment might well pave the way for the United States to become a leader in the global adoption of cryptocurrencies, influencing global economic policies and setting a precedent for how digital assets can be integrated into national economies.