Trump Media Proposes Truth Social Crypto Blue Chip ETF to Track Major Cryptocurrencies

Trump Media and Technology Group, the company behind Truth Social, has taken a bold step into the crypto market by filing for a new exchange-traded fund (ETF) with federal regulators. The proposed Truth Social Crypto Blue Chip ETF aims to track the prices of five major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Cronos (CRO), and XRP. According to a statement released on Tuesday, the filing marks another milestone for the fintech firm co-founded by U.S. President Donald Trump as it expands its footprint in the digital asset space. The move comes as investor interest in crypto-based financial products continues to grow.

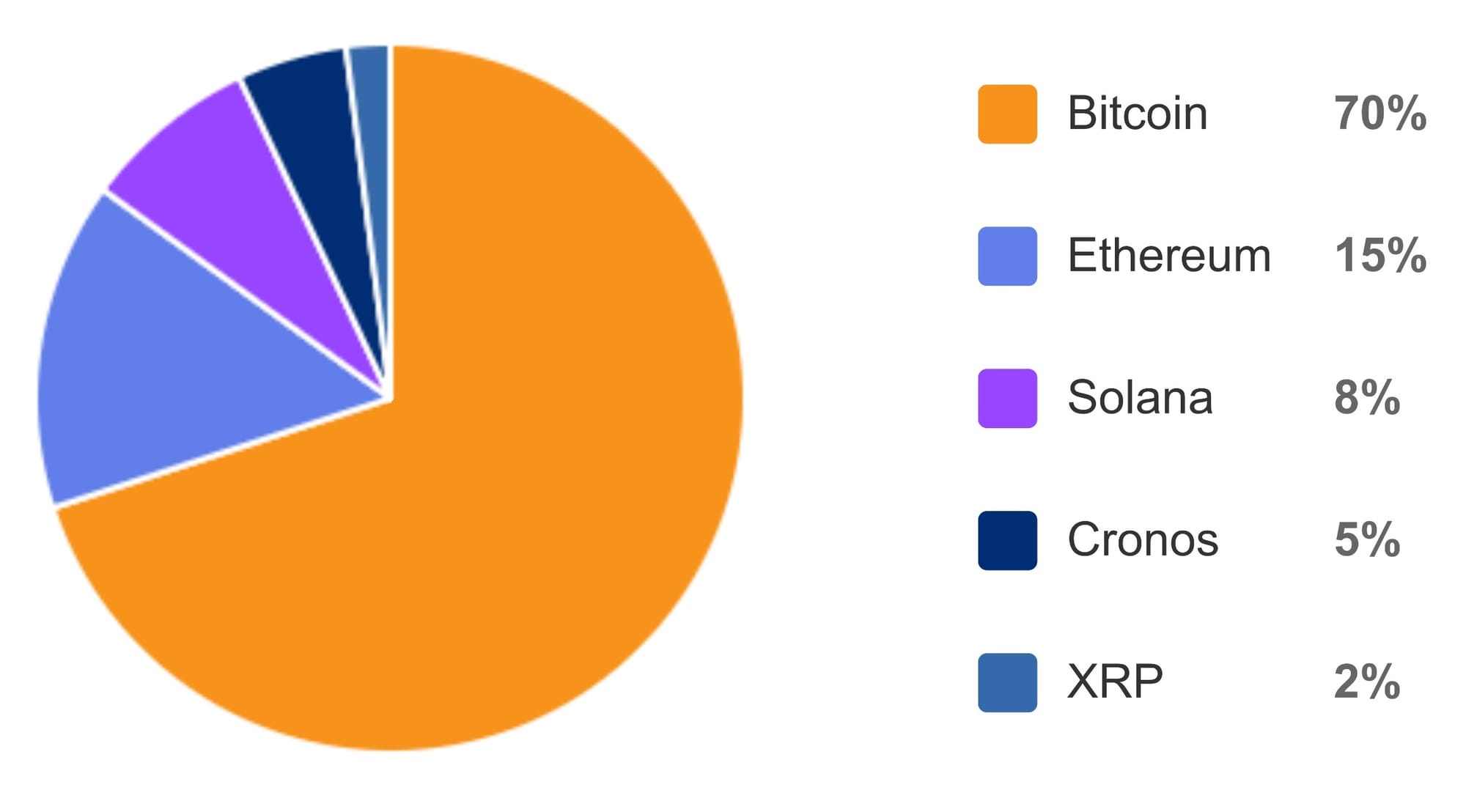

The ETF’s composition, detailed in an S-1 registration statement filed with the U.S. Securities and Exchange Commission (SEC) last Thursday, allocates 70% to Bitcoin, 15% to Ethereum, 8% to Solana, 5% to Cronos, and 2% to XRP. If approved, the fund will trade on NYSE Arca, with Yorkville America Digital serving as the sponsor.

Crypto.com, a prominent cryptocurrency exchange platform, will act as the digital assets custodian, prime execution agent, staking provider, and liquidity provider for the fund. This strategic partnership underscores Trump Media’s intent to leverage established crypto infrastructure to ensure the ETF’s operational success.

A Growing Crypto Portfolio

This latest filing is not Trump Media’s first foray into cryptocurrency ETFs. The company previously submitted applications for two other crypto-focused funds: one dedicated solely to Bitcoin and another split between Bitcoin and Ethereum, with a 75% BTC and 25% ETH allocation. The Truth Social Crypto Blue Chip ETF broadens this vision by incorporating a more diverse range of digital assets, reflecting the firm’s confidence in the long-term potential of multiple cryptocurrencies. The inclusion of Solana, Cronos, and XRP alongside market leaders Bitcoin and Ethereum suggests a strategy aimed at capturing growth across different blockchain ecosystems.

Trump Media’s crypto ambitions extend beyond ETFs. In May, the company raised over $2.5 billion to establish a Bitcoin treasury, a move intended to position it as a significant player in the digital asset market. While the firm has yet to announce its first Bitcoin purchase, it recently reaffirmed its treasury plans while unveiling a $400 million stock buyback program. These financial maneuvers highlight Trump Media’s commitment to integrating cryptocurrency into its broader business strategy, even as it navigates the complexities of regulatory approval and market volatility.

The proposed ETF arrives at a time when institutional interest in cryptocurrencies is surging. Bitcoin, often viewed as a store of value, continues to dominate the market, while Ethereum’s smart contract capabilities drive its adoption in decentralized finance and other applications. Solana has gained traction for its high-speed transactions, and XRP remains a key player in cross-border payments. Cronos, tied to Crypto.com’s ecosystem, adds another layer of diversification to the fund. By offering exposure to these assets, the Truth Social Crypto Blue Chip ETF could attract investors seeking a balanced approach to crypto investing.

Regulatory approval remains a critical hurdle. The SEC has historically taken a cautious stance on crypto ETFs, citing concerns over market manipulation and investor protection. However, recent approvals of Bitcoin and Ethereum ETFs have signaled a thawing in the agency’s approach, potentially paving the way for funds like Trump Media’s. If greenlit, the ETF could begin trading in the coming months, providing retail and institutional investors with a new vehicle to gain exposure to the crypto market without directly holding digital assets.