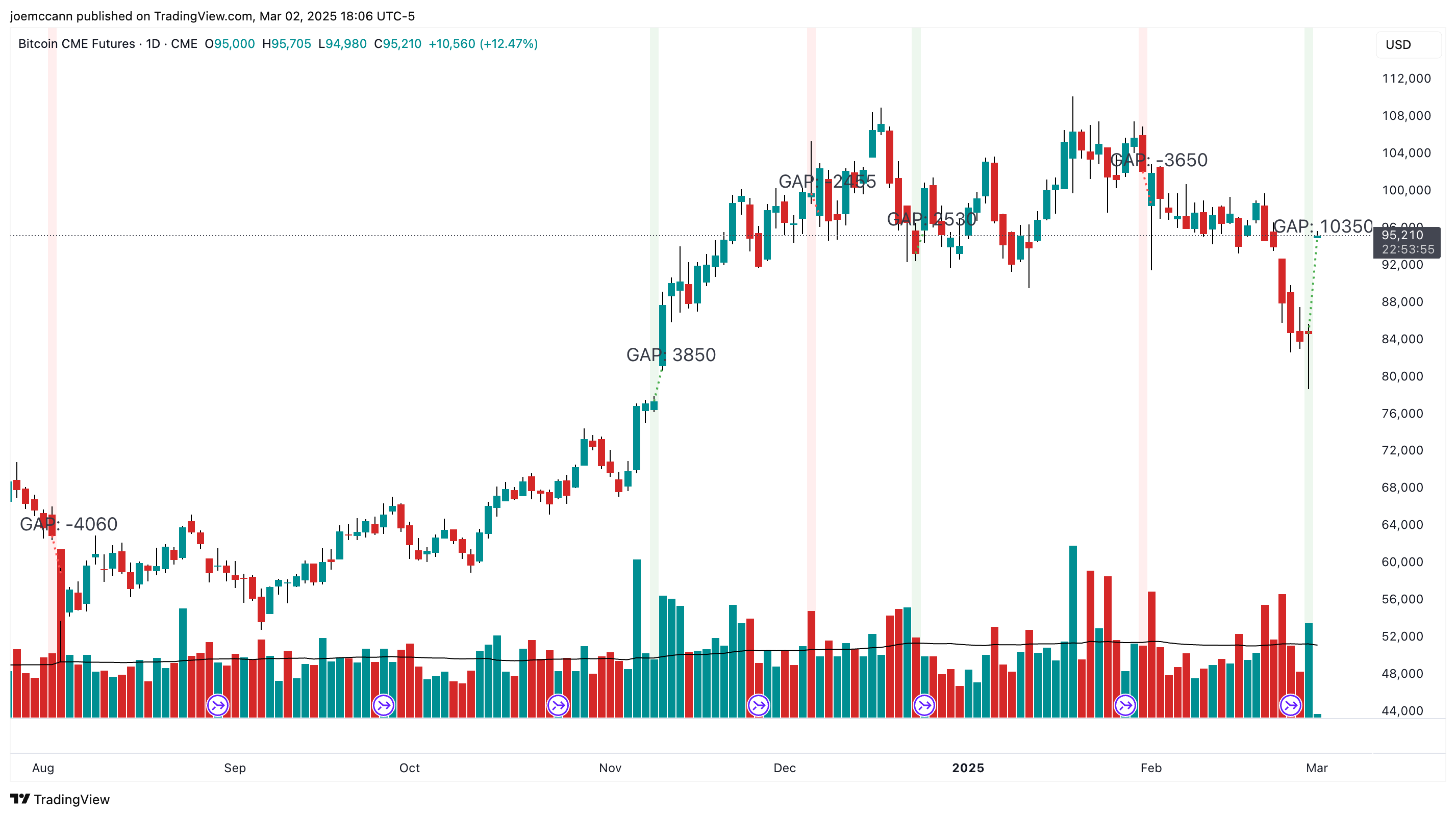

Traders Eye New Opportunities as Bitcoin Futures Hit Record CME Gap of $10,350

Fresh data from Bitcoin futures over the weekend show a staggering $10,350 gap, which has set a new record on the Chicago Mercantile Exchange. This gap marks the largest price difference ever observed between Bitcoin’s Friday close and Monday open on the CME.

For context, this figure dwarfs the previous high of $4,060, recorded in August 2024, signaling a notable shift in market dynamics that traders are trying to interpret. McCann, the founder of Asymmetric, a hedge fund that ranked among the top performers in 2023, brings a seasoned perspective to this development, making it a focal point for anyone tracking Bitcoin’s unpredictable journey.

So, what exactly is a CME gap, and why does it matter? Unlike the crypto spot market, which operates around the clock, the CME pauses trading over the weekend. This downtime often leads to a disconnect between Bitcoin’s price at the close of Friday and its opening value the following Monday.

When the broader crypto market moves significantly during those off-hours—whether due to news, sentiment, or macroeconomic factors—the CME futures price can leap or plunge to catch up. In this case, a $10,350 gap underscores just how volatile Bitcoin can be outside traditional trading windows. Historical trends suggest that roughly 65% of these gaps eventually “fill,” meaning the price tends to revisit the pre-gap level over time. For traders, this pattern offers a potential roadmap for positioning, though nothing in crypto is ever a sure bet.

A Deeper Look at Market Implications

The scale of this gap isn’t just a number—it’s a window into Bitcoin’s current state. With the crypto market running 24/7, weekends often bring surprises that traditional exchanges like the CME can’t reflect in real time. This latest record hints at a surge of activity or sentiment shifts that unfolded off the CME’s radar, which are tied to the major announcement made today by President Trump about the U.S. national strategic reserve stockpile.

For the average investor or trader, this moment could signal opportunity. Gaps like these often attract attention because they highlight inefficiencies between markets, which some use as entry or exit signals. Yet, with Bitcoin’s price action notoriously hard to predict, leaning too heavily on past gap-filling stats could be risky. The 65% fill rate is compelling, but it’s not a rule etched in stone.