Tokenization of Treasuries Could Drive Financial Innovation using Crypto

A recent report from the Treasury Borrowing Advisory Committee (TBAC) sheds light on how blockchain technology and digital assets could reshape the Treasury market. This insightful document delves into the implications of this sector, offering a glimpse into potential innovations and the inherent risks they carry.

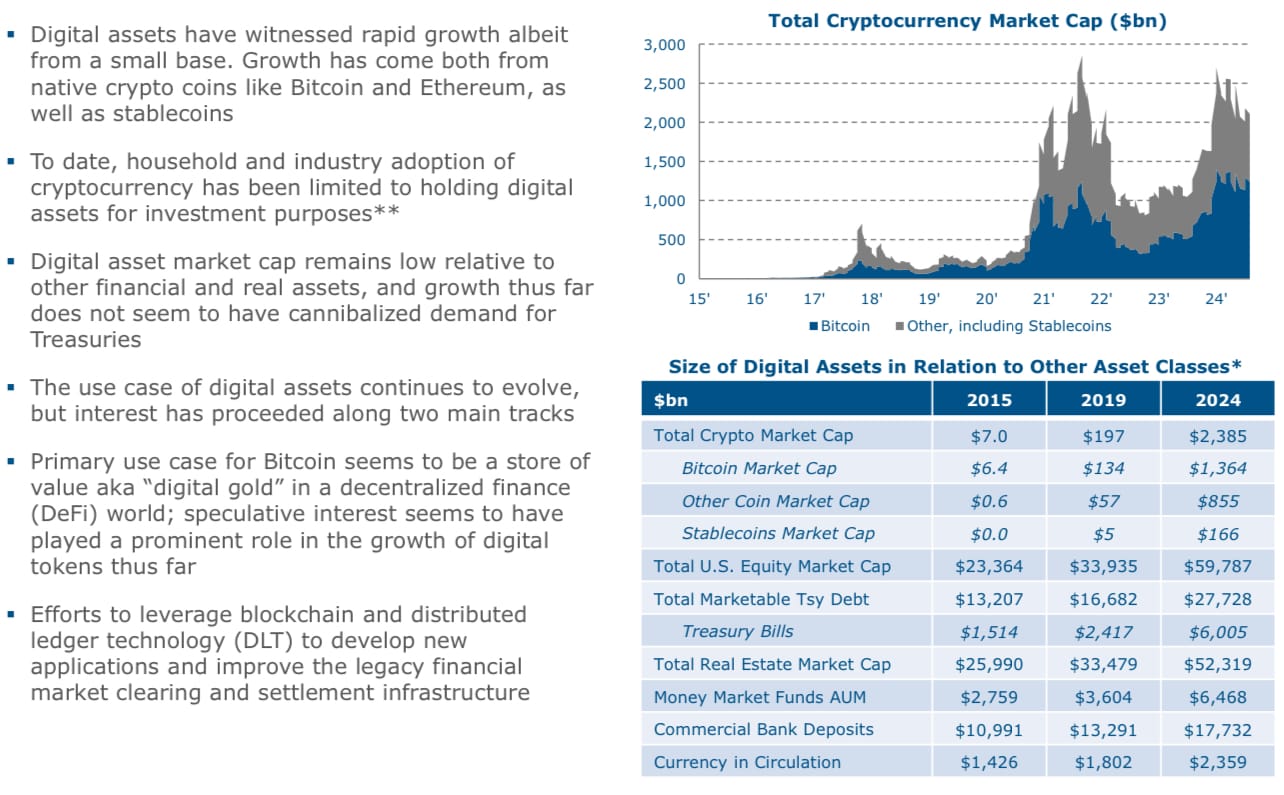

The report starts with a comprehensive look at how digital assets have grown rapidly, yet from a relatively small base. This growth has primarily been driven by cryptocurrencies like Bitcoin and Ethereum, alongside stablecoins which are pegged to maintain a stable value, often backed by collateral like U.S. Treasuries. Despite this expansion, the impact on the Treasury market has been minimal so far, focusing mostly on a modest increase in demand for short-dated Treasuries due to stablecoins' need for collateral.

The Promise and Peril of Blockchain in Treasury Operations

The use of blockchain technology for Treasuries extends beyond mere investment into creating new operational efficiencies. Blockchain tokens offers the promise of instant settlement, reducing the risks associated with traditional clearing and settlement processes. This could streamline transactions, making them more transparent and potentially reducing operational costs. However, the report warns of significant challenges. The technology is still in its nascent stages for such applications, facing hurdles like cybersecurity threats, scalability issues, and the complexity of managing digital custody.

Moreover, the report discusses ongoing initiatives where blockchain technology is already being piloted. Various financial institutions, including giants like BlackRock and Franklin Templeton, are experimenting with tokenized Treasury funds. These efforts aim to make Treasury securities more accessible, potentially increasing market liquidity by allowing fractional ownership or enabling 24/7 trading. Yet, these projects are just scratching the surface, with much of the Treasury market's infrastructure still rooted in traditional systems.

The story around tokenization isn't just about efficiency but also about innovation. The concept of smart contracts could automate much of the collateral management, enhancing how Treasuries are used in financial transactions. However, this innovation comes with a caveat. The report highlights potential risks, including the possibility of increased leverage in the financial system, which could lead to greater volatility or even financial instability if not managed properly.

The regulatory landscape remains a significant concern. While there's excitement about what tokenization could achieve, the legal and regulatory frameworks are still catching up. The report suggests that for tokenization to reach its full potential, it might require a centralized, trusted authority to oversee operations, ensuring both security and compliance across borders.

In conclusion, the TBAC report paints a picture of a future where the Treasury market could benefit immensely from blockchain technology, enhancing liquidity, transparency, and accessibility. However, this future is not without its perils. The financial system must navigate through technological, operational, and regulatory complexities to harness these benefits while mitigating risks like market manipulation, cybersecurity breaches, and potential disruptions to financial stability. As we stand at this crossroads, the journey towards a more digitized Treasury market will demand meticulous planning, robust security measures, and a willingness to adapt to an ever-evolving regulatory environment.