Texas Introduces Legislation for Establishing a Strategic Bitcoin Reserve

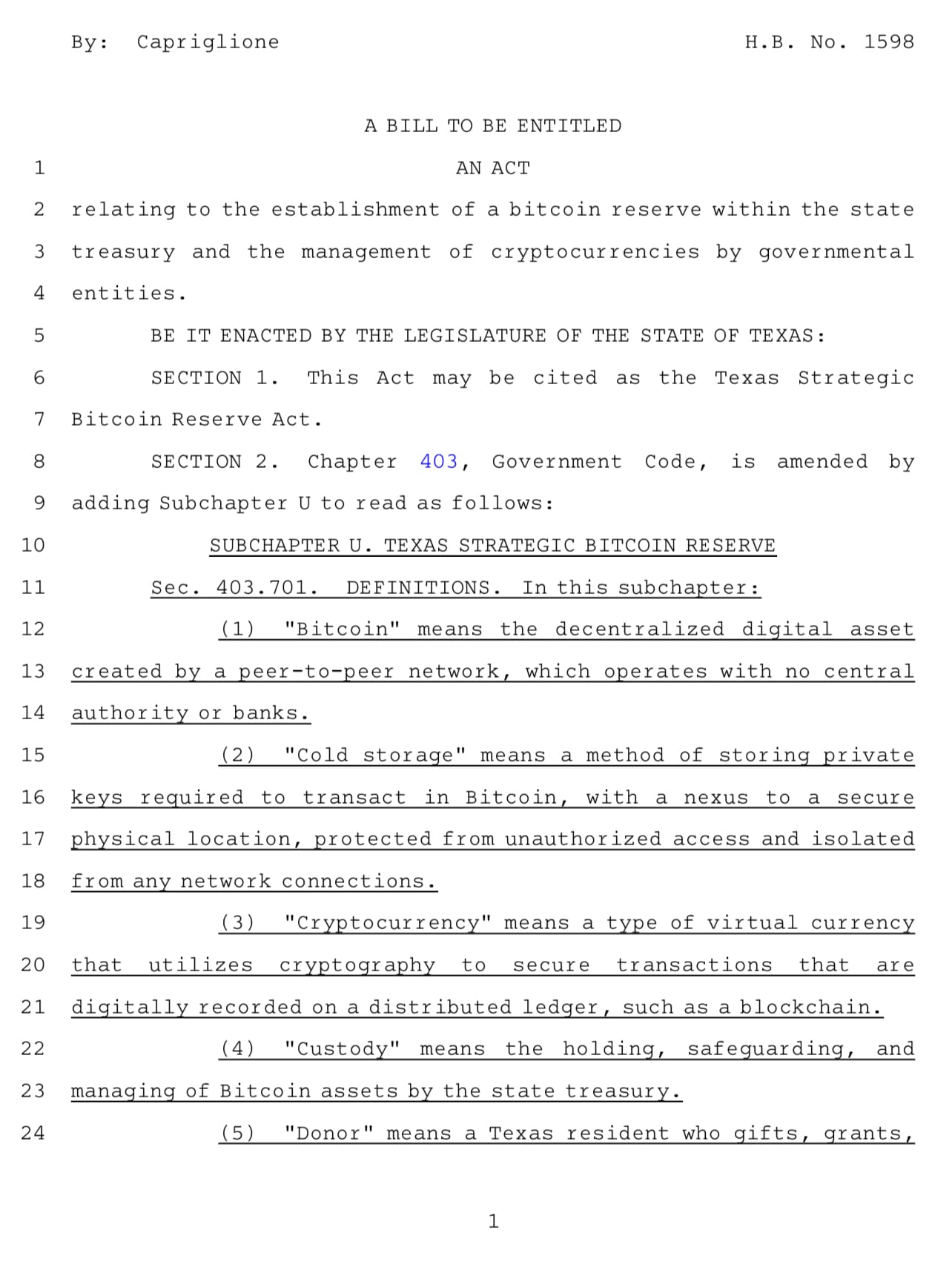

The Texas House of Representatives has introduced a new Bitcoin bill today. House Bill 1598, known as the Texas Strategic Bitcoin Reserve Act, is a legislative push to establish a state-held Bitcoin reserve, propelling Texas into the forefront of global crypto discussions.

This legislation, introduced by Representative Giovanni Capriglione, seeks to create a "Texas Strategic Bitcoin Reserve" within the state treasury. The initiative is not merely about amassing digital currency but is a strategic move to safeguard Texas against economic volatility and inflation, which are often associated with traditional fiat currencies.

Economic Implications and Strategy

Bitcoin, dubbed digital gold, has increasingly been seen as a stable store of value amidst inflationary pressures. By venturing into Bitcoin, Texas aims to diversify its asset portfolio, similar to how countries maintain gold reserves. The strategy here is to protect the state from monetary policy swings and potentially benefit from Bitcoin's value appreciation. Skeptics might point to Bitcoin's volatility, but supporters argue that the potential rewards justify the risks. Should Bitcoin's value significantly increase, Texas would be positioned to leverage this growth for fiscal advantage.

This bill sparks a larger conversation about the role of digital currencies in public finance. By endorsing Bitcoin, Texas not only signals its readiness to embrace blockchain technology but also aims to attract tech entrepreneurs, innovators, and investors, potentially enhancing its already dynamic economy. However, managing such a reserve comes with its set of challenges, including Bitcoin's price fluctuations and the environmental concerns associated with mining. The state would need to develop robust mechanisms for acquisition, storage, and management of these digital assets with a strong emphasis on transparency, security, and regulation.

The implications of this bill could extend beyond Texas, possibly influencing other states or nations to consider digital currencies in their financial strategies. If successful, Texas could set a precedent, encouraging a broader acceptance or at least a more open dialogue about the integration of cryptocurrencies into government fiscal policies. Yet, this venture isn't without debate. The discussion around the environmental impact of Bitcoin mining, due to its energy consumption, will be central to the bill's examination.

As this bill navigates through the legislative process, it will undoubtedly attract both advocates and critics. Proponents will highlight the potential for economic innovation and diversification, while detractors might caution against the speculative nature of cryptocurrencies.

The Texas Strategic Bitcoin Reserve Act, if enacted, would signify a pivotal shift in state policy, showcasing Texas's willingness to innovate in the financial sector where others might hesitate. This could either lead to significant financial gains for Texas or serve as a cautionary example of the risks involved in state-level crypto investment.

As we continue to monitor the progression of House Bill 1598, it's clear that its implications could extend well beyond Texas, potentially reshaping how governments view, regulate, and perhaps even adopt cryptocurrencies. The debate around this bill has only just begun, but it's already one of the most significant policy discussions in Texas, potentially charting a new course for state financial management.