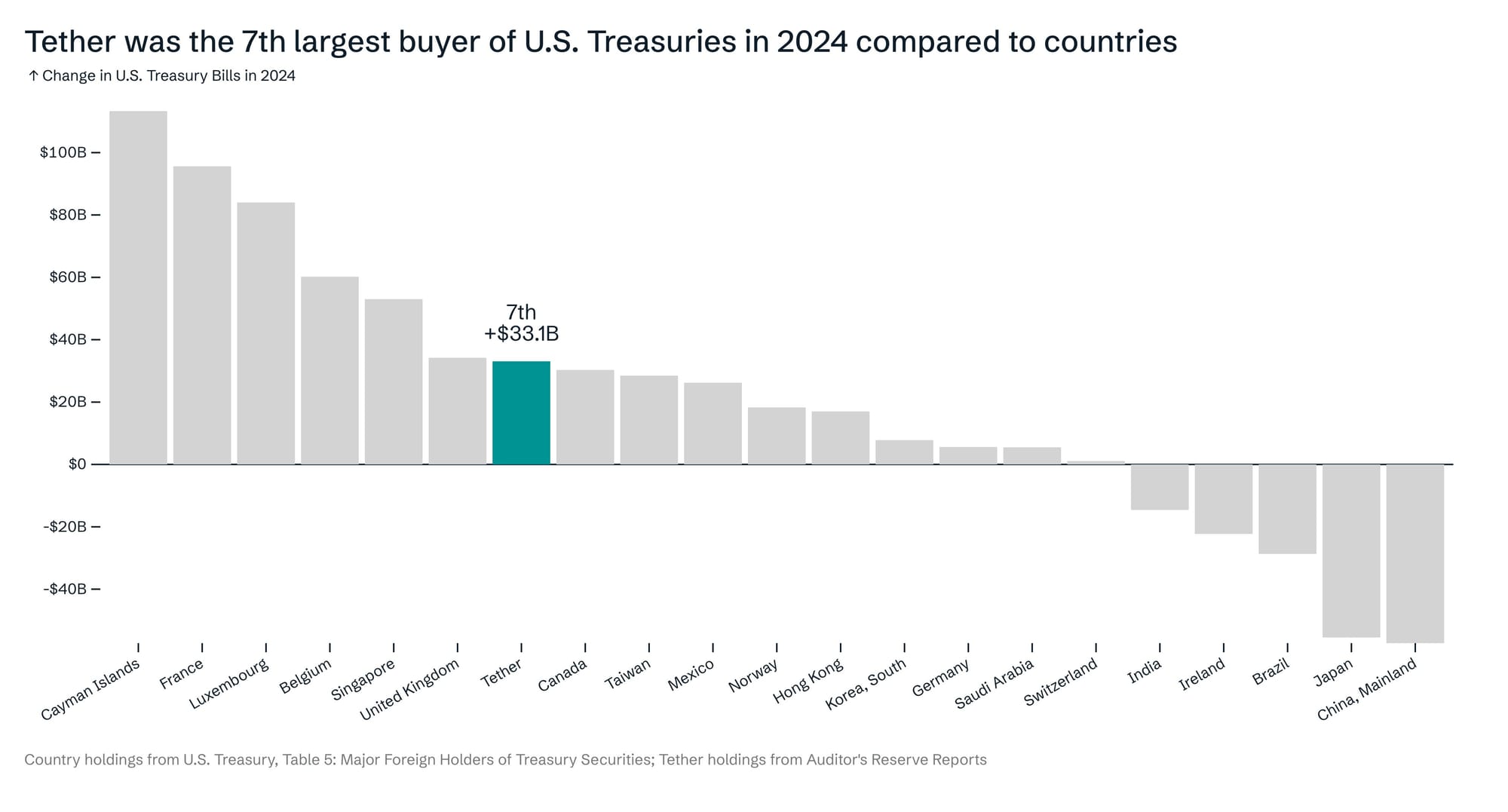

Tether Reported as Seventh-Largest US Treasury Holder in 2024 with $33.1 Billion in Assets

Tether has solidified its standing in the financial world by becoming the seventh-largest holder of US Treasuries in 2024, a notable achievement for the company behind the widely used USDT stablecoin. With $33.1 billion in these government securities, Tether has outpaced several prominent nations, including Canada, Norway, Germany, and Saudi Arabia. This milestone shows the growing role of crypto related entities in traditional financial markets, as Tether leverages these assets to reinforce the stability and credibility of its stablecoin.

The company’s substantial investment in US Treasuries reflects a deliberate strategy to anchor its reserves in one of the world’s safest and most liquid asset classes. By doing so, Tether ensures that USDT, which is pegged to the US dollar, remains a reliable option for users in the volatile cryptocurrency space. The $33.1 billion figure, shared by Tether CEO Paolo Ardoino, highlights the scale of this commitment. It places Tether ahead of countries like Taiwan, Mexico, Hong Kong, and South Korea, marking a significant moment for the firm as it continues to expand its economic footprint.

Comparing Global Treasury Holdings

While Tether’s position is impressive, it operates within a broader landscape of international buyers. According to Ardoino, the Cayman Islands led global purchases of US Treasuries in 2024, amassing over $100 billion in holdings. Other major players include France, Luxembourg, Belgium, Singapore, and the United Kingdom, each contributing to the competitive market for these securities.

However, Ardoino pointed out a key distinction in these figures. Holdings from places like the Cayman Islands and Luxembourg often represent the combined investments of multiple hedge funds, whereas Tether’s $33.1 billion is tied to a single entity. This concentration of assets underscores Tether’s unique role as a unified force in the Treasury market, distinct from the diversified portfolios of other regions.

The significance of US Treasuries in Tether’s operations cannot be overstated. These securities provide a foundation for USDT, which has become a cornerstone of the crypto ecosystem. By holding such a large volume of Treasuries, Tether not only strengthens its own financial position but also signals confidence in the enduring value of US government-backed assets. This approach has allowed the company to navigate the complexities of the digital currency landscape while maintaining a strong connection to traditional finance.