Steve Bannon Faces Lawsuit Over FJB Memecoin Crypto Scandal

Prominent conservative podcaster Steve Bannon has become involved in a legal dispute centered on his role in a specific cryptocurrency project. The matter involves a memecoin known as "Fuck Joe Biden" (FJB) which experienced significant difficulties under the management of Bannon and his associates.

An investor based in Missouri named Andrew Barr recently initiated the legal action against Bannon, Boris Epshteyn, and several other individuals tied to the coin operations. Barr alleges personal losses reaching $58,730.98 as a result of the investment. The complaint seeks approval to proceed as a class action which would allow other similarly situated participants to join the proceedings.

The Operations and Decline of the FJB Project

The FJB memecoin started with a name drawn from political slogans before Bannon and Epshteyn gained ownership in December of 2021. At that point the team reoriented the project under a rebranding called Freedom Jobs Business designation and presented it as support for a new form of economic activity resistant to external pressures. MAGA right-wing influencers within similar circles including Jack Posobiec and Benny Johnson assisted in raising awareness about the memecoin among potential users.

A key feature of the token involved an 8% fee applied to each transaction with 3% directed toward ongoing management and promotion activities. The remaining 5% carried a commitment to support charitable efforts focused on areas such as care for veterans. Documentation provided by the operators demonstrated only modest contributions to these causes leaving many participants questioning the full execution of the plan.

Public nature of blockchain records enabled close observation of wallet activities associated with the project. Analysis indicated that some amounts reserved for donations were instead allocated toward investments in various lesser known crypto tokens and memecoins carrying elevated risk profiles. Such movements became apparent to attentive members of the community relatively early in the process.

Court filings include direct message conversations between project administrators that reveal internal assessments of the financial oversight. Sarah Abdul who held a senior role in the administration of the memecoin described the situation surrounding fund handling as worse than expected during exchanges with programmer Chase Bailey. Bailey responded by characterizing certain decisions as displaying noticeable negligence in their approach.

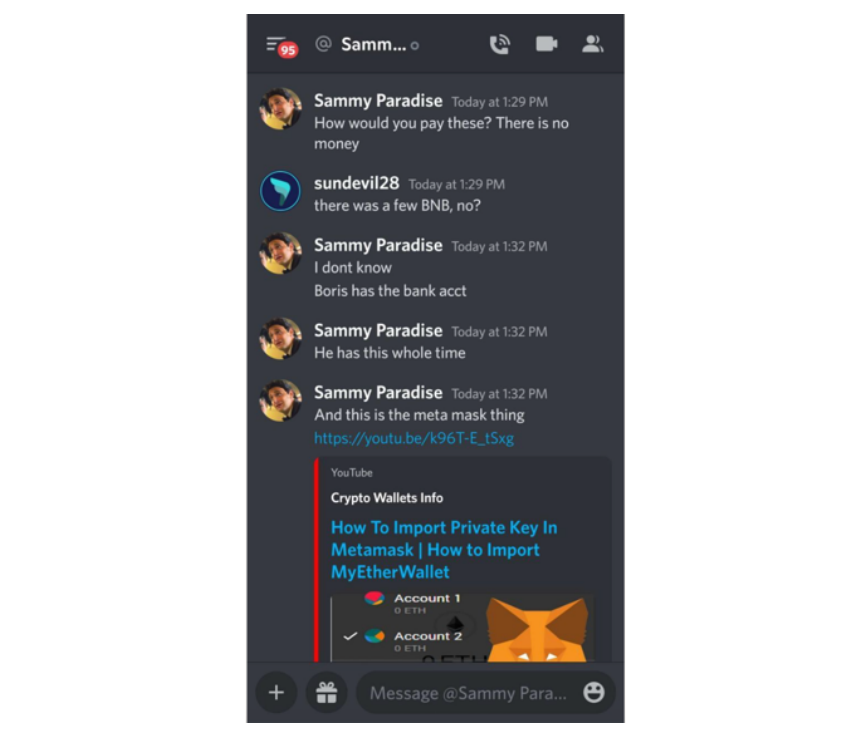

In one message exchange, lawsuit defendant Grant Tragni who went by the online username "Sammy Paradise", said that "How would you pay these? There is no money." When asked if there was still BNB left, he replied, "I don't know, Boris has the bank acct."

The memecoin encountered additional pressures during the general downturn in values across many similar assets in 2023. Bannon and Epshteyn appeared to step back from active promotion of the token as its market price declined markedly. Records suggest that fees totaling around $2.7 million collected for designated purposes did not receive transparent allocation or reporting.

Efforts to address the challenges included an attempt to refresh the project identity by changing the name to Patriot Pay. This rebranding faced immediate hurdles because the selected name had already been claimed preventing successful trademark registration. Reduced discussions of the coin on associated media platforms further limited exposure at a critical time for maintaining interest.

In February of the previous year participants discovered that their wallet access had been secured in a manner that blocked all outgoing transfers or exchanges. The token effectively stopped trading on available exchanges resulting in uncertainty about any residual worth. Administrators have offered limited updates since that time according to details outlined in the filing.

Bannon possesses experience with large scale fundraising initiatives from his earlier political endeavors with the likes of Jeffrey Epstein. One notable example involved support for border security infrastructure that led to separate legal reviews at multiple government levels. These instances add background to the present examination of his cryptocurrency related activities.

The lawsuit remains in its early phases with a judge yet to determine its class action status.