Stablecoins Undermine Decentralization and the Vision for Financial Freedom

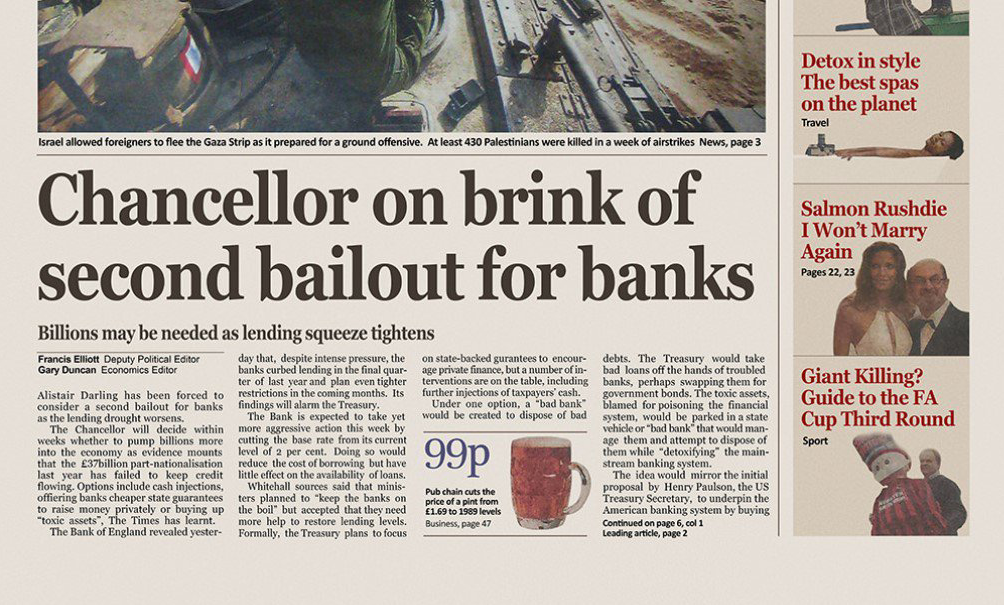

In 2008, Satoshi Nakamoto introduced Bitcoin with a revolutionary idea: a decentralized, peer-to-peer digital cash system that bypassed banks, governments, and intermediaries. The Genesis block’s embedded message, referencing a 2009 news headline about bank bailouts, underscored Bitcoin’s purpose as a rebellion against a flawed financial system.

It promised individuals control over their money and a path to financial inclusion through censorship-resistant networks. Seventeen years later, the rise of stablecoins like Tether (USDT) and USD Coin (USDC) is challenging this vision, pulling the crypto ecosystem toward a centralized, state-monitored digital dollar that mirrors the system Bitcoin aimed to replace.

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks"

- Satoshi Nakamoto, January 3, 2009, Genesis block

Stablecoins, pegged to fiat currencies like the U.S. dollar, offer price stability that contrasts with the volatility of Bitcoin, Ethereum, or Solana. This stability has driven their adoption in trading, remittances, and decentralized finance, but it comes at a cost. Stablecoins are increasingly positioned as the primary payment infrastructure for crypto, diverting attention from decentralized cryptocurrencies that prioritize financial sovereignty. By emphasizing convenience, they risk reducing Bitcoin and its peers to speculative assets rather than tools for global financial freedom. This shift dilutes the crypto community’s commitment to building systems free from centralized control.

Stablecoins Undermine Decentralization

The reliance of stablecoins on the U.S. dollar also carries geopolitical weight. Issuers like Tether and Circle hold reserves in U.S. Treasuries, which supports American government spending, including military actions such as funding wars. Bitcoin was designed to bypass fiat systems and their associated power structures, yet stablecoins reinforce the dollar’s global dominance. Just yesterday, U.S. Treasury Secretary Scott Bessent said, "Crypto is not a threat to the dollar. In fact, stablecoins can reinforce dollar supremacy." This alignment ties crypto’s growth to the very state-backed financial system Satoshi Nakamoto sought to escape, undermining the ethos of separating money and state.

Unlike Bitcoin’s permissionless network, stablecoins operate as centralized digital assets, functioning much like private central bank digital currencies (CBDC). Issuers can freeze accounts, monitor transactions, and comply with government orders, as seen in cases where USDT and USDC have blacklisted addresses. Incoming regulations like the GENIUS Act are tightening this control, making stablecoins appealing to governments seeking surveillance capabilities. This centralization exposes users to the same risks - arbitrary account freezes, censorship, and exclusion - that decentralized cryptocurrencies were built to eliminate.

The surge in stablecoin adoption aligns with a broader cultural shift in crypto, driven by institutional investors and corporate advocates who favor regulation and integration with traditional finance. Since 2020, figures like Michael Saylor have promoted Bitcoin as a corporate asset but often within frameworks that invite government oversight. The shift from digital cash to digital gold, a settlement network, has changed the mindset completely. Stablecoins fit this agenda perfectly, offering a regulated, dollar-backed option that appeals to institutions wary of crypto’s volatility. This trend risks transforming crypto into a state-sanctioned system, where stablecoins dominate payments and decentralized cryptocurrencies are sidelined, betraying Bitcoin’s original mission.

The convenience of price stability with stablecoins is undeniable, enabling practical use cases that drive crypto adoption. However, this ease comes with a steep cost. By prioritizing stablecoins, the crypto community risks abandoning the fight for financial freedom that defined Bitcoin’s creation. A stablecoin dominated future, where transactions are fully trackable and accounts are subject to state control, eliminates the anonymity and autonomy that cash once provided, leaving dissenters vulnerable to financial exclusion. Hello dystopian future!

To preserve Bitcoin and crypto's vision, the greater community must refocus on decentralized payment systems. This requires developing scalable, user-friendly solutions for Bitcoin, Ethereum, Solana, and other cryptocurrencies to rival stablecoins’ usability without compromising principles. It also demands educating users about the trade-offs of centralized stablecoins and the long-term value of censorship-resistant networks. Resisting the push for crypto regulations that promise legitimacy but delivers control is equally critical to maintaining the ecosystem’s independence.

Satoshi’s message was both a warning and a call to action, highlighting the failures of centralized finance and offering a decentralized alternative. Stablecoins, with their dollar pegs and centralized oversight, are steering crypto back toward that flawed system, now digitized and tightly controlled. If the people allow stablecoins to redefine the ecosystem, it risks sacrificing the freedoms Bitcoin was created to protect. The path forward lies in recommitting ourselves to decentralization, ensuring crypto remains a tool for empowerment rather than a state-controlled extension of the status quo.