Stablecoin Payments Surge to $94.2 Billion with USDT Dominating Market

Stablecoins have emerged as a transformative force in global finance, offering a faster and more cost-effective alternative to traditional payment systems. A new report from Artemis, Castle Island Ventures, and Dragonfly reveals that stablecoin payments settled $94.2 billion between January 2023 and February 2025, with an annualized run rate of $72.3 billion as of February 2025. Drawing from data provided by 20 firms and estimates from 11 others, the study provides a detailed look at how stablecoins are reshaping business-to-business (B2B), peer-to-peer (P2P), and consumer transactions worldwide. With their supply soaring from under $10 billion five years ago to nearly $239 billion today, stablecoins are gaining traction across diverse regions and industries.

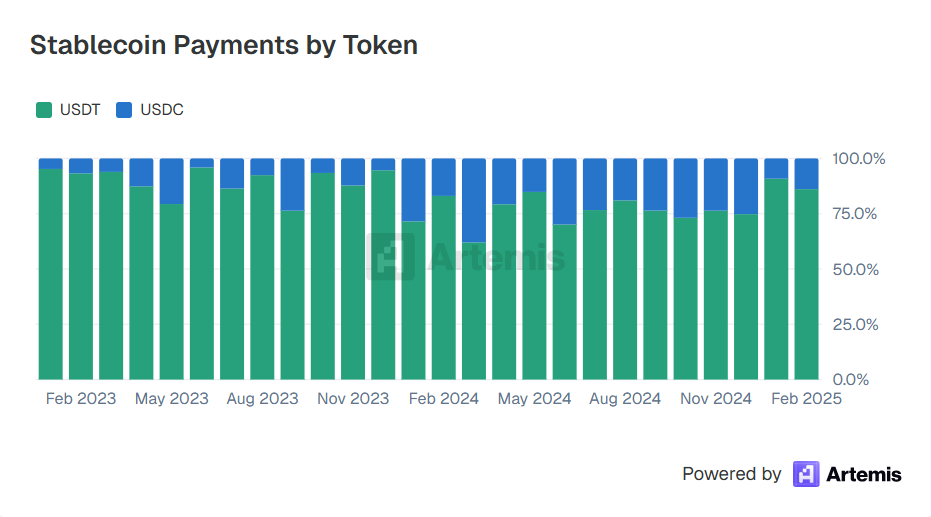

The report highlights the dominance of Tether’s USDT, which accounts for roughly 90% of payment volumes, while Circle’s USDC holds a notable share in markets like Argentina and India. Blockchain networks like Tron, Ethereum, Binance Smart Chain, and Polygon facilitate these transactions, with Tron leading in volume due to its efficiency in high-value transfers. The United States, Singapore, and Hong Kong stand out as top sending countries, underscoring the global reach of stablecoin adoption. As major players like Visa and Mastercard integrate these digital currencies, stablecoins are poised to redefine how money moves across borders.

Stablecoin Use Cases and Regional Trends

Business-to-business transactions lead the stablecoin surge, with a $36 billion annualized run rate driven by cross-border payments and supplier settlements. These transactions, often facilitated by firms like Reap in Asia, have grown from $100 million in early 2023 to $3 billion monthly by early 2025. Stablecoins offer significant cost savings and faster settlement times compared to traditional systems like SWIFT, particularly in regions with volatile currencies. Card-linked payments, with a $13.2 billion run rate, are also gaining momentum as consumers use stablecoin-backed cards for everyday purchases, signaling mainstream adoption.

Peer-to-peer transfers, flat at an $18 billion run rate, remain vital for remittances and small-value transactions, especially in Africa and Latin America. In contrast, business-to-consumer payments, such as payroll, have reached a $3.3 billion run rate, while prefunding for cross-border liquidity stands at $2.5 billion. Regionally, the Singapore-China corridor is the most active, with the U.S. playing a central role in seven of the top eight transaction corridors. In Latin America, Tron dominates most markets, though Ethereum leads in Argentina and Peru, where USDC captures nearly half the volume.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishAfrica showcases stablecoins’ ability to replace traditional USD payment systems, with Tron and Ethereum leading in countries like Nigeria and Kenya. In Asia, diverse blockchain usage reflects local preferences, with Polygon gaining traction in India. Europe and North America show strong adoption, with Tron leading but Ethereum holding significant shares in markets like Spain and the U.S. These regional variations highlight stablecoins’ flexibility in addressing unique economic needs, from currency stability in Latin America to efficient cross-border flows in Asia.

The report also underscores enterprise adoption, with payment giants like Stripe and Worldpay integrating stablecoin solutions. This trend aligns with supportive regulatory signals such as the GENIUS Act to maintain USD dominance. Looking ahead, the study projects stablecoin supply could reach $2 trillion by 2028, driven by their growing role in global trade and consumer finance. As stablecoins continue to address inefficiencies in traditional systems, their impact on financial inclusion and economic efficiency is becoming undeniable, setting the stage for broader adoption in the years to come.