Stablecoin Market Poised for $1.2 Trillion Cap by 2028, Coinbase Report Predicts

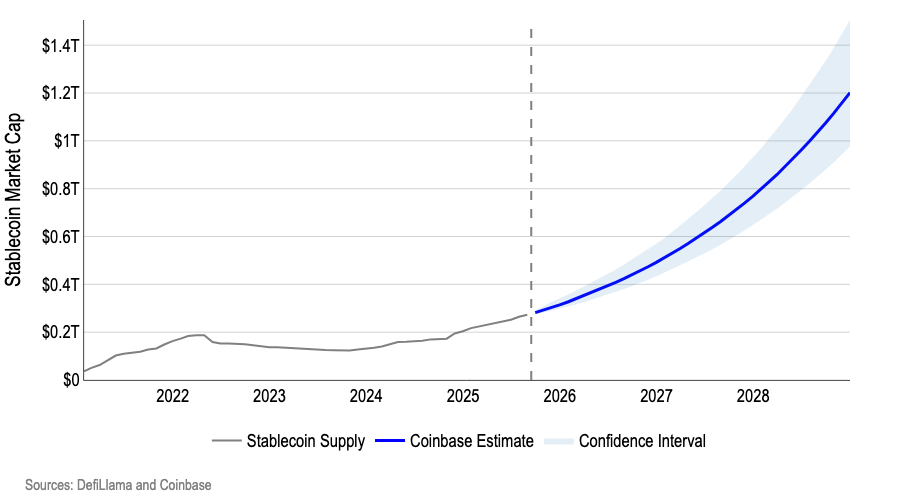

A recent report from Coinbase, a leading global cryptocurrency exchange, projects that the stablecoin market could reach a staggering $1.2 trillion total market value by the end of 2028. This forecast, derived from thousands of Monte Carlo-style simulations using autoregressive modeling, highlights the growing influence of stablecoins in the global financial system.

The Coinbase report highlights the role of regulatory advancements, such as the GENIUS Act passed in July 2025, in fostering a stable and resilient ecosystem for these digital assets. As stablecoins continue to reshape demand for U.S. Treasuries, their growth is expected to have measurable effects on front-end yields and broader market dynamics.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishRegulatory and Market Dynamics Fuel Growth

The stablecoin market has already shown remarkable growth, with a compound annual growth rate of approximately 65% since 2021, pushing the global market cap past $275 billion by mid-August 2025. Transaction volumes have also surged, reaching $15.8 trillion year-to-date through July 31, 2025, compared to $10.3 trillion in the same period of 2024, according to Artemis data. Coinbase’s stochastic model, which emphasizes recent adoption trends and a favorable policy environment, suggests that stablecoins could capture a significant portion of the global money supply. Unlike traditional forecasting methods, this model accounts for the unpredictable, “crypto-style” volatility in stablecoin growth, offering a more nuanced view of future expansion.

The report highlights the critical role of regulatory frameworks like the GENIUS Act, which establishes clear reserve rules and liquidity buffers for stablecoin issuers such as Tether, which leads the market with over two-thirds of the market share. These measures are designed to mitigate the risk of large-scale redemptions, which could otherwise trigger forced selling of Treasury bills and destabilize markets. By weighting post-2024 data more heavily, Coinbase’s model reflects the structural improvements in policy and accelerating adoption trends, providing a robust foundation for its $1.2 trillion projection. The analysis also notes that stablecoin issuers are now among the top holders of U.S. government debt, with the top two issuers ranking as the seventh largest buyers of Treasuries in 2025.

Stablecoin issuance and redemption directly influence the front end of the U.S. yield curve, as issuers purchase short-dated Treasury bills when stablecoins are minted and sell them during redemptions. Coinbase estimates that a $3.5 billion stablecoin inflow over five days could reduce three-month T-bill yields by about two basis points within 10 days and up to four basis points within 20 business days. Conversely, sharp redemptions could tighten yields, though substitution effects may temper these movements. The report suggests that sustained stablecoin growth could lower front-end funding costs, creating a dynamic interplay between digital assets and traditional financial markets.

The path to a $1.2 trillion market cap hinges on efficient on-ramps, broad distribution networks, and evolving roles for market participants. While predicting exact adoption patterns remains challenging due to the compounding utility of stablecoins, Coinbase’s analysis indicates that incremental, policy-enabled growth will drive this expansion. The report avoids overly optimistic assumptions, instead grounding its projections in historical data and current trends.