Stablecoin Market Booms Post-GENIUS Act with Mixed Outcomes for Key Players

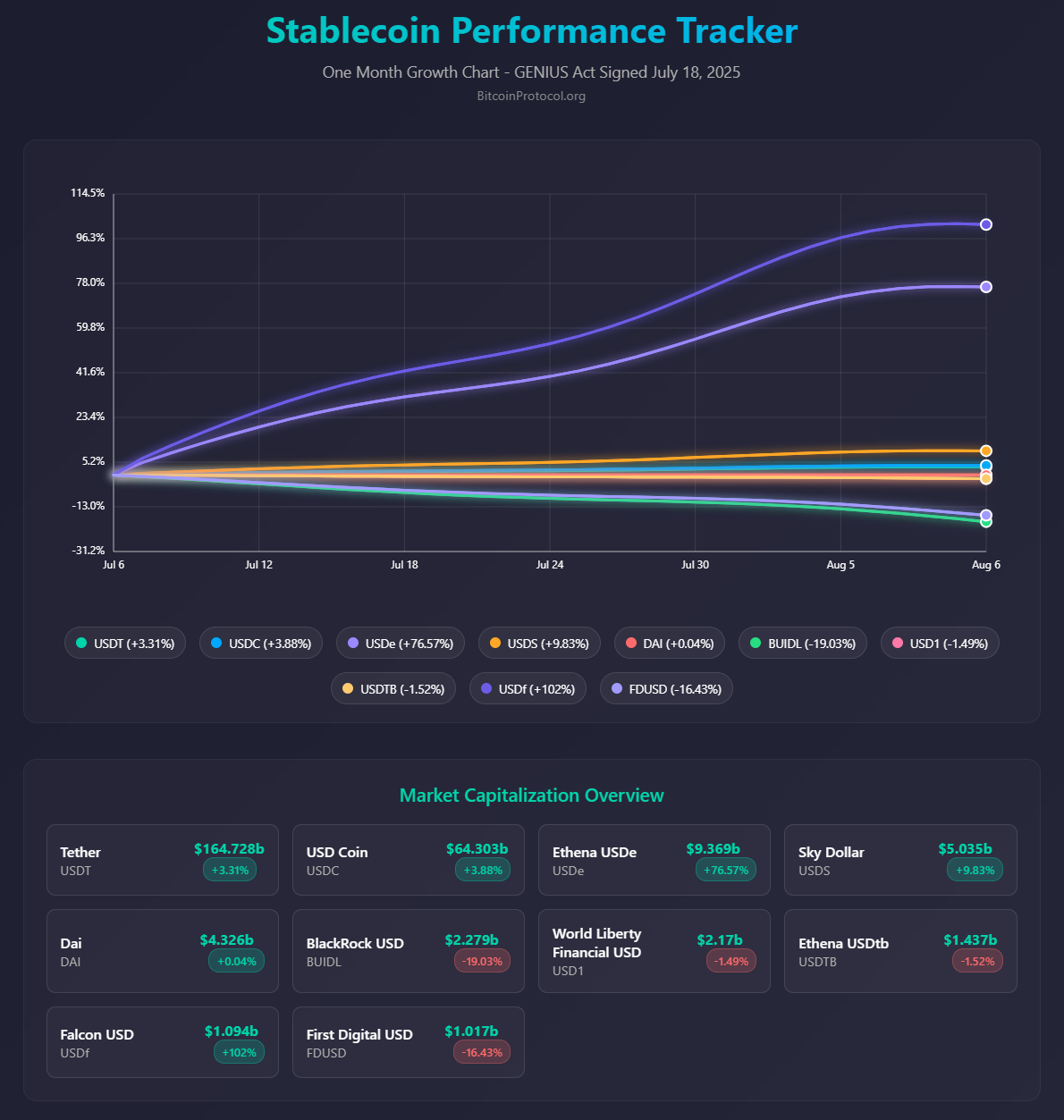

The stablecoin market has experienced significant growth since President Donald Trump signed the GENIUS Act into law on July 18, 2025, establishing a regulatory framework for dollar-pegged cryptocurrencies. According to data from DefiLlama, the total market value of stablecoins has reached $268.585 billion, encompassing over 250 distinct stablecoins ranging from industry giants to obscure tokens with minimal market presence.

This surge reflects growing confidence in stablecoins as a bridge between traditional finance and the crypto ecosystem, spurred by the clarity provided by the new legislation. The GENIUS Act, which mandates that stablecoin issuers maintain 1:1 backing with high-quality liquid assets, has reshaped the competitive landscape, creating clear winners and losers among major players.

Winners and Losers in the Stablecoin Surge

The stablecoin issued by Falcon Finance, founded by Andrei Grachev, has emerged as a standout performer, recording the largest relative market cap increase among top stablecoins since the GENIUS Act’s passage. Despite Grachev’s controversial past, including a fraud conviction in Russia, Falcon Finance’s synthetic stablecoin, USDf, has gained traction, bolstered by a $10 million investment from World Liberty Financial (WLF), a crypto venture tied to President Trump and his family. This investment has enhanced USDf’s liquidity and cross-chain compatibility, contributing to its market cap of $1.175 billion and a 121% supply increase over the past month. Falcon’s focus on institutional-grade digital dollar solutions and transparency measures, such as quarterly assurance reviews, has further fueled its rise.

In contrast, WLF’s own stablecoin, USD1, has faced challenges, declining by 1.49% in market cap over the past month. Launched in March 2025 and backed by U.S. Treasuries and cash equivalents, USD1 holds a market cap of approximately $2.19 billion. Its recent dip is largely attributed to its role as the currency for a $2 billion investment by Abu Dhabi’s MGX in Binance, which may have temporarily skewed its market dynamics. Despite this setback, USD1 benefits from the GENIUS Act’s legal support and WLF’s strategic partnerships, positioning it for potential recovery.

The market leaders, USDT and USDC, continue to dominate with market caps of $164.66 billion and $63.68 billion, respectively, accounting for over 85% of the total stablecoin market. Both have grown by billions since July, though their growth rates lag behind crypto-collateralized stablecoins like Falcon’s USDf and Ethena’s USDe. USDT, with its widespread adoption in Asia and Europe, and USDC, favored in North America, remain the go-to choices for traders seeking stability. However, their slower growth suggests that newer, more agile players are capturing market share in the post-GENIUS Act environment.

PayPal USD (PYUSD), launched in 2023, has outpaced USDT and USDC in relative growth, capitalizing on its integration into PayPal’s payment ecosystem. Despite this, its market cap remains below $1 billion, making it a distant competitor to the top tier. Meanwhile, BlackRock USD (BUIDL) and First Digital USD (FDUSD) have struggled, with declines of 19% and 16% respectively over the past month. These setbacks highlight the challenges faced by some established players in adapting to the rapidly evolving regulatory and market landscape.

On the global stage, China’s push to launch renminbi-backed stablecoins signals a strategic move to challenge U.S. dollar dominance in the crypto space. Beijing aims to leverage blockchain technology to internationalize the renminbi, but concerns over capital flight and financial oversight are slowing progress. This development, spurred by the GENIUS Act’s global ripple effects, underscores the growing geopolitical significance of stablecoins.

The stablecoin market’s growth since the GENIUS Act reflects a maturing sector, with regulatory clarity driving adoption and innovation. While Falcon Finance and PayPal USD have seized opportunities, the struggles of USD1, BUIDL, and FDUSD highlight the competitive pressures within the industry. As USDT and USDC maintain their dominance, the rise of synthetic stablecoins and global competitors like China’s renminbi-backed tokens suggest a dynamic future for digital currencies.