Spot Bitcoin ETFs Record $1.7 Billion in Three Day Inflow Surge

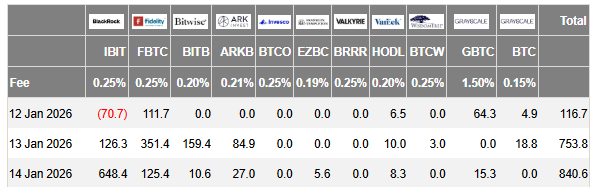

U.S. spot Bitcoin exchange-traded funds continued their strong momentum with another substantial day of net inflows on Wednesday. Data from Farside Investors showed $840.6 million entering these products, marking the largest single-day total since October. This figure surpassed Tuesday’s $754 million, which had itself set a three-month record.

The three-day streak now totals $1.71 billion in fresh capital, demonstrating consistent investor interest heading into the new year. Eight of the twelve spot Bitcoin ETFs recorded positive flows on Wednesday. This widespread participation underscores broad-based confidence across the sector.

Leading Funds Drive Gains as Institutional Interest Returns

BlackRock’s IBIT, the dominant player by assets under management, attracted $648 million alone on Wednesday. Fidelity’s FBTC followed with $125.4 million, while Ark & 21Shares’ ARKB added $27 million. Smaller but notable inflows also appeared in products from Grayscale, Bitwise, VanEck, Valkyrie, and Franklin Templeton, reflecting participation across the full range of issuers.

These sustained inflows point to renewed institutional allocation following a quieter period of caution at the end of last year. Asset managers and advisors appear to be repositioning portfolios, taking advantage of current price levels and favorable regulatory conditions. The steady capital commitment over multiple days suggests conviction rather than short-term speculation.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishBeyond Bitcoin, other cryptocurrency ETFs showed similar strength. Spot Ethereum ETFs recorded $175.1 million in net inflows on Wednesday, extending their own three-day positive run. Spot Solana ETFs and XRP ETFs also posted gains, with combined inflows of $23.6 million, indicating that demand is spreading across major digital assets.

Market prices have responded positively to the inflow trend. Bitcoin is priced at $95,948 at the time of writing, reflecting a 7% weekly gain. Ethereum rose 9% over the same period to $3,344.91, while Solana advanced 8% to $143.76. These price movements align with the increased institutional exposure through regulated ETF vehicles.

The consistent flow pattern across multiple asset classes highlights growing acceptance of cryptocurrency investment products within traditional portfolios. Investors now have straightforward, regulated options to gain exposure without direct custody concerns. As these funds continue to attract capital, they reinforce the bridge between conventional finance and digital assets.

The current pace of inflows ranks among the strongest stretches since the spot Bitcoin ETFs launched. The combination of high daily totals and broad issuer participation signals sustained appetite rather than isolated bursts. This development supports the broader narrative of maturing market infrastructure for cryptocurrency investments.