South Korea's Martial Law Shakes Up Cryptocurrency Market

The sudden declaration of martial law by South Korean President Yoon Suk Yeol has sent ripples of uncertainty through the global cryptocurrency market, igniting a chaotic response in trading activity and price volatility. This unexpected political maneuver has not only destabilized the financial markets but has also put a spotlight on how geopolitical events can impact digital currencies.

In a late-night address to the nation, President Yoon justified the imposition of martial law as a necessary step to counter what he described as anti-state activities by the opposition Democratic Party. The immediate aftermath saw military forces deployed at strategic locations, including the National Assembly, with a temporary ban on political gatherings. This move marks a significant deviation from South Korea's democratic norms, the first of its kind since the country's transition to democracy in 1987. Critics have been vocal, branding the decision as a step towards authoritarianism, with opposition leaders and even some from Yoon's own conservative faction questioning its legality and implications for civil liberties.

Market Reaction and Trading Dynamics

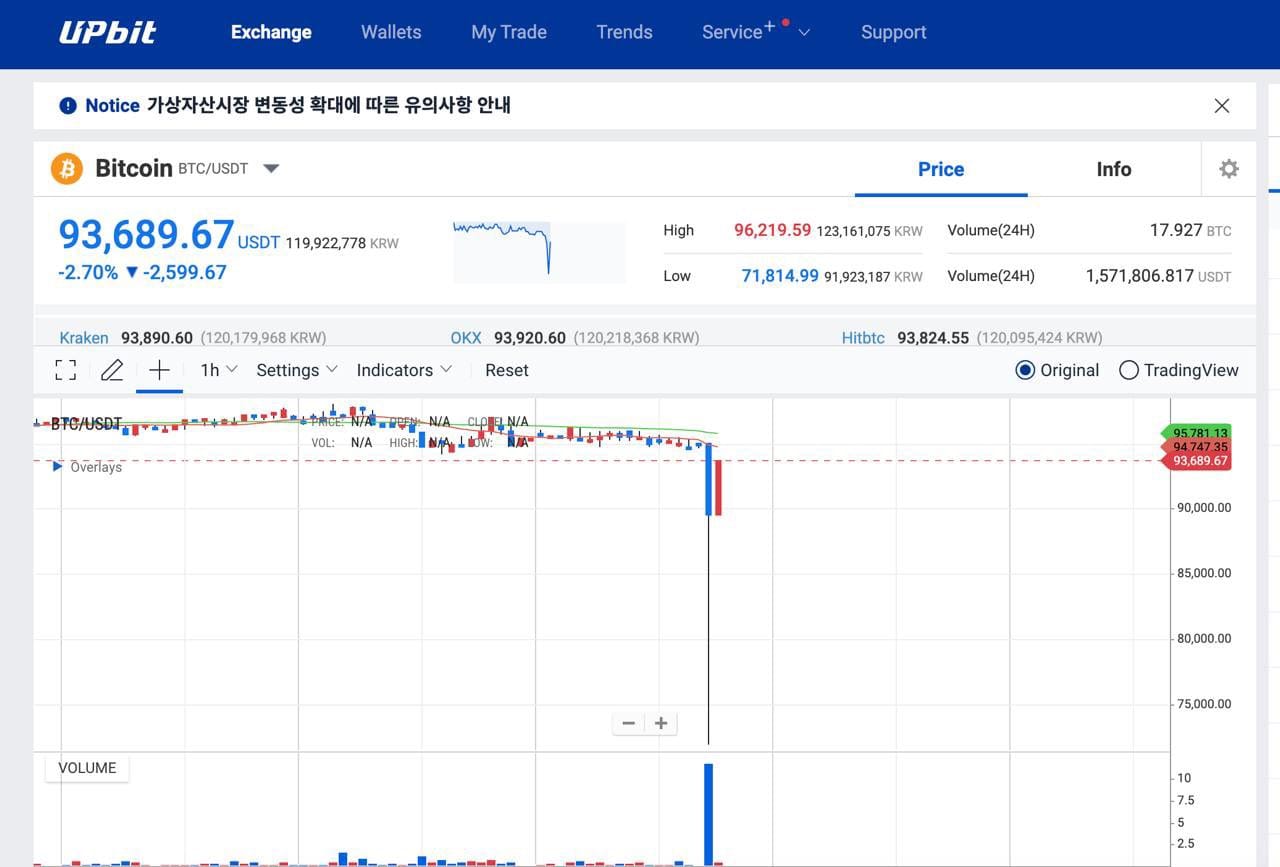

The crypto market, known for its sensitivity to both economic and political news, did not take long to reflect this turmoil. Bitcoin on South Korea's largest cryptocurrency exchange, Upbit, saw a dramatic plunge, dropping below $75,000 before stabilizing near $91,699. This was in stark contrast to the global price of bitcoin, which was approximately $95,700, illustrating a significant regional price disparity due to the local political climate. Other cryptocurrencies like XRP also experienced sharp declines, reflecting a broader market reaction to the news.

Interestingly, amid this chaos, there was a notable influx of Tether (USDT) into Upbit, with over $163 million transferred within an hour of the martial law announcement. This surge, as reported by on-chain analytics firm Lookonchain, suggests that some traders saw the market dip as a buying opportunity, a phenomenon often referred to as "bottom fishing" in investment circles.

The volatility triggered by these events underscores the interconnectedness of cryptocurrency markets with global political happenings, particularly in countries like South Korea, which host significant trading volumes. The rapid response from the market also highlights the agility of crypto traders in adapting to or capitalizing on sudden shifts in the political landscape.

While the full ramifications of this martial law declaration on the crypto market are yet to unfold, it serves as a reminder of the fragility of digital asset prices in the face of geopolitical risks. As South Korea grapples with this political crisis, the eyes of the world, particularly those invested in or observing the cryptocurrency space, will be keenly watching how stability, or the lack thereof, influences market dynamics in the coming days.