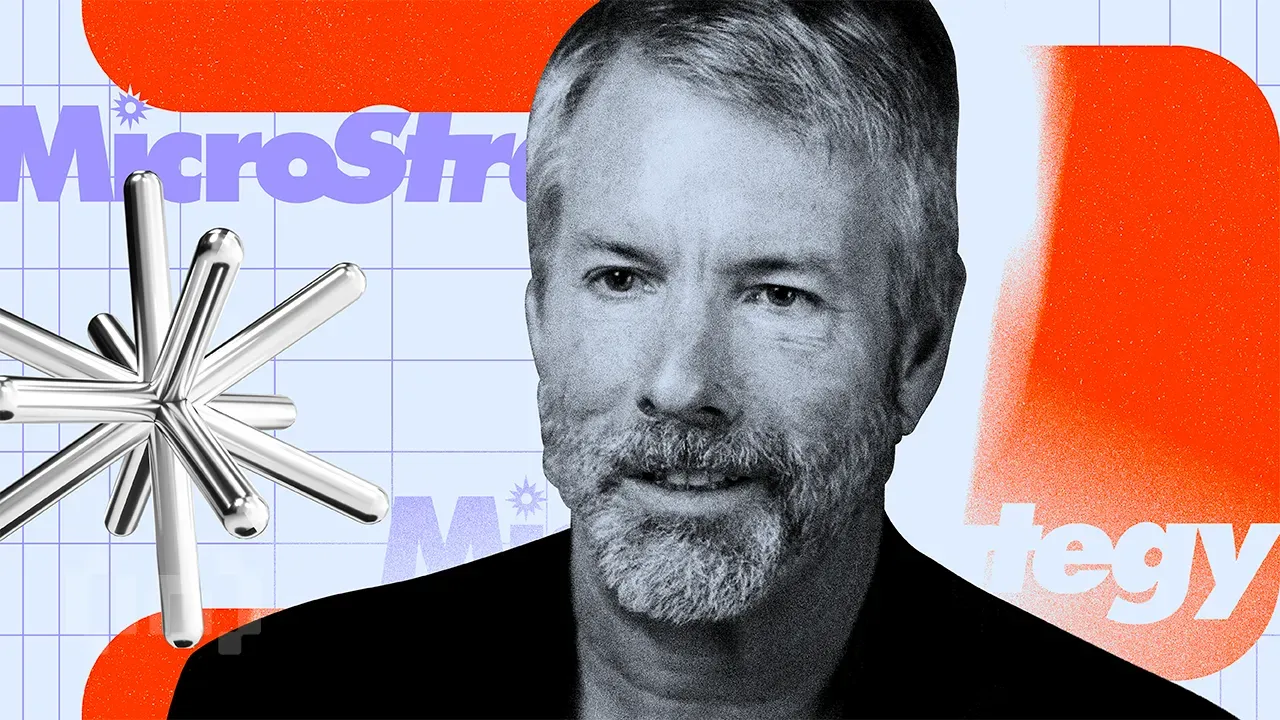

Saylor's Bitcoin Bet Under Scrutiny Amid Price Plunge

Michael Saylor, the CEO of MicroStrategy, has been steadfast in his advocacy for Bitcoin, but recent market movements have put his strategy under the microscope. With Bitcoin experiencing a significant price drop, questions arise about the sustainability and wisdom of MicroStrategy's massive investment in the cryptocurrency.

The Debate Over Bitcoin's Value

Jason Calacanis, a well-respected angel investor known for his early investments in companies like Uber and Robinhood, recently critiqued Saylor's approach. Calacanis pointed out the potential pitfalls of turning MicroStrategy into what he termed "memestock madness." His skepticism stems from the financial mechanics of holding such a volatile asset; he questioned the rationality of paying a dollar for assets worth significantly less. Saylor countered this by framing Bitcoin as the cornerstone of digital capital transformation, suggesting that MicroStrategy's strategy is not just an investment but a pioneering move in the financial landscape.

Saylor wrote,

Bitcoin represents the digital transformation of capital, and $MSTR is accelerating this process by issuing fixed income & equity securities backed by BTC. The dynamic is quite interesting but a responsible treatment of the topic requires more than 280 characters.

The debate intensified when MicroStrategy announced a staggering $5.4 billion addition to its Bitcoin holdings. This news came on a day when Bitcoin's price plummeted to around $92,775, aligning with a broader market correction that also affected gold prices. This correlation might offer some solace, suggesting that Bitcoin behaves like a traditional safe-haven asset during downturns, but it does little to quell the concerns about its volatility.

Calacanis's curiosity about the future of MicroStrategy's strategy in a scenario where Bitcoin's value either soars or crashes is palpable. He posed a critical question: what if Bitcoin's price plummets to between $30,000 and $40,000? This scenario isn't just hypothetical; it's a real concern given Bitcoin's historical volatility. If Bitcoin were to reach $1 million, Saylor would be hailed as a visionary. However, the inverse could lead to significant financial distress for the company.

The narrative around Saylor's Bitcoin strategy isn't just about numbers and market trends; it's about vision versus volatility. Saylor envisions a future where Bitcoin underpins a new form of digital economy, but the path to that future is fraught with the kind of market fluctuations that can turn an investment thesis into a financial debacle. The ongoing debate isn't merely about whether MicroStrategy's gamble will pay off but whether the company's balance sheet can withstand the storm if Bitcoin's value takes another nosedive.

This scenario places MicroStrategy at the intersection of innovation and risk, where every price movement of Bitcoin writes another chapter in the saga of one company's attempt to redefine corporate investment strategy. As the market continues to watch, the real test for Saylor and MicroStrategy will be navigating these turbulent waters, balancing the promise of digital transformation against the stark reality of market dynamics.