Robinhood Lists BNB for Crypto Trading Amid Rising Market Interest

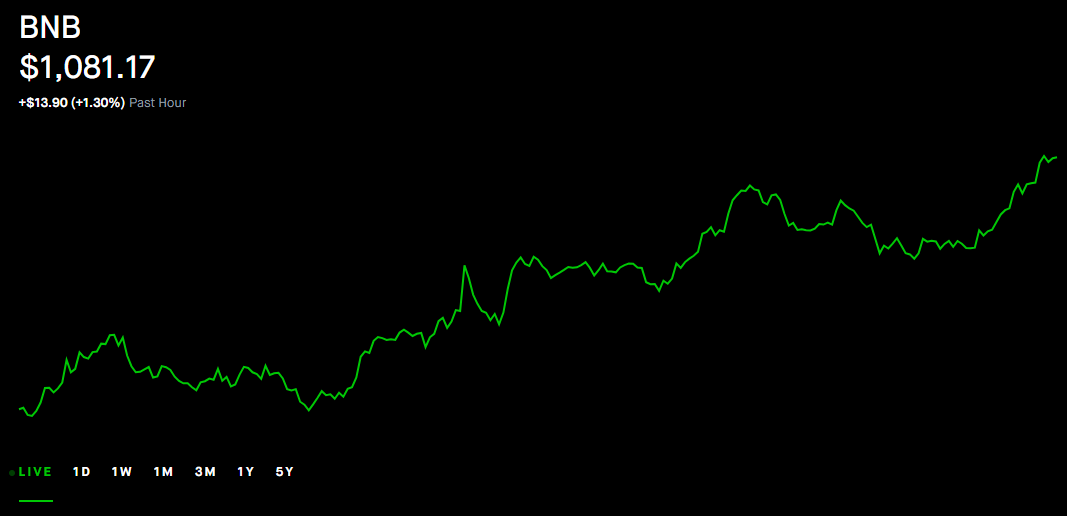

Robinhood has listed BNB to its trading platform, marking another step in its push to broaden cryptocurrency options for users. The addition allows traders to buy, sell, and hold the token directly through the app, aligning with the platform's goal of simplifying access to digital assets. At the time of the announcement, BNB is trading at $1,081.17, a level that underscores its robust performance in recent months and points to growing investor confidence.

This listing arrives at a time when BNB continues to demonstrate resilience in the broader crypto market. As the native token of the Binance ecosystem, including the BNB Chain, it powers essential network functions and attracts developers building decentralized applications. The price surge reflects broader trends in layer-one blockchains, where efficiency in transactions and scalability draws in both retail and institutional players.

The move by Robinhood highlights the evolving dynamics of crypto exchanges seeking to capture more market share. By integrating BNB, the platform not only diversifies its portfolio but also caters to users interested in tokens tied to major ecosystems. Trading volumes for BNB have picked up steadily, with daily activity on the BNB Chain surpassing several billion dollars in value transferred.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishNavigating Regulatory Waters and Ecosystem Growth

Robinhood's decision follows a period of regulatory clarity that has bolstered its crypto operations. In the first half of 2025, the company resolved an investigation by the U.S. Securities and Exchange Commission regarding its digital asset services, lifting a cloud of uncertainty that had lingered for years. This resolution has enabled Robinhood to accelerate its expansion without the same level of scrutiny that once slowed progress in the sector.

Other major platforms are charting similar paths, further normalizing tokens linked to Binance. Coinbase recently included BNB on its listing roadmap, signaling that industry leaders see value in offering exposure to this asset despite its complex history. Such developments suggest a maturing market where competition drives innovation and user choice.

BNB's role within its ecosystem remains central to its appeal. Users rely on it to cover transaction fees on the BNB Chain, which processes thousands of operations per second at low costs compared to legacy networks. Beyond fees, the token facilitates participation in launchpad events for new projects and provides staking opportunities that reward holders with yields.

Binance itself has navigated significant hurdles to reach this point of broader acceptance. The exchange faced a high-profile lawsuit from the SEC in prior years, alongside the departure of its longtime CEO, Changpeng Zhao (CZ), amid compliance efforts. Since then, Binance has engaged constructively with U.S. regulators, implementing stricter know-your-customer protocols and enhancing transparency measures to rebuild trust.

These efforts appear to be paying off, as evidenced by the token's integration into mainstream venues. The listing on Robinhood could introduce BNB to a fresh audience of retail investors who previously stuck to more established coins. With Robinhood's user base exceeding 20 million active accounts, this exposure has the potential to amplify trading activity and stabilize price movements over time.

Looking at the bigger picture, BNB's trajectory ties into the ongoing shift toward utility-driven cryptocurrencies. Projects on the BNB Chain now span DeFi protocols, non-fungible token marketplaces, and gaming platforms, creating a self-sustaining loop of demand for the token. As adoption spreads, liquidity pools deepen, which in turn supports smoother trading experiences across exchanges.

Robinhood's embrace of BNB also reflects a strategic pivot toward comprehensive crypto services. The platform has rolled out features like recurring buys and advanced charting tools specifically for digital assets, making it easier for newcomers to engage. This user-centric approach positions Robinhood as a gateway for those transitioning from traditional finance into the crypto space.

The cryptocurrency market as a whole benefits from such integrations, fostering a more interconnected landscape. Tokens like BNB, once viewed through the lens of their originating exchange, now stand on their own merits based on network utility and community support. As platforms continue to evolve, expect further listings that bridge silos and enhance overall market depth.