Ripple’s Role in Spreading Bitcoin FUD Unraveled in SEC Lawsuit Documents

In a revealing twist from the ongoing legal saga between Ripple Labs and the U.S. Securities and Exchange Commission, internal emails from 2018 have surfaced, shedding light on the blockchain company’s efforts to promote the narrative that Bitcoin is controlled by China.

The disclosure comes as part of the SEC’s lawsuit against Ripple, which accuses the company of conducting a $1.3 billion unregistered securities offering through its cryptocurrency, XRP. The emails, submitted as evidence, suggest Ripple actively engaged in spreading fear, uncertainty, and doubt—commonly referred to as FUD—about Bitcoin, a move that has sparked intense debate within the cryptocurrency community.

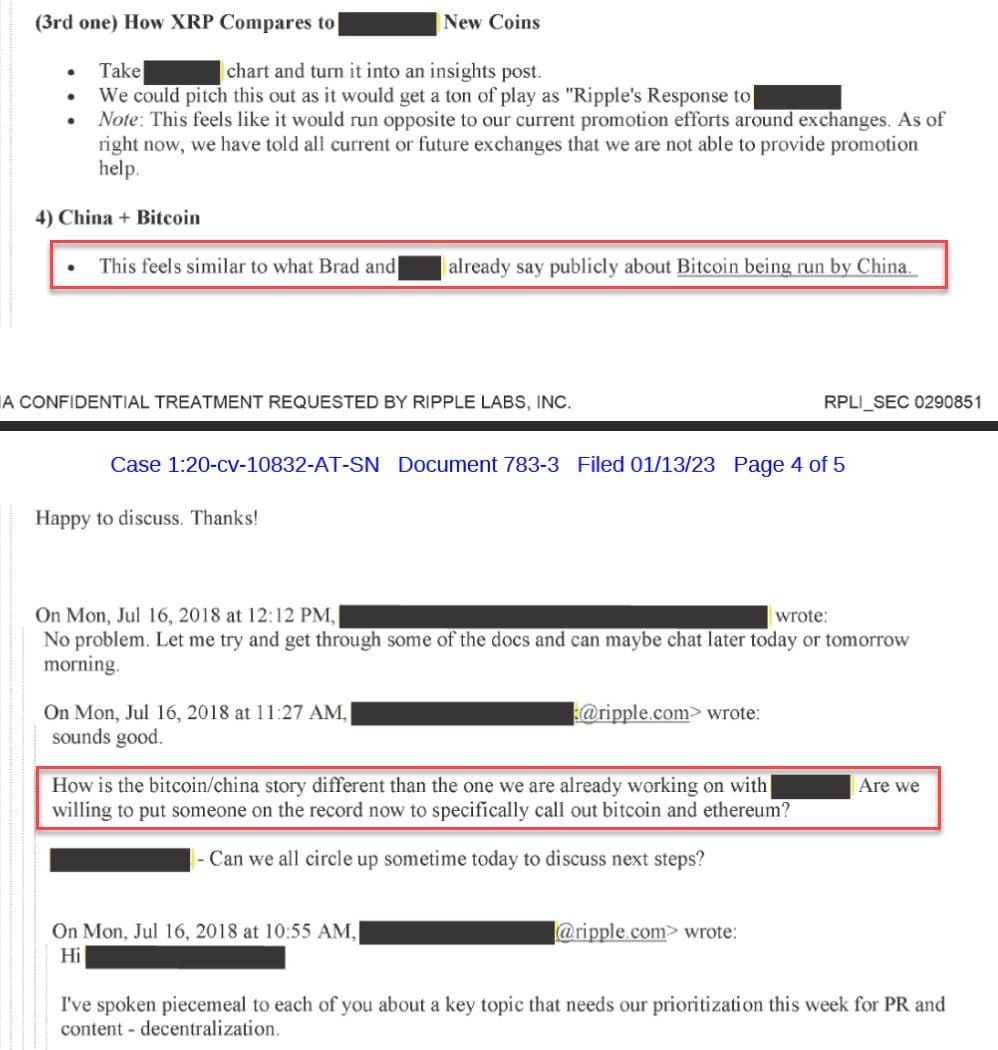

The documents, dated July 2018, include conversations among Ripple executives discussing strategies to counter Bitcoin’s dominance. One email, highlighted in the post, references the “Bitcoin is controlled by China” claim, a narrative that gained traction years ago due to China’s significant role in Bitcoin mining.

At the time, China hosted over 50% of the world’s Bitcoin mining operations, largely due to its low electricity costs and access to mining hardware. This concentration raised legitimate concerns among crypto enthusiasts, including the theoretical risk of a 51% attack, where a single entity could control the majority of the network’s computing power. However, Ripple’s apparent orchestration of this narrative, as revealed in the emails, suggests a calculated effort to undermine Bitcoin’s reputation and bolster XRP’s position in the market.

The Unfolding SEC Battle and Its Implications

This revelation adds another layer to Ripple’s contentious relationship with regulators. The SEC initiated its lawsuit against Ripple in December 2020, alleging the company and its executives, including CEO Brad Garlinghouse and co-founder Christian Larsen, raised funds through unregistered XRP sales.

The case has seen significant developments, including a 2023 ruling that XRP sales on public exchanges did not classify as securities, though the SEC has since appealed that decision in October 2024. Ripple’s role in spreading FUD about Bitcoin, as uncovered in these emails, could further complicate its public image and legal standing, particularly as the crypto industry grapples with regulatory clarity.

The emails, filed under a confidential treatment request in the SEC’s case, show Ripple executives debating how to leverage the China narrative to their advantage. One message specifically calls for someone to publicly label Bitcoin and Ethereum as centralized, a strategy that aligns with Ripple’s broader goal of positioning XRP as a decentralized alternative for cross-border payments.

While Bitcoin’s mining concentration in China has been a topic of discussion in the past, the deliberate amplification of this concern by Ripple raises questions about Ripple’s ethics. Just this past week, Ripple CEO Brad Garlinghouse attended the White House Crypto Summit, where days prior he was advocating for XRP to be included in the national digital assets stockpile.