Report: US, China, and UK Dominate in Scam and Failed Crypto Projects

A recent study by 5Money and Storible paints a stark picture of the crypto landscape. From January 2022 to October 2024, the United States, China, and the United Kingdom have emerged as the leading nations in both scam and dead crypto project launches, attracting global attention to the underbelly of this burgeoning market.

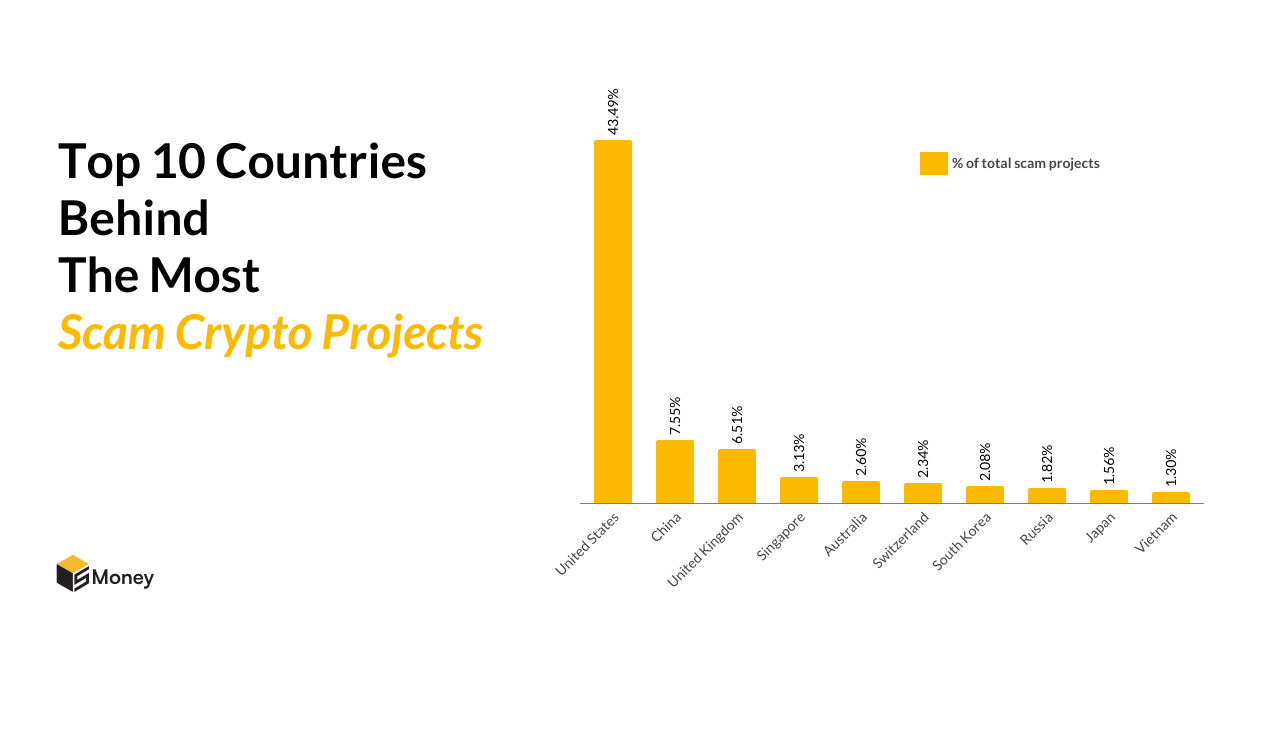

The data, culled from an analysis of 1,544 cryptocurrency projects worldwide, reveals a troubling trend. The United States stands out, not just for its sheer volume of crypto projects but for the proportion that turned out to be scams, with American founders being linked to 43% of all fraudulent projects. This high incidence can largely be attributed to the significant number of projects launched in the U.S., coupled with high-profile failures like the collapse of FTX, which shook investor confidence and the market alike.

Following closely are China and the United Kingdom, contributing 8% and 7% to the global tally of scam projects, respectively. These statistics suggest a pattern where countries with robust market growth also tend to harbor environments conducive to scams and project failures. The report notes, "Scams and failed projects are more common in countries with strong market growth," highlighting a correlation between market expansion and the risk of fraud.

The numbers around failed projects isn't much different. The U.S. again leads with 33% of all failed projects, followed by China at 7.63% and the UK at 7.22%. South Korea and Singapore are not far behind, each accounting for over 6% of the global failure rate. This spread of failure across key markets underscores the challenges of sustainability and viability in the crypto space.

The Global Perspective on Crypto Scams

Delving deeper into the scam metrics, Russia tops the charts with 24% of its crypto projects being scams, illustrating a significant issue within its burgeoning developer community. Switzerland and China follow with 22% and 20% respectively, pointing to a broader issue of trust and regulatory oversight in these countries. Vietnam also features prominently, with 12% of its projects falling into the scam category, suggesting a need for vigilance across both emerging and established crypto markets.

South Korea, however, presents an intriguing case when it comes to project failure rates, with a staggering 59% of its projects deemed dead. This high rate, despite a lower overall number of projects compared to countries like the U.S., indicates unique challenges possibly linked to market saturation or regulatory hurdles. Singapore and the UK follow with failure rates over 50%, while Canada and the Netherlands each report half their projects as failed. Vietnam ranks sixth globally in this aspect, with 42% of its projects not surviving the cut.

The study calls for a unified approach to regulation and standards to curb the rampant issues of scams and project failures. Regulatory bodies worldwide are responding, with the UK's Financial Conduct Authority aiming to finalize crypto regulations by 2026, and both Singapore and South Korea implementing stricter consumer protection measures.

Echoing these concerns, a February report by AlphaQuest highlighted that over 70% of crypto projects launched during the 2020-2021 bull run were dead by early 2024, with a significant number folding post the FTX bankruptcy. The year 2023 was particularly harsh on the crypto sector, witnessing almost 60% of dead projects due to low liquidity and trading volume, marking it as one of the toughest years in recent crypto history.