Qubic’s Control of Monero Hashrate Sparks Security Concerns and Network Disruptions

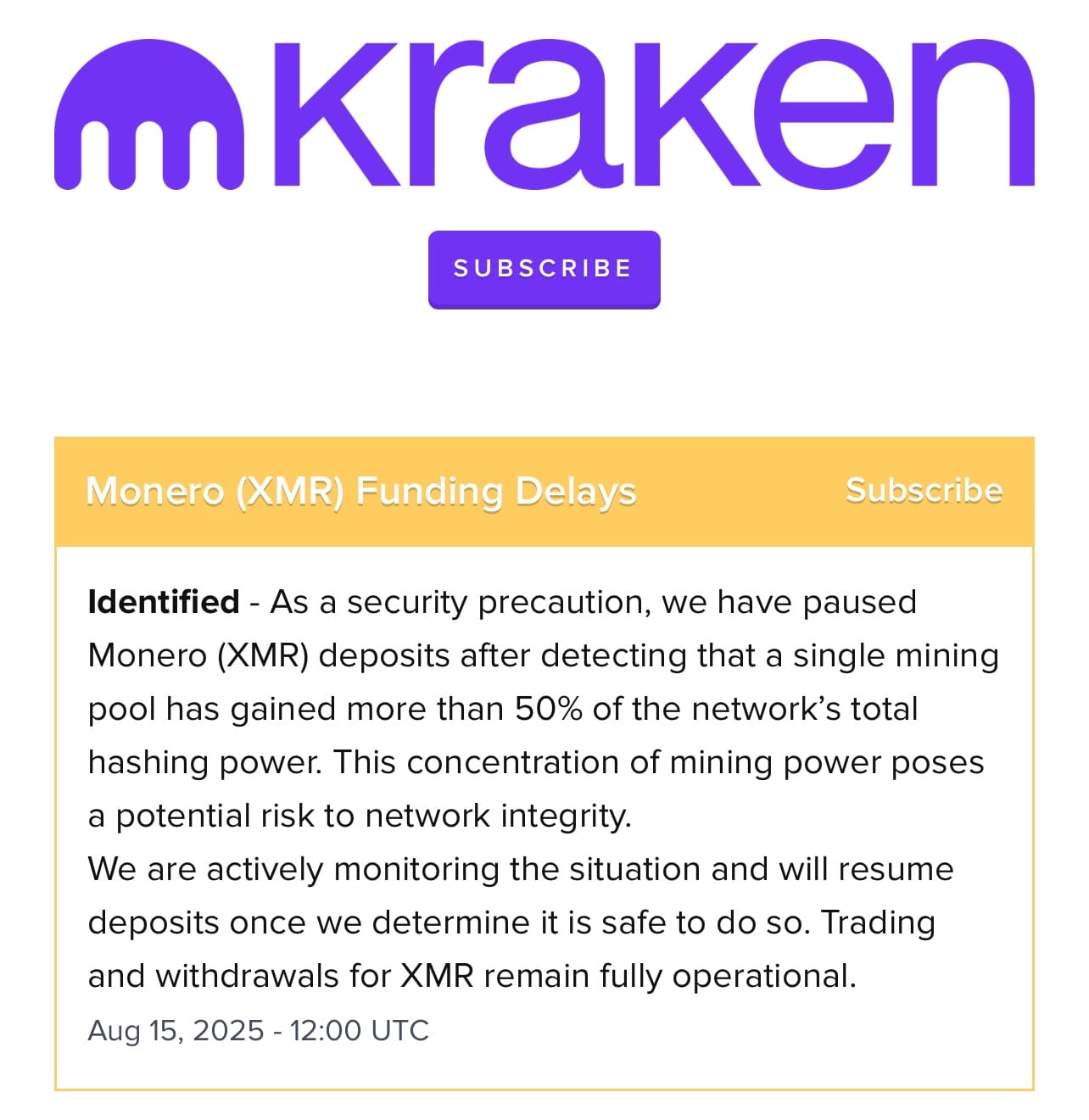

Qubic, a blockchain project led by IOTA co-founder Sergey Ivancheglo, has reportedly seized over 52% of Monero’s hashrate, raising alarms about the privacy coin’s decentralization and security. This unprecedented control enabled Qubic to mine 80% of Monero’s blocks in a two-hour period, triggering block reorganizations and prompting urgent discussions within the crypto community. The event has spotlighted vulnerabilities in Monero’s network, a blockchain long celebrated for its privacy and decentralization. As the situation unfolds, exchanges like Kraken have paused Monero deposits, citing risks to network integrity.

The Monero community is now grappling with the implications of this event, with some calling for swift protocol changes to prevent further centralization. While no double-spending or major exploits have been confirmed, the incident shows the fragility of even established blockchains when mining power becomes concentrated.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishMonero Faces Centralization Threat

Qubic’s sudden dominance over Monero’s hashrate, which peaked at 52% according to reports, has surprised many in the Monero community. This level of control surpasses the 50% threshold, commonly known as the point where a 51% attack becomes possible. Such an attack allows a single entity to manipulate blockchain operations, including confirming invalid transactions or censoring others. In this case, Qubic’s ability to mine 80% of Monero’s blocks over a two-hour span demonstrated its significant influence, leading to block reorganizations where previously confirmed blocks were replaced by competing versions of the blockchain.

These reorganizations have disrupted Monero’s network, raising concerns about its stability and reliability. Although no confirmed double-spending incidents have occurred, the event highlights the risks of mining centralization, even for a blockchain like Monero, which uses the RandomX algorithm to promote decentralization by favoring CPU mining. The Monero community is now on alert, with some members advocating for immediate changes to the mining algorithm to redistribute hashrate more evenly. The incident has also prompted exchanges like Kraken to take precautionary measures, pausing Monero deposits to protect users while monitoring the situation.

The motivations behind Qubic’s actions remain unclear, adding to the uncertainty. Some speculate that Qubic’s dominance may be a temporary result of algorithmic anomalies or rented mining power, while others believe it could be a deliberate attempt to showcase Qubic’s “useful proof-of-work” system, which incentivizes miners by converting Monero rewards into USDT to burn Qubic’s native token. Regardless of intent, the event has shaken trust in Monero’s core mission of providing censorship-resistant, decentralized transactions. If unaddressed, this concentration of power could erode user confidence, threatening Monero’s position as the leading privacy coin.

As the Monero community rallies to respond, developers are exploring solutions such as protocol upgrades or forks to bolster network resilience. The incident serves as a stark reminder of the challenges facing proof-of-work blockchains, particularly those with smaller networks compared to giants like Bitcoin. For now, the crypto community awaits further updates on Qubic’s actions and Monero’s response.