Polymarket Adds Bitcoin Deposits to Crypto Prediction Platform

Polymarket has introduced support for direct Bitcoin deposits, a move that opens the platform to a broader range of cryptocurrency users. The leading prediction market, known for its decentralized betting on real-world events, previously relied mainly on stablecoins like USDC for funding. This update allows holders of Bitcoin to transfer funds straight into their accounts without needing to convert assets first.

The feature rolled out on October 6, marks a significant step in integrating Bitcoin more deeply into the ecosystem. Users can now deposit BTC directly and use it to participate in markets covering topics from political outcomes to sports results. Platform officials describe this as a way to streamline the experience for traders who prefer holding Bitcoin.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishStreamlining Access for Bitcoin Holders

Bitcoin’s role in prediction markets gains prominence with this development, as Polymarket positions itself to attract more participants amid rising cryptocurrency adoption. The direct deposit option leverages wrapped Bitcoin on the platform, ensuring seamless conversion for trading purposes. This addresses a common friction point where users had to bridge assets across networks, a process that often involved extra fees and delays.

Polymarket’s growth trajectory underscores the timing of this launch. The platform boasts over 1.2 million users and has seen trading volumes surge in recent months, particularly around high-profile events like national elections. By adding Bitcoin support, it taps into the largest cryptocurrency’s liquidity pool, potentially drawing in institutional players who view BTC as a core holding.

Executives at Polymarket highlight the practical advantages for everyday traders. Direct deposits reduce barriers to entry, allowing users to act quickly on emerging opportunities without asset swaps. This aligns with the platform’s mission to make information markets more efficient and inclusive for global audiences.

The update comes as Polymarket eyes further expansion, including a reported $200 million funding round that could push its valuation toward $1 billion. Investors see promise in its onchain model, which settles bets transparently via blockchain. A recent no-action letter from the U.S. Commodity Futures Trading Commission also signals regulatory progress, hinting at a possible relaunch in the American market.

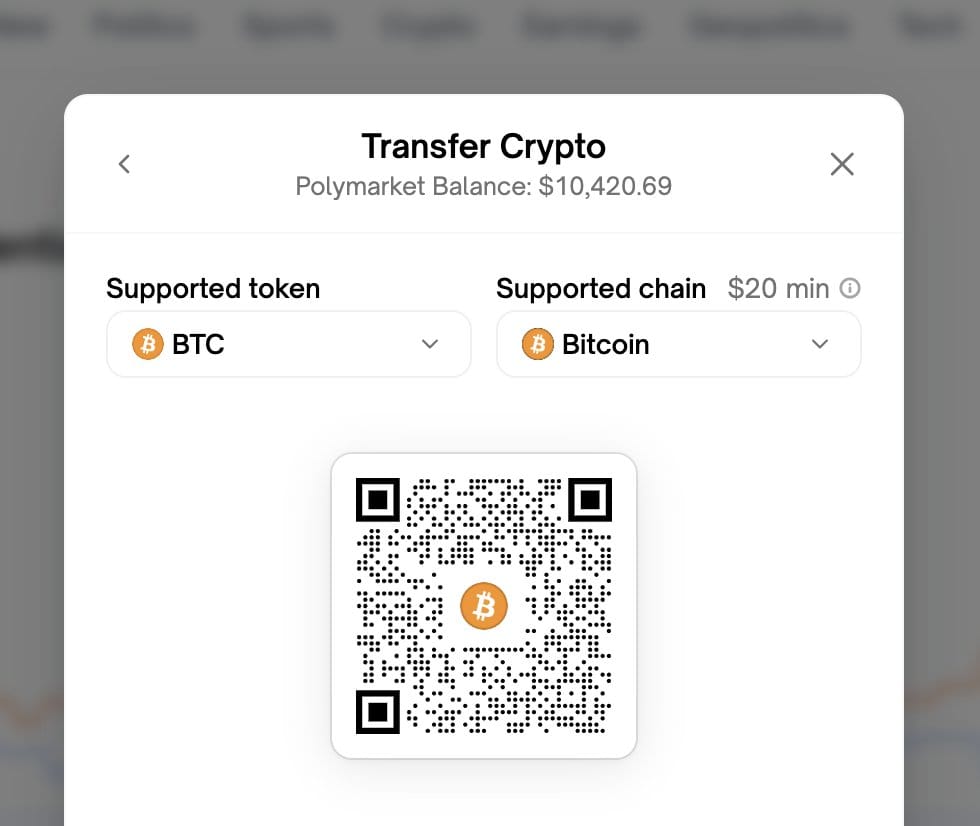

For users, the process remains straightforward. After connecting a compatible wallet, traders select Bitcoin as the deposit method and confirm the transaction on the Bitcoin network. Funds appear in the account shortly after, ready for allocation across active markets. Polymarket emphasizes security, with all deposits protected by the platform’s multi-signature protocols and audited smart contracts.

This integration reflects broader trends in DeFi, where Bitcoin’s utility extends beyond simple storage. Prediction platforms like Polymarket thrive on diverse funding sources, and Bitcoin’s inclusion could accelerate volume growth. As the crypto space evolves, such features help bridge traditional holdings with innovative applications.

Polymarket plans to explore additional cryptocurrency integrations to match user demand. The team focuses on maintaining low fees and high-speed settlements to keep the edge in a competitive field. This Bitcoin feature serves as a foundation for those ambitions, solidifying its status as a go-to hub for informed speculation.