Peter Thiel, Jeffrey Epstein, and Bitcoin: New Insights from 2025 Email Release

In the shadowy world where finance, tech, and elite networking all come together, few stories are as intriguing, and unsettling, as the connections between Silicon Valley titan Peter Thiel and the infamous financier Jeffrey Epstein. The recent release of over 20,000 pages of Epstein's emails and documents by the U.S. House Oversight Committee on November 13, 2025, has reignited scrutiny into Epstein's post-conviction life. While much of the media focus has been on Epstein's ties to political figures like President Donald Trump, a deeper dive reveals a fascinating thread: Epstein's ties to the early days of Bitcoin, facilitated in part through his relationship with Peter Thiel.

This isn't entirely new information, fragments have surfaced in prior years, but the 2025 email release provides fresh context, piecing together timelines, meetings, and financial flows that highlight how Thiel may have influenced Epstein's foray into Bitcoin and cryptocurrency. From 2014 dinners where Bitcoin may have been discussed to Epstein's multimillion-dollar investment in Thiel's Valar Ventures, which later backed many crypto projects, and Epstein's role in connecting key crypto players, the documents paint a picture of Epstein as a shadowy convener in Bitcoin's nascent ecosystem.

How Peter Thiel Introduced Jeffrey Epstein to Bitcoin’s Potential in 2014

The story begins in 2014, well before the broader public caught Bitcoin fever. Peter Thiel, the PayPal co-founder, had already positioned himself as one of the cryptocurrency's earliest institutional advocates. Through his Founders Fund, Thiel made a significant Bitcoin purchase, when the asset was trading under $1,000 per Bitcoin, a bet that would later yield billions in profits before the fund sold off most of its holdings ahead of the 2022 crash. Thiel has long viewed Bitcoin as "digital gold," a hedge against fiat currencies and centralized systems, themes that align with his contrarian investment philosophy, also a theme you will hear championed today from institutional investors like Michael Saylor and Tom Lee.

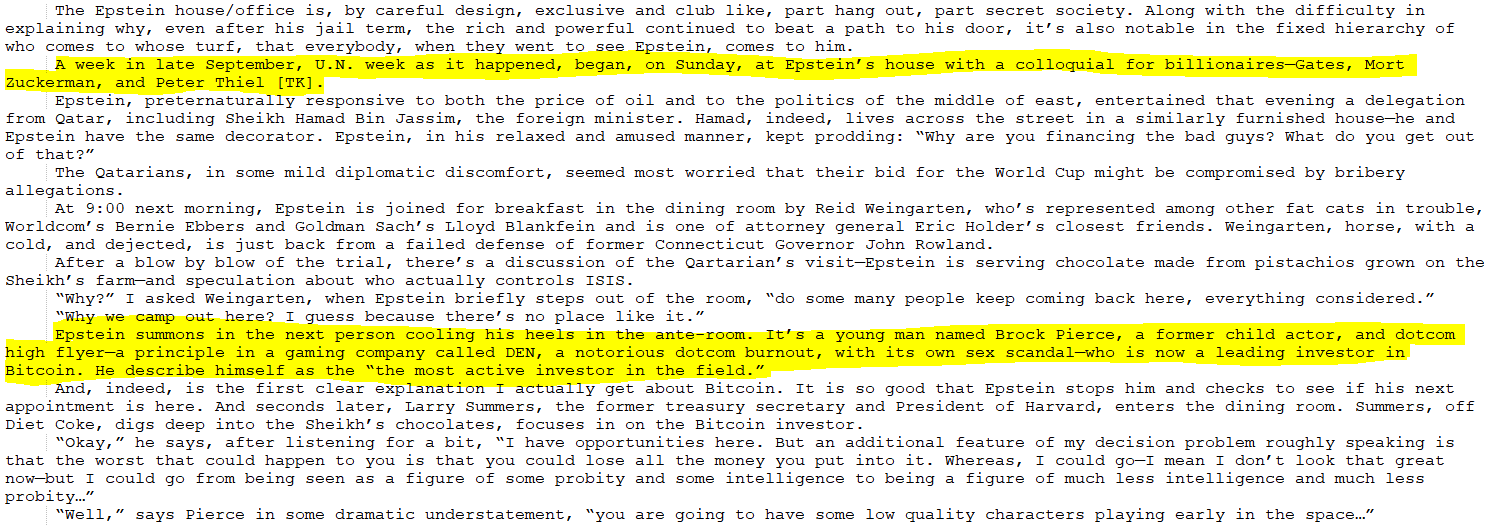

By September 2014, Thiel's path crossed with Epstein's. Scheduling records from Epstein's estate, now public in the 2025 release, show at least three meetings between the two that month, often at Epstein's opulent Manhattan townhouse. These encounters included one-on-one sessions, lunches, or dinners, some marked as tentative. While exact agendas aren't detailed, an unpublished draft article from New York Magazine, attached to a March 2015 fact-checking email in the dump, references Thiel's presence at Epstein's 2014 gatherings, specifically, a Sunday night discussion during U.N. Week in late September involving Bill Gates and Mort Zuckerman. The draft describes Epstein's townhouse as a hub for elite networking, naming Thiel alongside figures like Gates and Larry Summers, though it doesn't tie Thiel specifically to any crypto talks. Instead, it pivots to a separate Bitcoin discussion involving Brock Pierce (described as a "leading investor in Bitcoin") and Summers, which occurred around the same period as Thiel's scheduled visits.

This timeline suggests Thiel could have been one of the first to expose Epstein to Bitcoin's intricacies. Epstein, convicted in 2008 for soliciting prostitution from a minor, was rebuilding his social capital through "Mindshift" conferences and private dinners, attracting intellectuals and innovators despite his tarnished reputation. The 2025 email documents confirm Thiel's presence on Epstein's schedule around this pivotal time, with emails showing how Epstein leveraged intermediaries like former Israeli Prime Minister Ehud Barak to secure the introduction. Barak, who had met Thiel briefly in Davos, facilitated the 2014 New York meeting, underscoring Epstein's networking prowess.

Epstein's response to a fact-check query about these dinners, saying "nfw" (interpreted as "no fucking way"), indicates refusal or denial, but the draft's details imply such discussions occurred or were rumored enough to warrant verification. This period marks Epstein's entry into crypto conversations, predating his more active involvement.

Epstein’s Shift from Influence to Investment through Valar Ventures

Building on these early interactions, Epstein deepened his ties with Thiel's ecosystem. Between 2015 and 2016, Epstein invested $40 million into two funds managed by Valar Ventures, a venture capital firm co-founded by Thiel in 2010 alongside Andrew McCormack and James Fitzgerald. Valar focuses on early-stage fintech startups outside Silicon Valley, and this investment was unusual for Epstein, who rarely ventured into VC. By mid-2025, the stake had ballooned to nearly $170 million, a 325% return, making it the largest asset in Epstein's estate.

Importantly, Valar has increasingly pivoted toward cryptocurrency. While not exclusively crypto-focused, the firm backs several Bitcoin and crypto-related companies, providing indirect exposure. Examples include:

- Leading a $25 million Series A in Vauld (a crypto trading and lending platform) in 2021.

- Heading a $263 million Series C for Bitpanda (a crypto exchange) in 2021.

- Investing €30 million in One Trading (a crypto trading platform, formerly Bitpanda Pro) in 2023.

The 2025 House Committee email release confirms Epstein's ongoing ties to Peter Thiel's network. This includes a 2016 pitch for the surveillance startup Reporty (later Carbyne) to Valar Ventures, which was rejected as premature, as confirmed in separate leaked emails. Notably, Thiel's Founders Fund later invested in Carbyne's $15 million Series B round in 2018, showing overlapping interests. While there's no evidence Epstein directly funded Founders Fund's Bitcoin bets or earmarked Valar money for crypto explicitly, these links illustrate how he indirectly profited from the sector through Thiel's ventures.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishEpstein as a Crypto Convener Brokering Key Connections

Post-2014, Epstein didn't just absorb influence; he amplified it by connecting players in his vast network. In 2014 and into 2015, Epstein funneled approximately $850,000 (some via associate Leon Black) to MIT's Media Lab, enabling the 2015 launch of its Digital Currency Initiative (DCI). This directly bankrolled Bitcoin Core developers like Gavin Andresen, Wladimir van der Laan, and Cory Fields after the Bitcoin Foundation's collapse. A February 2015 email from MIT's Joi Ito to Epstein reads: "Used gift funds to underwrite this which allowed us to move quickly and win this round. Thanks," with Epstein replying, "Gavin is clever."

Some time before March 2015, Epstein hosted a pivotal Bitcoin meeting at his townhouse between Brock Pierce and Larry Summers. Pierce pitched Bitcoin as volatile but promising, positioning himself as "the most active investor," while Summers expressed caution over reputational risks: "I could go from being seen as a figure of some probity... to much less." The unpublished NY Mag draft details this exchange, and the 2025 emails confirm Epstein's role in facilitating it, suggesting a larger involvement in Pierce's efforts than previously known.

Thiel's schedule overlaps with this period, hinting at a web where Thiel's early influence on Epstein led to broader crypto networking. By 2019, Epstein's interest persisted, as seen in emails where he warned an associate about Facebook's proposed Libra stablecoin, describing it as "money" rather than a true currency that "violates BARTER principles" and "could take down financial system in wrong hands."

The Bigger Picture of Networking Money and Bitcoin’s Elite Origins

The 2025 House Oversight email release doesn't rewrite history but consolidates it, showing Epstein as a bridge between traditional power and emerging tech disruptors like Peter Thiel and others like Brock Pierce. Thiel has distanced himself, calling Epstein a "child sex offender" and speculating on his death, but the financial windfall from Valar, locked up and benefiting Epstein's estate, raises many ethical questions. Victims received settlements earlier, but this stake won't add to their restitution.

Ultimately, this story reveals Bitcoin's early adoption wasn't only grassroots, it involved elite networks of people and influence including capital which flowed freely, even through controversial figures and groups.

We created an Epstein Bitcoin Email archive to go through all the newly released Epstein emails relating to Bitcoin, cryptocurrency, and blockchain, to search through all the communications for important information relating to this topic. Try it out!