October 2025 Crypto Trends: Institutional Growth and ETF Surge

The crypto sector navigated a turbulent October 2025 with a blend of setbacks and recoveries that underscored its maturing landscape. Bitcoin stood firm as the sector's anchor, buoyed by steady institutional investments and evolving exchange-traded fund strategies. Altcoins presented a varied picture, where gains in some areas offset losses elsewhere amid broader economic pressures.

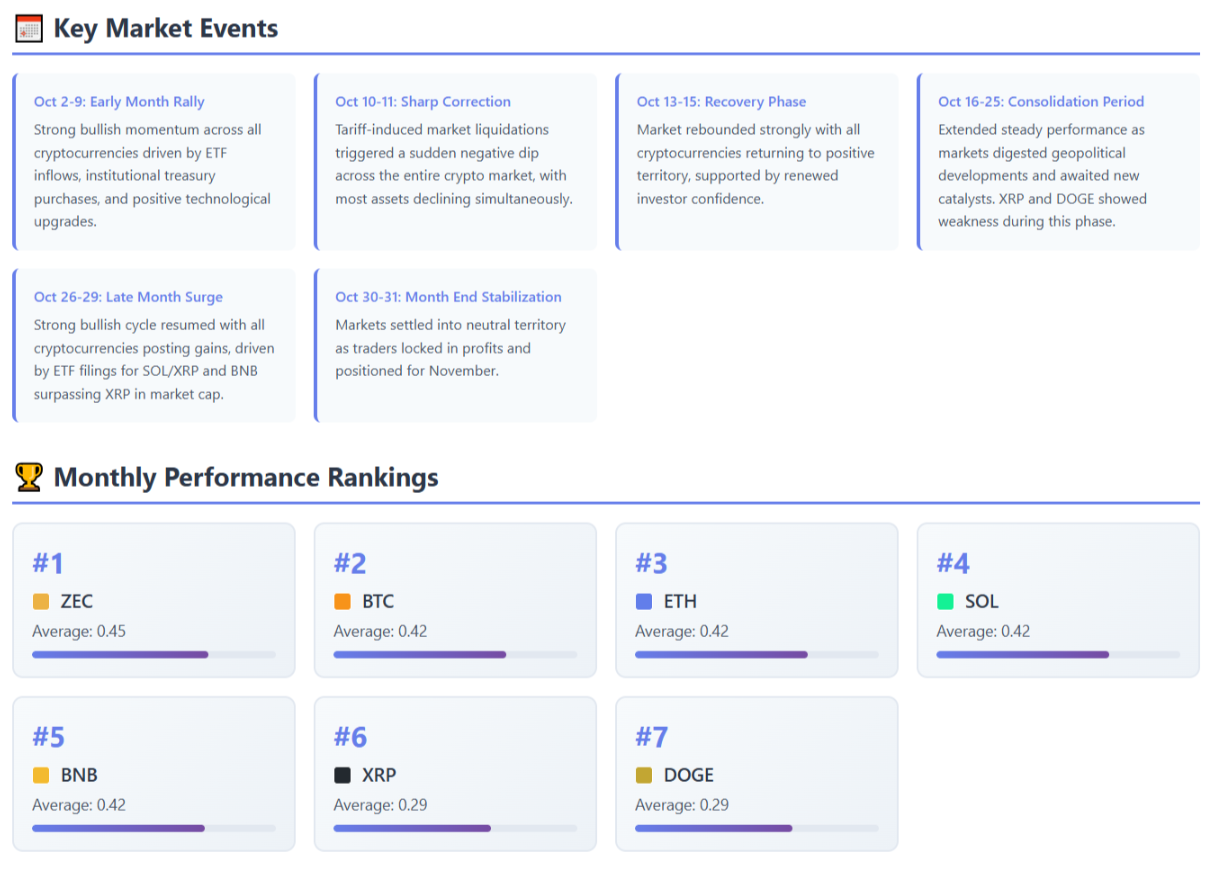

Geopolitical frictions, particularly escalating U.S.-China trade disputes, sparked sharp declines early in the month. Yet the total crypto sector value climbed overall, fueled by expanding stablecoin usage and hints of wider acceptance in traditional finance. This push-pull dynamic painted a picture of a market adapting to external shocks while building internal momentum.

Key Developments in Major Assets

Bitcoin's performance captured much of the month's narrative, as it shrugged off initial tariff-related dips to climb toward fresh peaks on several occasions. Corporate treasuries ramped up holdings, and exchange-traded funds saw consistent inflows from large investors, which helped stabilize prices during volatile swings. These factors pointed to a deepening commitment from established players, setting a tone of quiet confidence for the asset's role in diversified portfolios.

Ethereum followed a similar path of recovery, gaining traction from its latest network upgrade known as Fusaka, which streamlined operations and cut transaction costs. Inflows into Ethereum-focused funds provided a lift, even as leveraged trading amplified short-term fluctuations. The asset's trajectory suggested growing appeal for developers and institutions alike, with accumulation patterns indicating faith in its foundational position within decentralized applications.

Solana emerged as a standout among altcoins, with revenue streams swelling thanks to fresh exchange-traded fund introductions and deeper ties to stablecoin networks. These integrations strengthened its decentralized finance offerings, drawing in users seeking efficient alternatives for trading and lending. Temporary network hiccups led to brief pullbacks, but the overall uptick in institutional curiosity highlighted Solana's potential to challenge established leaders in speed and scalability.

Bitcoin and Crypto Insights October 2025 Report

Read the report & see what's driving growthEmerging Patterns and Forward Outlook

Stablecoins played a pivotal role in October's story, with their market presence ballooning to lead in transaction volumes and revenue generation. Banks began weaving them into systems for smoother international transfers, bridging gaps between crypto and legacy finance. This shift not only bolstered liquidity during rough patches but also signaled a practical evolution in how digital assets handle everyday value movement.

Looking toward the final quarter of 2025, forecasts center on Bitcoin breaking higher barriers, propelled by sustained fund demand and anticipated interest rate adjustments from central banks. Analysts see room for an extended growth phase, often termed a supercycle, as these tailwinds align with historical patterns of adoption. Ethereum's path could narrow the gap with Bitcoin's dominance, thanks to fee reductions from upgrades that invite more activity on its chain.

November brings fresh focal points that could steer the market's direction, starting with potential nods for altcoin exchange-traded funds. Delays tied to the recent U.S. government shutdown have held up approvals for assets like XRP and Solana, but breakthroughs here might ignite targeted surges. Trade dynamics between the U.S. and China remain a wildcard, capable of rippling through Bitcoin prices and beyond, demanding close attention from traders and observers.

The Bitcoin and Crypto Insights report for October 2025 distills these events into a comprehensive overview, covering news, patterns, and shifts that shaped the past month. Published at the start of each month, this subscriber-exclusive resource equips crypto users with actionable perspectives on the evolving digital asset world. Access the full edition through BitcoinProtocol.org Insights to dive deeper into the data and analysis that inform tomorrow's decisions.