No, Iran Wasn't Running Nuclear Powered Bitcoin Mining ASICs

On June 21, 2025, the global Bitcoin mining hashrate experienced a dramatic 25% decline, sparking widespread speculation about its connection to U.S. military strikes on Iranian nuclear facilities. The timing of the airstrikes, announced by President Donald Trump at 7:50 PM EDT, coincided almost in sync with the hashrate drop, prompting theories that Iran may have been operating nuclear-powered Bitcoin mining operations disrupted by the bombings.

We explore the plausibility of this theory, examining Iran’s role in Bitcoin mining, the nature of its nuclear program, and the broader factors behind the hashrate decline. While the correlation is intriguing, the evidence suggests the drop was driven by global market reactions and regional disruptions rather than a direct hit on nuclear-powered mining.

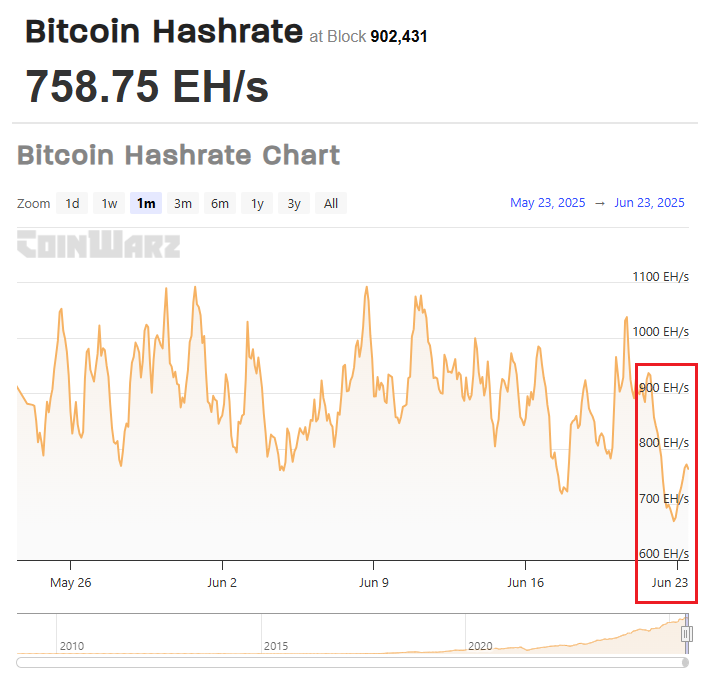

The U.S. strikes targeted three Iranian nuclear sites: Fordow, Natanz, and Esfahan, which are key facilities in Iran’s controversial nuclear program. President Trump’s announcement confirmed that all planes safely delivered their payloads and exited Iranian airspace. Within an hour of the initial bombing, the global Bitcoin hashrate began to fall, dropping from 920.7393 EH/s at 8:00 PM GMT to 686.4929 EH/s by 2:00 PM GMT the next day. This steep decline, far exceeding typical fluctuations, fueled speculation on platforms like X, where users suggested Iran might have been using nuclear energy to power advanced Bitcoin mining operations.

In particular, one user wrote, "Holy Sh**! Global hash rate drops like a rock around the same time nuclear sites were bombed by the US. Could it be Iran has nuclear powered asics as a way to convert energy into btc under the radar to fund their operations?"

Iran’s Bitcoin Mining and Nuclear Power Context

Iran has been a significant player in Bitcoin mining since officially recognizing it in 2019, leveraging its subsidized electricity to generate revenue and bypass international sanctions. Estimates from Elliptic indicate that Iran accounted for approximately 4.5% of global Bitcoin mining in 2021, though this share fell to around 3.1% by 2024 due to energy constraints and regulatory crackdowns. The country’s mining operations, often controlled by the Islamic Revolutionary Guard Corps (IRGC), generate nearly $1 billion annually, converting surplus energy into cryptocurrency for imports. This strategy allows Iran to navigate trade embargoes, with the central bank facilitating the use of mined Bitcoin to fund economic activities.

However, Iran’s nuclear power contributes minimally to its electricity grid, providing only 2–3% of the nation’s energy needs. The Bushehr nuclear plant, Iran’s sole operational reactor, generates about 6–7 TWh annually, dwarfed by natural gas (60–70%) and oil (15–20%) power sources. Facilities like Natanz and Fordow, targeted in the strikes, are enrichment sites, not power plants, and do not contribute to electricity production. This limited nuclear capacity makes it unlikely that Bitcoin mining operations relied heavily on nuclear power, as gas and oil plants dominate Iran’s energy-intensive mining sector.

The timing of the hashrate drop aligns almost identically with the estimated bombing window of 5:00 PM to 7:00 PM EDT (9:00 PM to 11:00 PM GMT) on June 21. The hashrate began declining at 9:00 PM GMT, suggesting a link to the strikes. If Iran’s 3.1% share of the global hashrate (roughly 28.5 EH/s) went offline, it could account for a portion of the initial 50 EH/s drop observed within the first hour. However, the total decline of 234 EH/s far exceeds Iran’s contribution, indicating that other factors amplified the effect.

Global Bitcoin miner behavior likely played a significant role in the hashrate plunge. The geopolitical shock of the U.S. strikes, coupled with Bitcoin’s brief dip below $100,000, likely prompted miners worldwide to pause operations, fearing sustained market volatility. Regional disruptions in Iran, such as power or internet outages caused by the strikes, could have further impacted gas-powered mining farms, which dominate the country’s operations. The IRGC’s control over an estimated 230,000 mining devices suggests significant capacity, but these are more likely powered by Iran’s abundant fossil fuel resources than its limited nuclear output.

Speculative theories on X about nuclear-powered mining rigs lack concrete evidence. While the IRGC could theoretically divert Bushehr’s electricity to strategic projects, the plant’s modest output and primary role in grid support make this improbable. The strikes on enrichment facilities like Natanz may have caused localized grid instability, indirectly affecting nearby mining operations, but the scale of the hashrate drop points to a broader, overall market-driven response. The partial recovery to 758.75 EH/s by June 23 indicates that miners have resumed operations, though caution persists amid ongoing uncertainty and turmoil in the markets.

The connection of Iran’s nuclear program and Bitcoin mining highlights the country’s complex economic strategies under sanctions. While nuclear facilities serve primarily as geopolitical assets, mining operations rely on Iran’s fossil fuel dominance to generate revenue. The Bitcoin hashrate drop, though temporally linked to the bombings, reflects a cascade of global and regional reactions rather than a direct disruption of nuclear-powered mining. As the crypto market stabilizes, the incident underscores the sensitivity of Bitcoin’s infrastructure to geopolitical events.

More Bitcoin and Crypto News:

- U S Authorities Probe Bitmain Bitcoin Mining Hardware Over National Security Risks

- Robinhood Expands Crypto Staking With Ethereum And Solana For U S Customers

- Paypal Boosts Pyusd Adoption With 3 7 Yield To Compete In Stablecoin Market

- Janover Inc Embraces Solana Treasury Under New Crypto Leadership

- Bitfufu Secures Massive Bitcoin Mining Boost With Bitmain Deal