Monero Price Surges to Record High After Dubai Bans Privacy Coins

Monero (XMR), the leading privacy-focused cryptocurrency, reached a new all-time high of $686 on Monday, marking a sharp 14 percent gain in just 24 hours. The breakout pushed the coin's market cap above $12 billion for the first time, while daily trading volume topped $500 million. Traders watched the price climb steadily through the weekend and accelerate after news broke of new regulatory restrictions in Dubai.

The surge stands out because it occurred against a relatively quiet broader crypto market. Bitcoin and Ethereum posted modest gains over the same period, but Monero clearly decoupled, rising roughly 45% over the past week. The move highlights renewed interest in privacy coins at a time when many investors are reassessing the value of financial anonymity on public blockchains.

Dubai Regulator Restricts Privacy Coin Activity

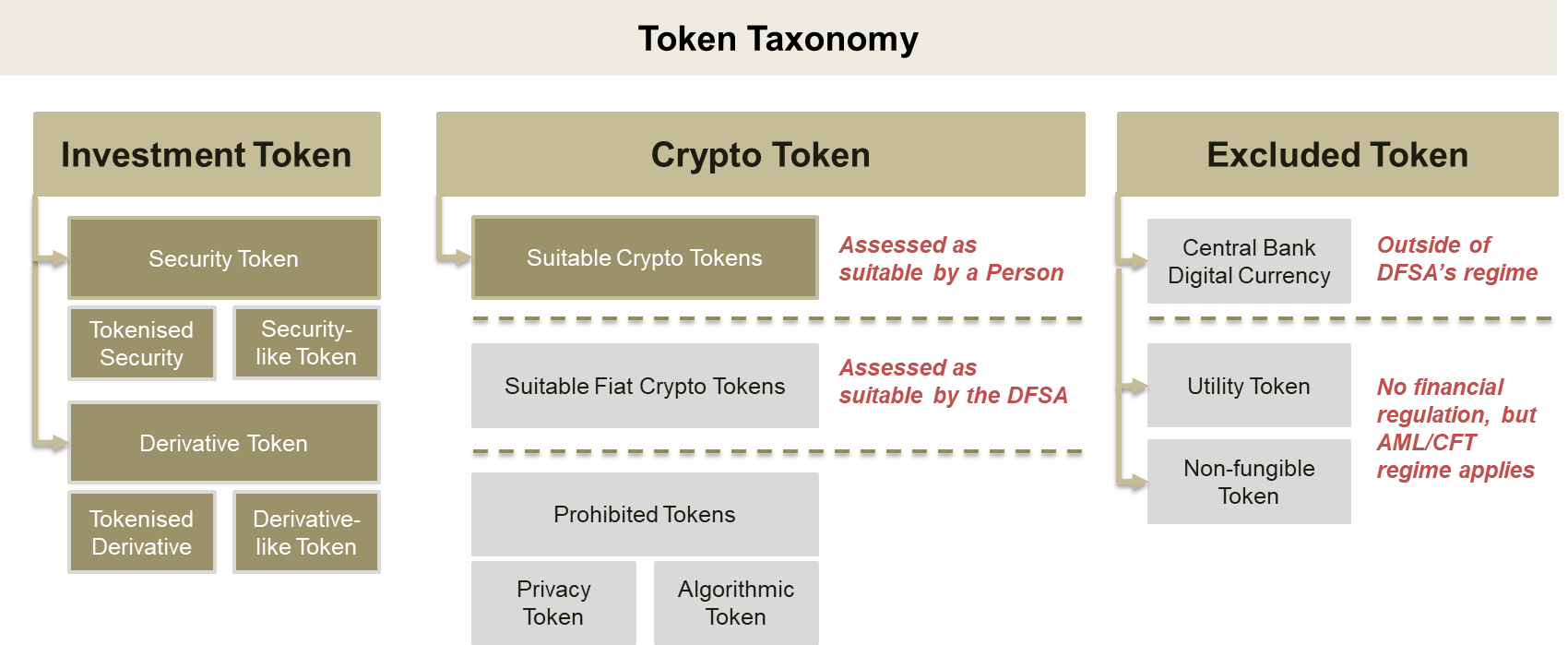

The Dubai Financial Services Authority (DFSA), the regulator overseeing the Dubai International Financial Centre (DIFC), announced new rules that took effect on January 12. Regulated entities in the DIFC are now prohibited from trading, promoting, custodying, or offering derivatives tied to privacy coins. The restrictions also ban the use of mixing services or tumblers by licensed firms, though individuals remain free to hold privacy coins in personal wallets.

On the DFSA website, the new guidelines read specifically:

"Privacy Tokens and Privacy Devices are typically used for two main purposes: to facilitate anonymity and to prevent the tracing of transactions. Anonymity hides the identity of a holder of a Crypto Token or the identity of two parties to a transaction on the blockchain, while non-traceability makes it difficult or impossible for third parties to follow the trail of a series of transactions. The use of Privacy Tokens or Privacy Devices is prohibited as they can facilitate money laundering, market abuse, fraud or other financial crime."

"The definitions of Privacy Token and Privacy Device will apply to Crypto Tokens and devices that have features that are used or intended to be used for hiding, anonymising, obscuring or preventing the tracing of information, whether or not they are in fact used for that purpose. For example, some Crypto Tokens have features that can be turned on at the option of the user to hide or prevent the tracing of information. A Crypto Token that has such optional features, will be a Privacy Coin as defined and is prohibited from being used in the DIFC."

The DFSA’s decision aligns with similar measures taken by regulators in other jurisdictions concerned about the potential for anonymous transactions to facilitate illicit activity. Exchanges operating under DFSA oversight must immediately delist affected coins and cease all related services. The announcement came without advance warning, prompting quick compliance from local platforms.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishMarket reaction to the news was swift and counterintuitive. Rather than declining on reduced institutional access, Monero’s price rallied sharply, suggesting that many traders view exchange restrictions as a signal of stronger decentralized demand. Privacy coin advocates have long argued that regulatory pressure often drives users toward self-custody and peer-to-peer trading, which can increase scarcity on centralized platforms.

The broader privacy coin sector also saw notable movement. Total market capitalization for privacy-focused coins rose 3.5% in the past day, accompanied by a 30% increase in trading volume. Dash led secondary gainers with a 55% jump, while Zano climbed 14%. Zcash, despite a modest 1% daily gain, remained down 22% over the week after profit-taking following its own late-2025 technical upgrade.