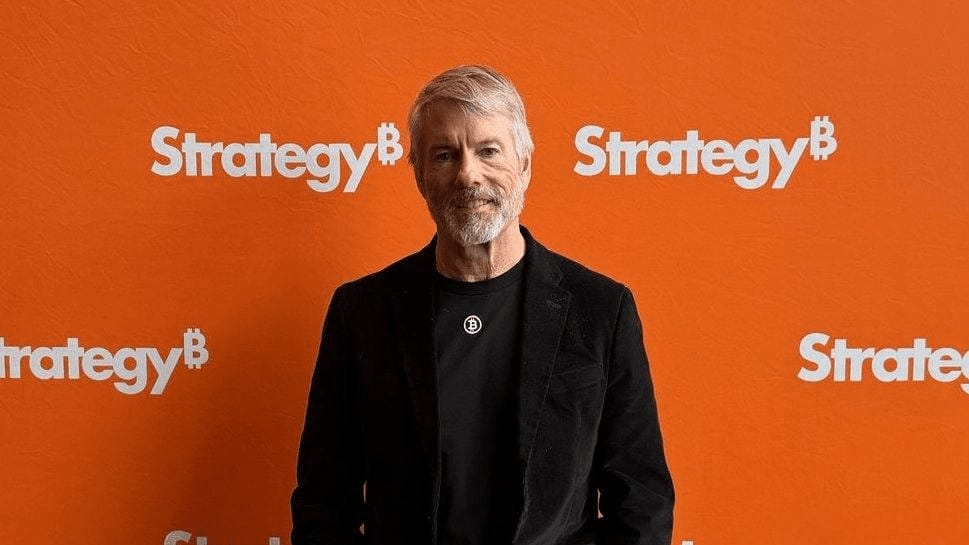

Michael Saylor’s Strategy Launches IPO for Preferred Stock to Fuel Bitcoin Acquisitions

MicroStrategy Incorporated, operating under the brand name Strategy and led by CEO Michael Saylor, announced plans to launch an initial public offering (IPO) for 2.5 million shares of its 10.00% Series A Perpetual Stride Preferred Stock (STRD).

The announcement, made on Monday, marks a significant step for the company as it seeks to bolster its financial strategy, with a particular focus on expanding its Bitcoin holdings. The offering aims to provide Strategy with flexible capital for its corporate objectives. The company stated that the net proceeds will primarily support general corporate purposes, including the acquisition of Bitcoin and working capital needs.

Strategy’s move reflects its ongoing commitment to integrating Bitcoin into its financial framework, a maneuver that has drawn considerable attention in recent years. By allocating funds toward Bitcoin, the company aims to diversify its asset base while maintaining operational liquidity.

The IPO is being managed by prominent financial institutions, with Barclays, Morgan Stanley, Moelis & Company, and TD Securities serving as joint book-running managers. Additional support comes from co-managers, including The Benchmark Company, AmeriVet Securities, Bancroft Capital, BTIG, and Keefe, Bruyette & Woods. The offering will proceed through a prospectus supplement and an accompanying prospectus, as outlined in Strategy’s effective shelf registration statement filed with the Securities and Exchange Commission.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishDetails of the STRD Stock Offering

The STRD Stock comes with specific financial features designed to appeal to investors. Holders of the stock will be eligible for non-cumulative dividends at an annual rate of 10.00% on the stock’s stated amount, payable in cash only when declared by Strategy’s board of directors or an authorized committee. These dividends, if declared, will be distributed quarterly on March 31, June 30, September 30, and December 31, starting in September 2025. However, the non-cumulative nature of the dividends means Strategy is not obligated to pay them unless formally declared, and no unpaid dividends will accrue or accumulate over time. This structure provides the company with flexibility in managing its cash flow while offering potential returns to investors.

Additionally, Strategy retains the right to redeem all outstanding STRD Stock under specific conditions, such as when the total shares outstanding fall below 25% of the initially issued amount or if certain tax events occur. The redemption price would include the stock’s liquidation preference, initially set at $100 per share, plus any declared and unpaid dividends up to the redemption date. The liquidation preference may adjust daily based on factors like the stock’s last reported sale price or an average of recent trading days, ensuring alignment with market dynamics. In the event of a “fundamental change” as defined by the stock’s governing certificate, holders can require Strategy to repurchase their shares at the stated amount plus declared and unpaid dividends.