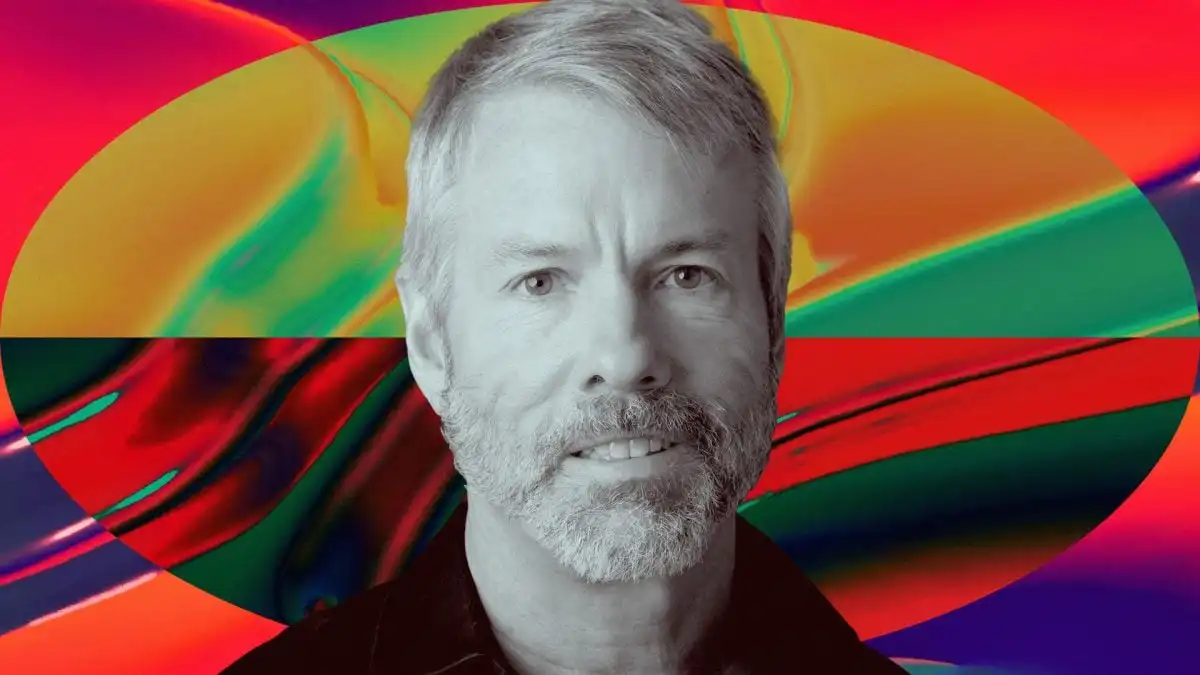

Michael Saylor’s Strategy Buys $1.42 Billion in Bitcoin, Now Owns 553,555 BTC

Strategy, the Bitcoin treasury company formerly known as MicroStrategy, has significantly expanded its portfolio with a recent acquisition of 15,355 BTC, valued at approximately $1.42 billion. The purchase, executed between April 21 and April 27 at an average price of $92,737 per BTC, brings the company’s total holdings to an impressive 553,555 BTC, according to a filing with the Securities and Exchange Commission. This substantial investment, funded through the sale of class A common stock (MSTR) and perpetual strike preferred stock (STRK), underscores Strategy’s commitment to its bitcoin-centric financial model, pioneered by co-founder and executive chairman Michael Saylor.

The company’s Bitcoin holdings, now worth over $52 billion, were acquired at an average price of $68,459 per BTC, totaling roughly $37.9 billion including fees. This investment represents more than 2.6% of Bitcoin’s fixed 21 million supply, with unrealized gains of approximately $14 billion. Last week, Strategy raised $1.4 billion through the sale of 4.02 million MSTR shares, leaving $128.7 million in shares available for future issuance. Additionally, the sale of 435,069 STRK shares generated $37.5 million, with $20.92 billion in STRK shares still available. These transactions align with Strategy’s broader “21/21 plan,” which aims to raise $42 billion through equity and fixed-income securities to fuel further Bitcoin acquisitions.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishGrowing Corporate Interest in Bitcoin

The acquisition follows a prior purchase of 6,556 BTC for $555 million between April 14 and April 20, which had elevated Strategy’s holdings to 538,200 BTC. This consistent accumulation reflects a broader trend among corporations embracing Bitcoin as a treasury asset. Last week, major players like Cantor Fitzgerald, SoftBank, Bitfinex, announced a $3.6 billion venture, joining companies such as Semler Scientific, KULR, and Metaplanet in adopting Strategy’s Bitcoin acquisition model.

Strategy’s stock performance has also benefited from its Bitcoin buying strategy and a rebound in both traditional and crypto markets. On Friday, MSTR closed at $368.71, up 5.2%, with Bitcoin gaining over 8% in the same week. In pre-market trading on Monday, MSTR saw a modest 0.7% increase, contributing to a 22.9% year-to-date rise and a market value of $98.1 billion. As Strategy continues to lead the corporate bitcoin accumulation race, its aggressive investment strategy positions it as a pivotal player in the evolving landscape of digital assets, setting a precedent for other firms exploring cryptocurrency as a strategic reserve asset.