Michael Saylor Proposes Game-Changing Digital Assets Strategy for U.S. Economic Leadership

Michael Saylor, a well-known advocate for Bitcoin published a comprehensive framework designed to integrate digital assets into the fabric of U.S. financial markets. This document, titled "Digital Assets Framework, Principles, and Opportunity for the United States," is not just a policy proposal; it's a vision for a financial renaissance driven by digital innovation.

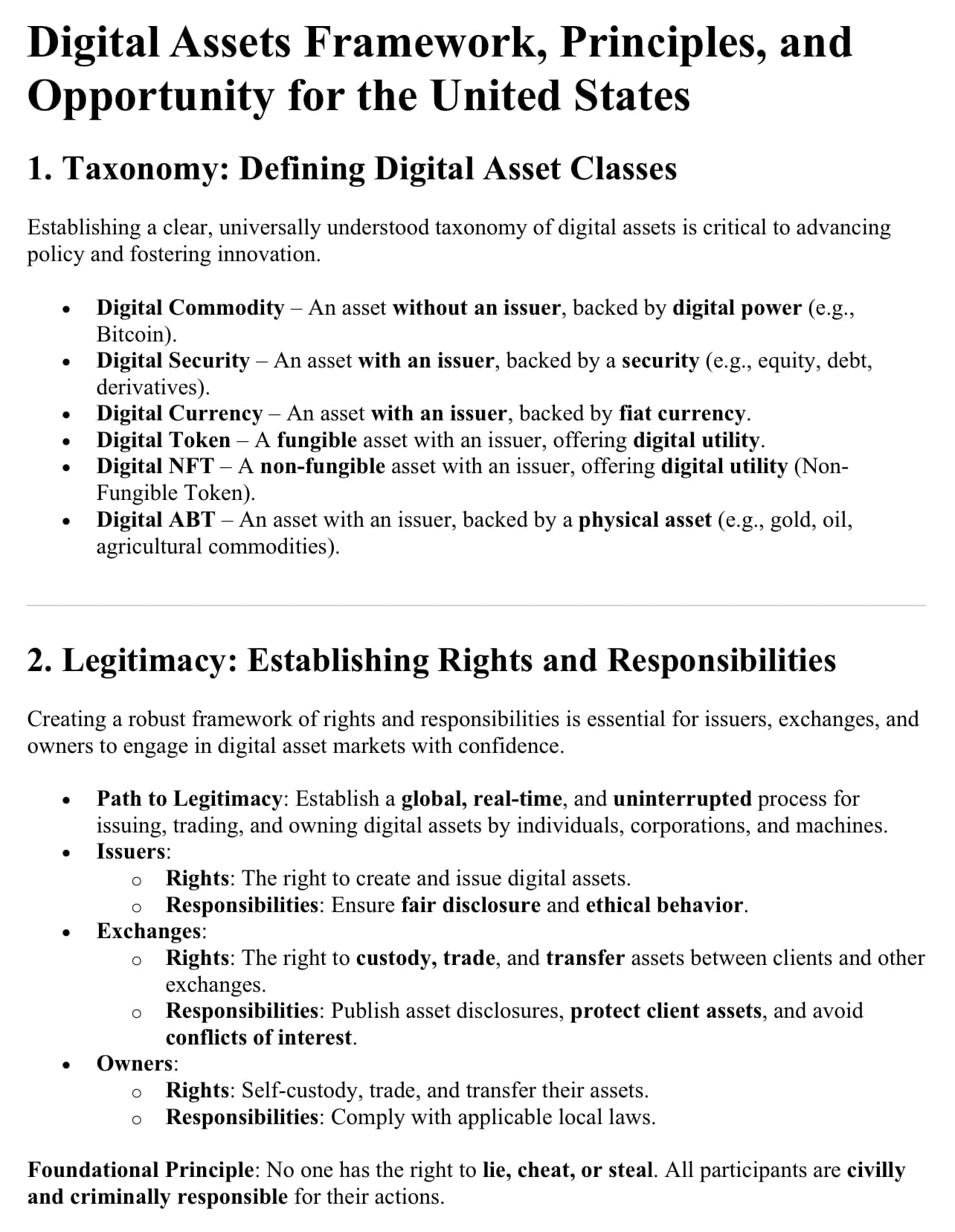

Saylor's document begins with a clear taxonomy for digital assets, categorizing them into various types based on their nature, backing, and utility. This classification system is crucial because it provides a foundation upon which regulations can be built, ensuring that each asset class is treated appropriately in legal and economic terms. From digital commodities like Bitcoin, which are issuer-less and backed by computational power, to digital securities linked to traditional financial instruments, Saylor pushes for a nuanced understanding of what digital assets truly represent.

The essence of Michael Saylor's proposal lies in its approach to legitimacy. It outlines rights and responsibilities for issuers, exchanges, and owners of digital assets. This structure not only aims to foster trust but also underscores that ethical behavior in the digital asset space is non-negotiable. By doing so, he's setting a precedent where deceit or malpractice could lead to severe civil or criminal consequences, aligning digital markets with traditional market ethics.

But Saylor doesn't stop at defining categories and ethical standards; he ventures into the practicality of how these assets should be managed. Here's where the document gets particularly interesting. He argues for a compliance model that's lean, efficient, and driven by the industry itself rather than being bogged down by regulatory red tape. This approach to compliance could potentially lower costs dramatically, making it feasible for even small enterprises or individual creators to leverage digital assets for funding or trade.

A Vision for a New Financial Era

Under this vision, Saylor sees the U.S. leading a capital markets renaissance. He imagines a future where digital assets are issued in hours rather than months, where the cost of going public is slashed from millions to thousands, and where the market is not just for the elite few but accessible to millions. This inclusivity could open up avenues for small businesses, artists, and mid-sized companies to tap into capital markets through tokenization of various assets, from art to intellectual property.

The document also ambitiously positions digital assets, particularly Bitcoin, as strategic tools for national economic policy. Saylor suggests that by embracing digital currencies, the U.S. could strengthen the dollar's global reserve status, manage national debt more effectively, and even leverage Bitcoin to create wealth for the U.S. Treasury. This part of his proposal is speculative yet thought-provoking, challenging traditional economic strategies with a blend of digital innovation and macroeconomic thinking.

Throughout the document, Saylor maintains that the U.S. has a historic opportunity to lead the digital economy. His proposal is not just about regulation but about catalyzing a shift towards a more dynamic, accessible, and innovative financial landscape. However, this vision requires a significant overhaul of current systems, attitudes towards cryptocurrency, and perhaps most critically, the buy-in from regulators and the public.

In summary, Michael Saylor's framework is both a call to arms for the U.S. to redefine its financial identity in the digital age and a roadmap to achieve it. While the document might seem ambitious, it's rooted in the belief that digital assets are not just the future of finance but a transformative force for economic policy and innovation. Whether or not this vision comes to fruition depends on how well the proposal can navigate through the complex web of existing laws, market dynamics, and public perception.