Michael Burry, Bitcoin Critic, Finds Promise in Blockchain Tokenization

Michael Burry has captured attention once again with a subtle shift in his public commentary on Bitcoin and digital assets. The hedge fund manager, immortalized by Christian Bale in the 2015 film The Big Short, built his reputation on prescient bets against the housing market ahead of the 2008 crash. That same year marked the birth of Bitcoin, created by Satoshi Nakamoto, born from the ashes of financial turmoil as a decentralized alternative to traditional systems. Burry's recent activity post on X signals curiosity about tokenization, a technology he once dismissed alongside cryptocurrencies.

On December 9, 2025, Burry shared an article from The Paypers titled Beyond crypto: how tokenization is quietly rewiring markets. In his post, he added a simple note: "I am learning." This comes just days after he reiterated his long-standing criticism of Bitcoin during a podcast appearance. The timing underscores Burry's complex relationship with blockchain innovations, where skepticism toward speculative assets coexists with openness to practical applications.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishTokenization Emerges as Finance's Next Frontier

The article Burry highlighted outlines tokenization's rapid ascent in global markets. Industry data from 21.co shows the tokenized asset market grew from $8.6 billion in 2023 to over $23 billion by mid-2025. Analysts project this could expand into tens of trillions within a decade, spanning bonds, funds, real estate, and private markets. Tokenized dollars and stablecoins play a key role here, bolstering the U.S. dollar's dominance by enabling seamless cross-border transactions.

Interoperability pilots further highlight the technology's promise, allowing real-time transfers of tokenized assets across platforms. By 2026, experts anticipate programmable real-time settlement will become standard, injecting liquidity into assets that have long been hard to trade. This development could streamline processes that currently involve days of delays and intermediaries, making finance more efficient for institutions and individuals alike.

Institutional players have driven much of this momentum throughout 2025. BlackRock CEO Larry Fink stands out as a vocal proponent, comparing tokenization's current stage to the internet in 1996. He argues it holds transformative potential for asset management and ownership. Fink's firm launched its tokenized U.S. Treasury product, BUIDL, on Ethereum last year, and has since expanded into broader blockchain initiatives.

Fink's evolving perspective adds weight to the conversation. Once a Bitcoin skeptic, he acknowledged in early December 2025 at the New York Times DealBook Summit that his initial doubts were misplaced. He now views Bitcoin as an asset of fear, akin to gold, serving as a hedge against geopolitical risks and currency debasement. BlackRock's iShares Bitcoin Trust, with over 70 billion dollars in assets under management by late 2025, reflects this practical embrace of digital assets.

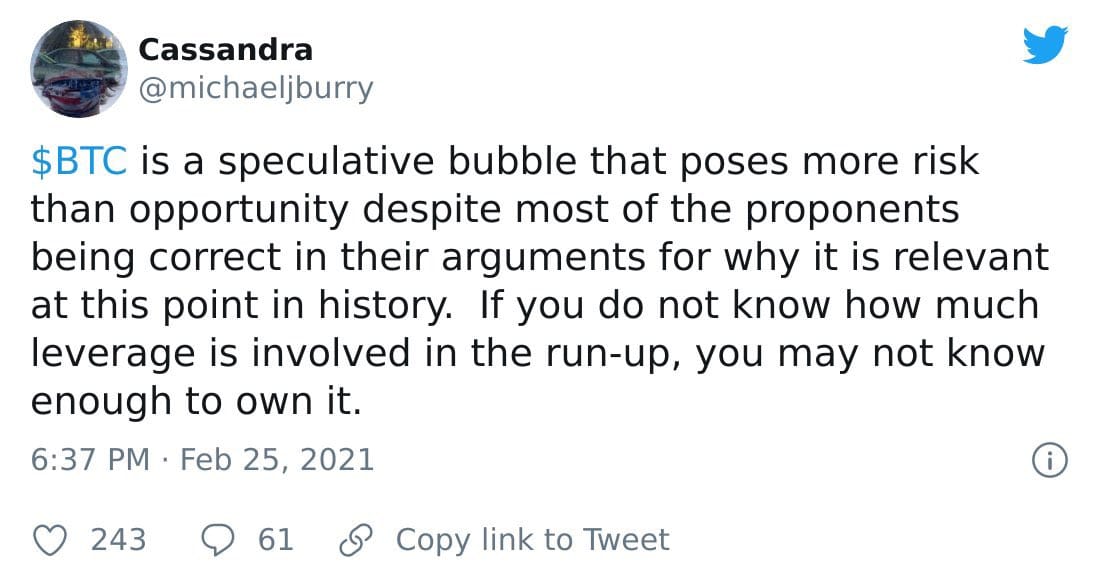

Burry's history with Bitcoin tells a different story. In 2021, he labeled it a speculative bubble, cautioning that high leverage in its rally made it risky for most investors. He urged caution, noting that proponents' arguments for its relevance did not outweigh the dangers. Those words came when Bitcoin traded far below its peaks, yet they echoed his core concern about overvaluation.

This month, Burry sharpened his critique on Michael Lewis's Against the Rules podcast, aired December 2, 2025. He called Bitcoin's climb to $100K the most ridiculous thing he has seen, dismissing it as the tulip bulb of our time. Drawing parallels to the 17th-century Dutch frenzy, Burry argued the cryptocurrency enables criminal activity to thrive unchecked. At the time of his comments, Bitcoin hovered around $88,700 dollars, down from a record above $120,000 in October.

As Burry continues to learn, data suggests tokenization may outpace pure speculation. Stablecoins alone have facilitated trillions in transfers this year, underscoring their utility beyond hype. For investors like Burry, who thrive on spotting undervalued opportunities, this quiet rewiring offers a fresh view. The convergence of blockchain with real-world assets could redefine liquidity and access, much as the 2008 crisis reshaped finance.

Bitcoin's origins in that era add an ironic layer to Burry's journey. While he profited from the collapse that inspired its creation, his current explorations hint at blockchain's enduring influence. The growth of tokenization, fueled by figures like Fink, points to a future where digital ledgers enhance rather than replace legacy systems. Burry's willingness to engage, even tentatively, reminds people that even the sharpest minds adapt to new realities.