Memecoin Mania Fades After Early Hype as 2025 Closes and Volatility Deepens

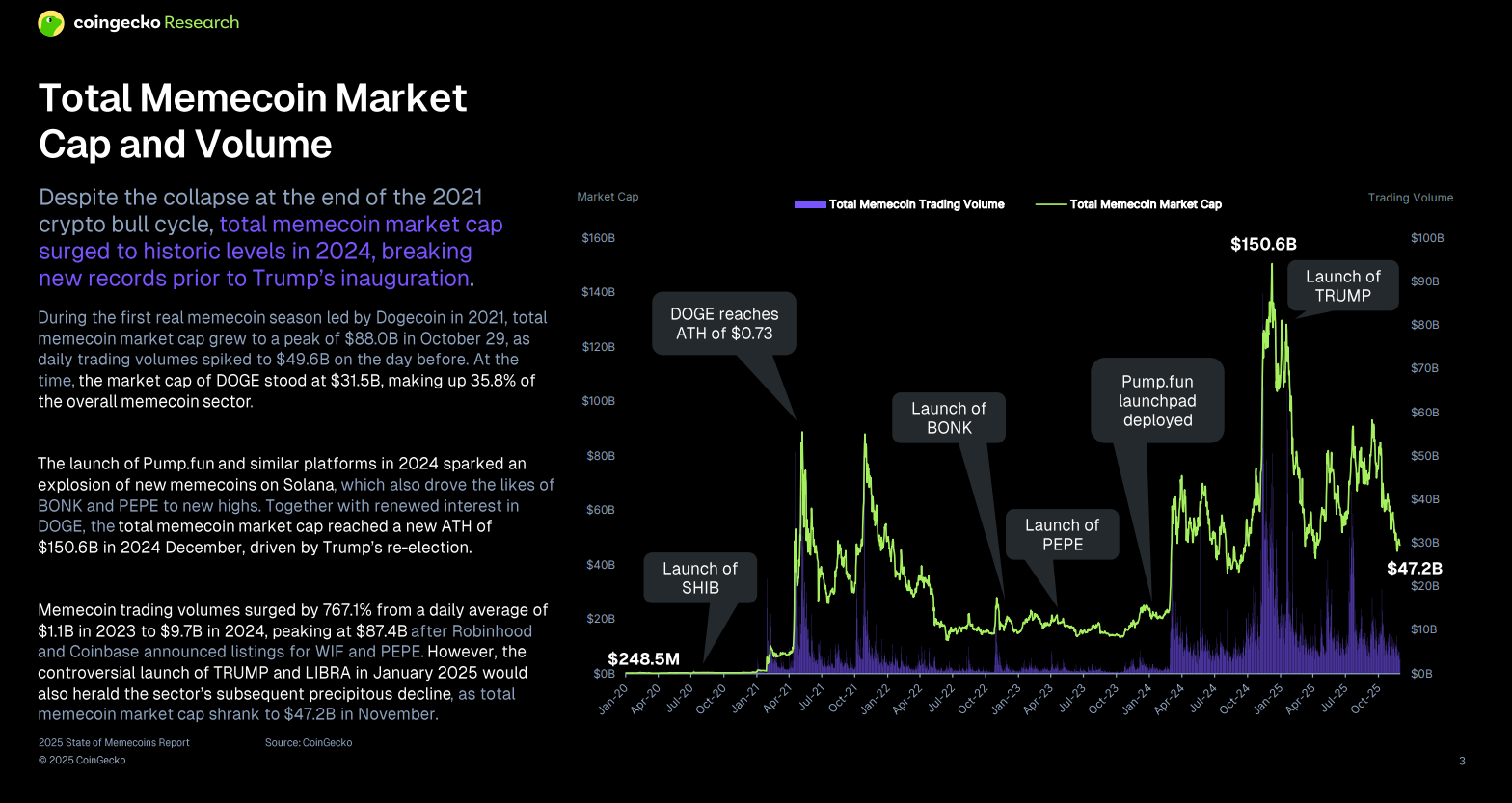

The memecoin market entered 2025 on a wave of momentum from the previous year's political and cultural surges, reaching a peak capitalization that reflected widespread retail enthusiasm. High-profile launches tied to public figures fueled initial gains, drawing in traders seeking quick returns amid broader crypto optimism. However, the sector faced significant challenges throughout the year, including oversupply from rapid token creation and shifting investor attention.

Trading activity started strong, with volumes reflecting the frenzy around new projects on networks like Solana. Early political narratives provided temporary boosts, but sustained growth proved elusive as volatility took hold. By mid-year, signs of fatigue emerged, with many tokens struggling to maintain liquidity amid competing launches.

Key Developments and Performance in 2025

Political themes dominated the early months, setting the tone for much of the year's activity. The official TRUMP token launched in January, quickly rising to over $74 per coin on inauguration day before experiencing substantial declines later in the year. Similar patterns appeared with other politically linked tokens, such as LIBRA associated with Argentina's President Javier Milei, which sparked controversy and rapid price drops amid ongoing scrutiny in Argentina.

Established memecoins like DOGE, PEPE, and SHIB, also navigated turbulent conditions. DOGE maintained the largest share of the sector's capitalization, often exceeding 47%, supported by its longstanding community and occasional external endorsements. SHIB and PEPE saw periods of recovery tied to broader market rotations but faced repeated setbacks during stress phases, highlighting the sector's sensitivity to overall sentiment.

Oversupply played a central role in the year's dynamics, with millions of new tokens introduced through accessible launchpads. Platforms like Pump.fun facilitated quick deployments, briefly capturing significant market share for newer projects. Yet independent tokens continued to dominate, accounting for over 86% of total capitalization, as many launchpad creations failed to sustain interest or liquidity.

Regulatory developments offered some clarity when the SEC indicated that most memecoins did not qualify as securities, easing certain concerns for participants. This signal supported short-term sentiment but did not prevent the broader pullback as trading volumes dropped substantially across exchanges. Mid-year rebounds provided brief relief, driven by rotations into top names, though these moves often faded quickly.

Notable individual performances underscored the sector's extremes. Tokens like FARTCOIN achieved headline gains during hype peaks, while others, including the MELANIA coin and certain celebrity-linked projects, suffered near-total value erosion. Data from tracking platforms showed that a majority of top memecoins recorded significant declines over extended periods, with losses frequently in double digits.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishAccording to an end of year report by CoinGecko, the sector's diversity expanded beyond traditional animal themes, incorporating pop culture, AI, and real-world events. Some projects explored added features in areas like DeFi and NFTs, aiming to build longer-term engagement. Centralized exchanges increased memecoin listings and integrated direct trading options, broadening access for retail users.

As the year progressed, engagement concentrated in a smaller group of survivors, with creation rates remaining high but participation thinning. November marked a low point around $47 billion in capitalization, followed by modest end-of-year activity. December brought familiar short-lived spikes in select tokens, closing the period on a leaner note.

The experiences of 2025 highlighted the memecoin sector's reliance on timing and narratives, with rapid booms giving way to quicker corrections at greater scale. Traders encountered valuable reminders about the pace of attention shifts in this space. Heading into the new year, the market appears more selective, with capital flowing toward proven names amid ongoing evolution.