Maryland Introduces Strategic Bitcoin Reserve Act Legislation

Maryland has stepped into the spotlight by considering Bitcoin as a strategic state reserve asset. This decision marks a significant milestone in the state's financial strategy, reflecting a broader trend across the United States where states are exploring innovative ways to diversify their assets.

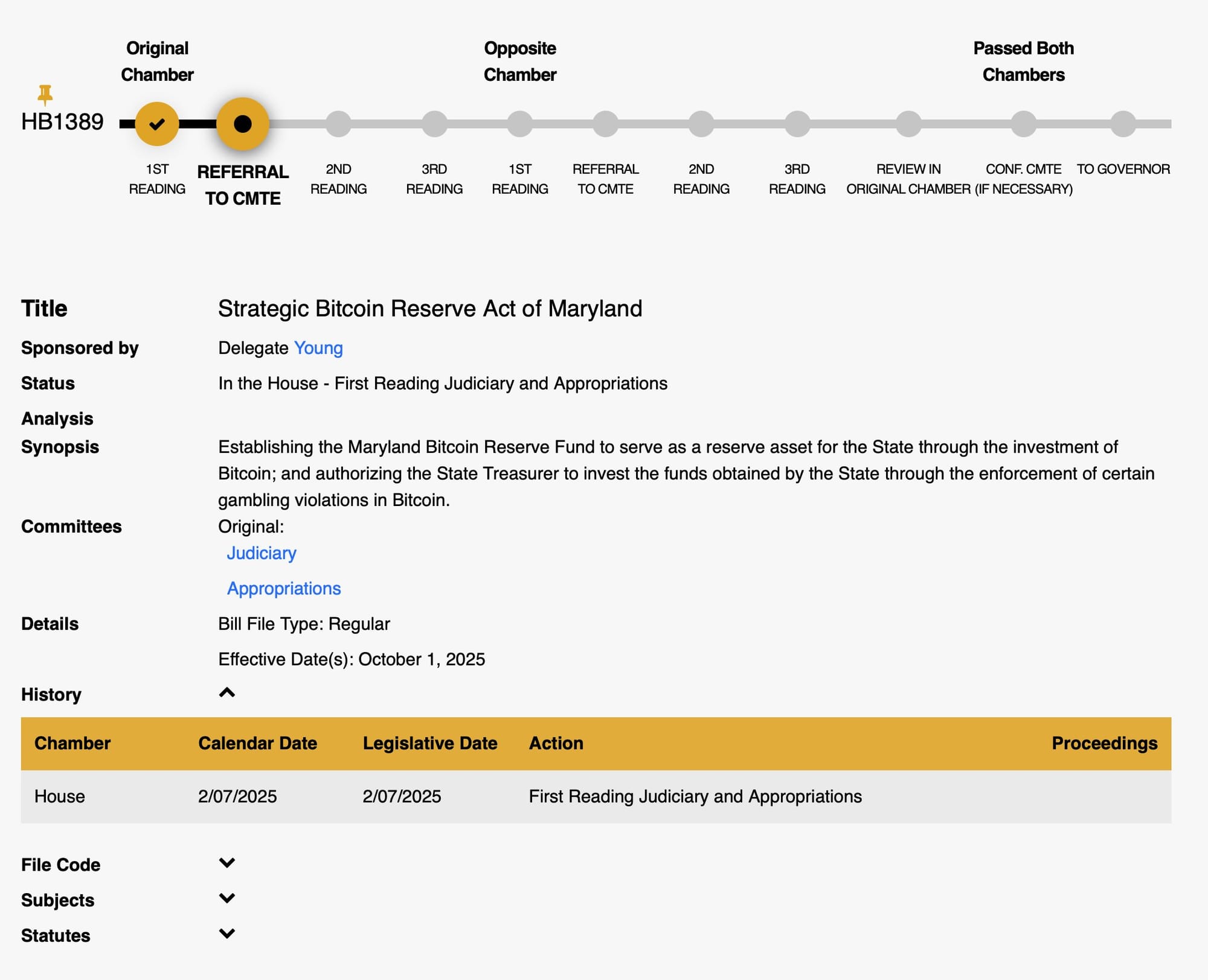

Maryland State Delegate Caylin Young has introduced House Bill 1389, known as the 'Strategic Bitcoin Reserve Act of Maryland.' This legislation aims to establish a state reserve fund that would be invested in Bitcoin, positioning Maryland as the 17th state to consider such a forward-thinking initiative. The move is not just about adopting new technology but about recognizing Bitcoin's potential as a long-term investment and a hedge against inflation.

The introduction of this bill is currently in its preliminary stages and will undergo a thorough review by the House Economic Matters and Appropriations committees. If passed, it would allow Maryland to join a growing list of states that are not only acknowledging the rise of digital currencies but are also actively integrating them into their financial frameworks. This trend signifies a shift in how state governments perceive and utilize digital assets, moving beyond traditional financial instruments to embrace the digital economy.

The Growing Trend Among U.S. States

This legislative action in Maryland echoes similar initiatives in states like Kentucky, where Representative Theodore Joseph Roberts recently introduced a bill allowing up to 10% of excess state reserves to be invested in digital assets, including Bitcoin. This growing interest among states highlights a broader acceptance and understanding of cryptocurrencies as viable financial assets. By considering Bitcoin for their reserves, states are not only diversifying their financial portfolios but are also preparing for an economic future where digital currencies play a pivotal role.

The trend towards integrating Bitcoin into state reserves is driven by several factors. Firstly, Bitcoin's decentralized nature offers a buffer against the volatility of traditional markets. Secondly, as a deflationary asset, Bitcoin provides a potential safeguard against inflation, which has become a critical concern for many states. Finally, this move could position states at the forefront of financial innovation, attracting tech-savvy businesses and investors to their economies.