Mapping Out Epstein's Shadow Network of Bitcoin Influence and Hidden Capital Flows

In the sprawling archives of Jeffrey Epstein's emails and documents, unleashed by the U.S. Department of Justice in late 2025 and early 2026, Bitcoin and cryptocurrency emerges not as a passing fascination, but as a meticulously woven thread in the financier's web of power, secrecy, and ambition. What began as a 2008 crisis brainstorm evolved into a decade-long campaign: funding Bitcoin's core infrastructure, forging ties with developers, routing millions through shadow funds, and leveraging the technology's features for "total deniability."

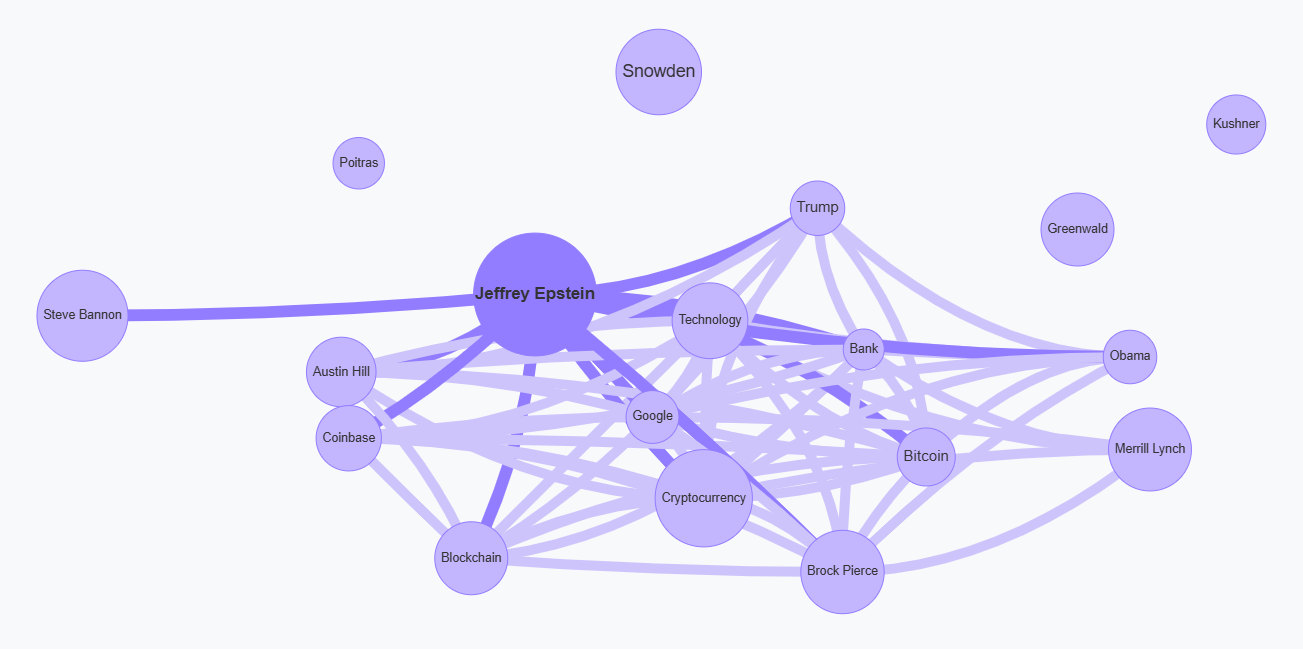

A network graph of ~100K data points from the Epstein-Bitcoin corpus, that we built from entity extraction, co-occurrence analysis, and ranking, lays it bare. Nodes sized by mention frequency reveal a dense ecosystem: Bitcoin and crypto at the core near Epstein, flanked by proxies like Austin Hill (Blockstream) and Brock Pierce, with outliers like Edward Snowden hinting at surveillance knowledge and possible evasion. Political heavyweights: Trump and Steve Bannon cluster nearby, alongside financial giants like Merrill Lynch, banks, and Coinbase.

As visualized in the interactive network graph that we created, strong edges connect Epstein to a constellation of crypto insiders, banks, and tech entities. Click a node like "Austin Hill," and it lights up and links to Blockstream deals, island meetings, and Bitcoin mixing proposals. This isn't noise, it's a literal map of influence. Epstein didn't just "dabble" in Bitcoin. He infiltrated it, using decentralization as cover for control, returns, and darker pursuits.

The graph, derived from nearly ~100K data points across the files, clusters recurring co-occurrences. It's experimental, automated extraction has limits, but it surfaces patterns our raw searches may miss.

Top entities by count: Snowden (surveillance), Epstein (the architect), Bitcoin (the vehicle). The result? A visual proof of what the emails whisper: crypto was Epstein's parallel financial system.

From Financial Crisis to Crypto Vision

Epstein's crypto odyssey predates Bitcoin's birth. In October 2008, weeks before Satoshi Nakamoto's whitepaper, his emails framed the global meltdown as a "greatest political revival opportunity."

To Peter Mandelson, he wrote: "The crisis begins with a lesson on money. NOT finance, MONEY. At its core, the whole system is based on TRUST... People no longer trust in any of the more standard institutions." He envisioned a "new dynamic system," summoning "internet experts" to rethink regulation, likening markets to the ungovernable web.

This wasn't idle musing. Epstein's pre-2008 career at Bear Stearns and his own firm had made him a master of opaque finance. Bitcoin's "trustless" design, cryptographic proof over banks, mirrored his critique. By 2011, he was hunting "bit coin guys." Emails to friend and connector, Jason Calacanis, sought intros to Gavin Andresen (Bitcoin's lead dev) and Amir Taaki.

Andresen rebuffed: "No, sorry, I'm busy." But the seed was planted.

Pierce, Hill, and Rubin as Epstein's Crypto Operatives

Direct access was rare; Epstein excelled through cutouts. Brock Pierce, former child actor, Tether co-founder, and early Bitcoin whale, was the linchpin. Files show Pierce at Epstein's Manhattan townhouse pitching Bitcoin to Larry Summers (ex-Treasury Secretary). "You are going to have some low quality characters playing early in the space," Pierce quipped. Summers hedged: financial loss was one risk; reputational ruin another.

Pierce's Crypto Currency Partners II (2014) became Epstein's "shadow fund." Emails detail $3M+ routed to Coinbase (2014 investment, sold for $11M+ profit) and Blockstream. By 2016, the $10M fund held stakes in Abra, BitGo, Kraken, Ripple, crypto's who's who. "Attached are the docs I sent you for the LLC that we intend to funnel your investments through," Pierce wrote Epstein.

Austin Hill (Blockstream co-founder) was the operational muscle. 2014 emails show Hill and Adam Back meeting Epstein on Little St. James, discussing Bitcoin amid "pretty girls." Hill's 2015 email: "I may bring a Bitcoin Belle who is an anarchist." By 2018, Hill pitched "tumbled bitcoin transactions" for "total deniability" in side projects, referencing prior Epstein funds hidden via Joi Ito.

"We've got in our network guys who did Snowden's escape to Russia level counter-surveillance," Austin Hill wrote to Epstein.

Jeremy Rubin (Bitcoin Core dev) was the technical scout. From 2014, Rubin updated Epstein from Japan (teaching Bitcoin at Digital Garage) and Stanford (presenting "inverse-input contracts," foreshadowing his CTV work). "Thought I'd check in... I've been watching Trump's appointees-Balaji [Srinivasan] as FDA head?" Rubin wrote. He intro'd Epstein to Chaincode Labs (Suhas Daftuar, Alex Morcos) and Bryan Bishop (LedgerX).

These men weren't peers; they were assets. Pierce for capital, Hill for privacy ops, Rubin for dev access.

Funding the Machine: MIT, Blockstream, Coinbase, and Beyond

Epstein's cash flowed like a spigot. $850K to MIT's Digital Currency Initiative (2015) bailed out Bitcoin Core devs post-Bitcoin Foundation collapse. Joi Ito thanked him: "Used gift funds to underwrite this." It funded Andresen, Wladimir van der Laan, Bitcoin's guardians.

$500K to Blockstream's seed (2014) via Ito's fund. Austin Hill and Adam Back's island trip sealed it. Blockstream's Layer 2 focus (Lightning Network) aligned with Epstein's "layer upon layer" vision from 2008.

$3M to Coinbase (via Pierce) yielded 3x returns. Valar Ventures (Peter Thiel) got $49M, ballooning to $170M; a crypto-heavy portfolio.

Graph clusters confirm: Coinbase links to Bank and Merrill Lynch (Epstein's old world). Blockchain and Cryptocurrency radiate from Epstein, Hill, Pierce, and so on.

Epstein Leveraged Crypto Privacy, Covert Funding, and Talent Networks

Epstein craved opacity. Hill's 2018 emails proposed "offshore hedge fund" deals settled in "Tumbled bitcoin transactions" - Bitcoin mixing to erase trails. "I know you've hid your investments through Joi," Hill wrote. Follow-ups offered "Snowden-level counter-surveillance."

Zcash co-founder Madars Virza surfaced in Ito-Epstein chats (2017-2019). "Madars is doing well," Ito noted. Privacy coins fit: zk-SNARKs for untraceable flows.

By 2018, crypto funded Epstein's obsessions. Bishop (LedgerX, Blockstream ties) pitched $9.5M for Designer Babies: germline editing for "first live birth... possibly a human clone" in five years. "Once we reach the first birth, everything changes." Austin Hill advised; emails joked "Dr. Evil" (Austin Powers clips) about cloning empires.

Masha Drokova (ex-Kremlin youth, VC) touted a Russian "blockchain prodigy better than Vitalik Buterin." "Money are very distracting," she wrote Epstein.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishEpstein's Crypto Empire

The graph and files reveal a strategy: Crypto wasn't a hobby, it was Epstein's endgame. Pre-2008 finance met post-crisis tech. Proxies hid fingerprints. Privacy tools enabled "deniability." Funding bought access; returns built wealth.

Epstein died in 2019, but his shadow lingers. Bitcoin's trillion-dollar market traces to these roots: MIT DCI, Blockstream, Coinbase. The graph's clusters demand scrutiny: Was Epstein's cash clean dev funding, or a vector for control and power?

We created an Epstein Bitcoin Email archive to go through all the newly released Epstein emails relating to Bitcoin, cryptocurrency, and blockchain, to search through all the communications for important information relating to this topic. Try it out!