LIBRA Mastermind Hayden Davis Allegedly Sniped Kanye West YZY Token for $12 Million

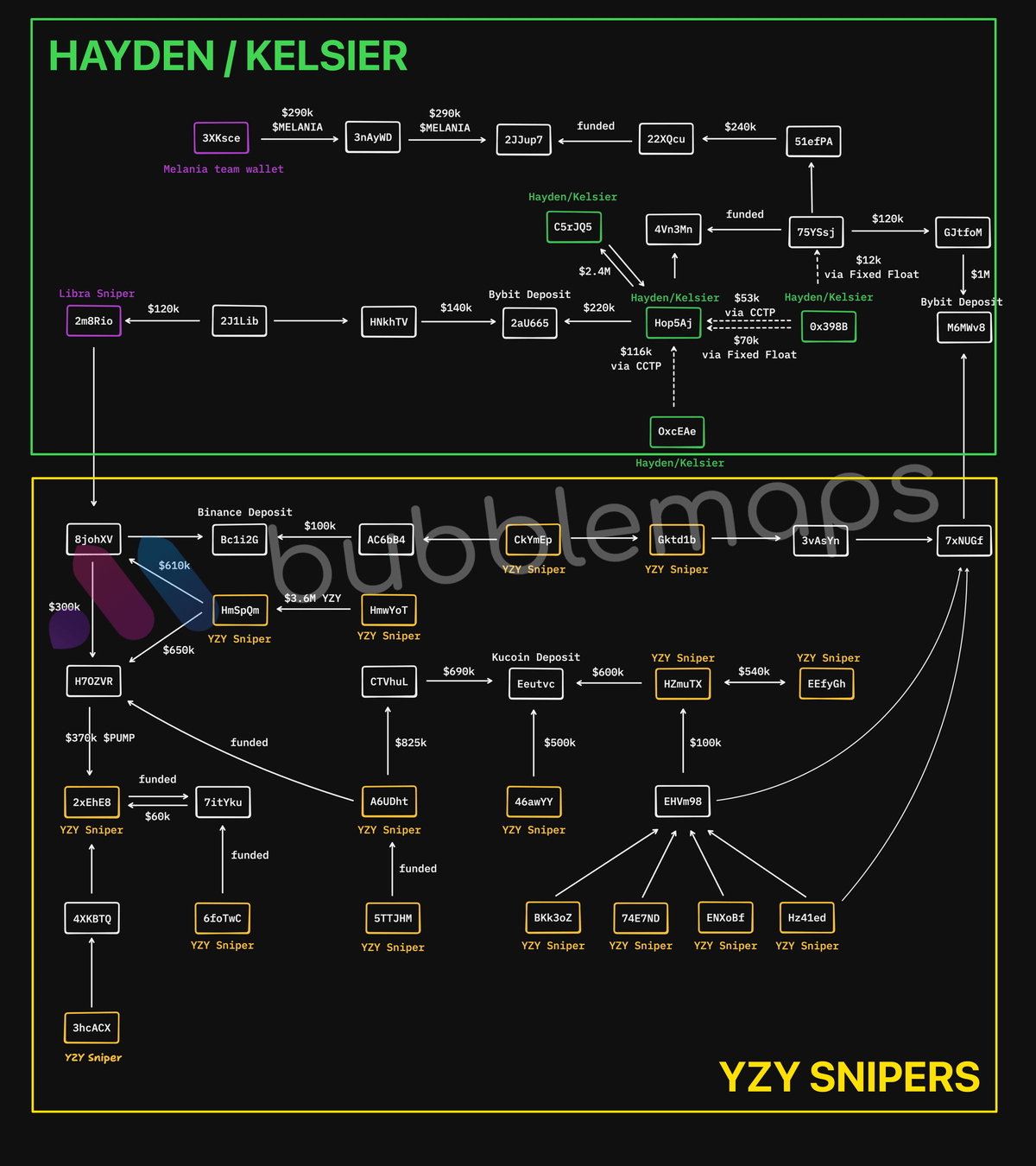

A new report from blockchain analytics firm Bubblemaps has raised concerns about the launch of Kanye West’s YZY token, alleging that Hayden Davis, orchestrated a sniping operation that netted $12 million in profits through 14 connected wallets.

The findings point to suspicious trading patterns that coincided with the token’s debut, sparking renewed scrutiny of celebrity-backed cryptocurrency projects. As blockchain forensics firms dig deeper into potential manipulation, the controversy surrounding YZY adds to a growing list of high-profile token launches under investigation.

Coordinated Trading and Profit Extraction

The Bubblemaps investigation began with a detailed timing analysis, revealing that Davis gained access to $57.6 million in previously frozen USDC stablecoins on August 20, 2025, just one day before YZY’s launch.

These funds, tied to the earlier LIBRA token scandal, were unfrozen by a U.S. judge as part of a class-action lawsuit settlement. Bubblemaps tracked several wallet addresses funded from centralized exchanges the day before the token’s debut, uncovering a cluster of accounts linked to Davis through funding transactions, Cross-Chain Transfer Protocol transfers, and shared deposits. These wallets began purchasing YZY tokens as early as 1:54 A.M. UTC, just one minute after the token’s announcement, suggesting a highly coordinated effort.

The report highlights a pattern of behavior consistent with Davis’s prior involvement in sniping high-profile tokens, such as MELANIA and LIBRA. While Bubblemaps could not confirm whether Davis had insider information or direct ties to the YZY team, the firm documented the rapid accumulation of tokens and subsequent profit extraction, which generated an estimated $12 million. The connected wallets executed trades with precision, capitalizing on the token’s early price surge before its dramatic collapse. This discovery has fueled speculation about the integrity of YZY’s launch and raised questions about the role of insider trading in celebrity token projects.

The YZY token’s launch was marked by intense volatility, with trading activity briefly pushing its market cap close to $3 billion. However, within hours, the token’s value plummeted by over 90%, settling at a capitalization of approximately $137 million. Independent analysis from Coinbase’s Conor Grogan revealed that 94% of the initial token supply was controlled by insiders, including a single multisig wallet holding 87% of the tokens before distribution. This concentration of ownership, combined with high trading fees and slippage costs, created a challenging environment for retail investors.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishThe YZY liquidity pool featured a 1% base fee with dynamic adjustments reaching as high as 2.68%, alongside wider bin steps that introduced 4-5% slippage. These factors resulted in round-trip trading costs of approximately 10%, further complicating profitability for everyday traders. As of press time, YZY was trading at $0.5670, down 82% from its all-time high of $3.1633, reflecting the steep losses faced by many investors.

Davis, no stranger to controversy, has faced accusations of fraud and insider trading in connection with the LIBRA token collapse. In June, Davis testified in federal court denying the fraud claims. Now, with the Bubblemaps report, it adds to the growing scrutiny of his activities in the crypto space. The investigation into YZY’s launch remains ongoing, with blockchain forensics firms examining whether similar patterns of manipulation are present in other celebrity token projects.