Kevin O’Leary Shares Bitcoin and Crypto Insights, Urges Skeptics to Start Small

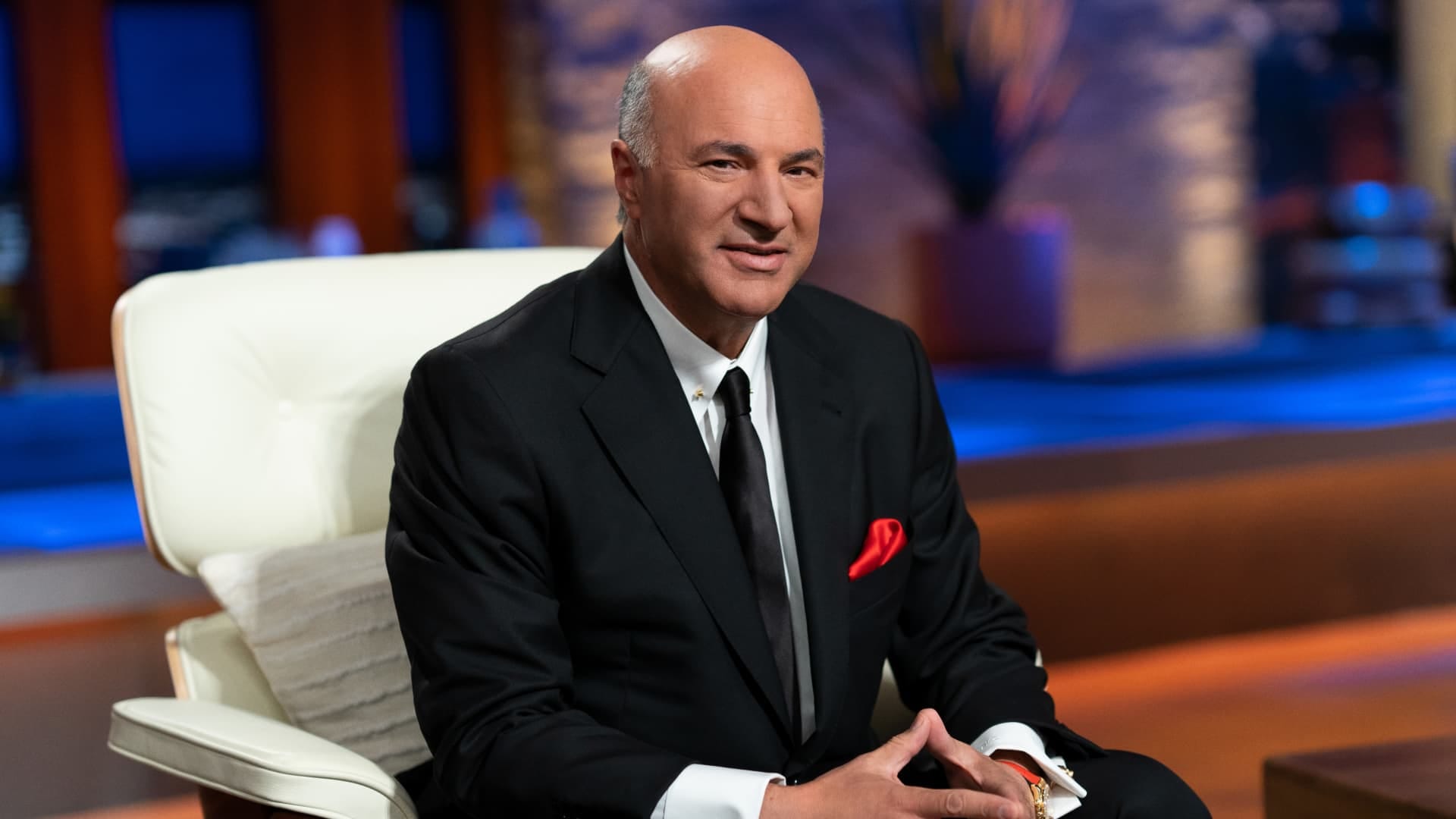

In a recent Fox News interview, Kevin O’Leary, widely recognized as “Mr. Wonderful” from his time on Shark Tank, offered a compelling perspective on the evolving world of cryptocurrency.

Speaking to an audience that may include both enthusiasts and skeptics, O’Leary encouraged those hesitant about digital currencies to dip their toes in with modest investments, particularly in well-established options like Bitcoin. His advice comes at a time when the crypto market is gaining traction, buoyed by what he describes as a supportive shift in the current U.S. administration’s approach to the sector. For O’Leary, this is more than just a passing trend—it’s a glimpse into the future of finance.

O’Leary’s central message was clear and practical. He suggested that newcomers begin with small stakes to familiarize themselves with the technology and market dynamics without exposing themselves to significant risk. Likening Bitcoin to “digital gold,” he emphasized that even a $100 investment could serve as an entry point to understanding this new asset class.

This approach, he argued, mirrors the caution one might exercise when venturing into equities, where diversification and measured steps are key. For those mystified by the complexity of crypto, O’Leary’s guidance is straightforward: start small, learn incrementally, and avoid overcommitting until the landscape feels less daunting.

A New Era for Crypto Regulation and Integration

Beyond his advice for beginners, O’Leary painted an optimistic picture of cryptocurrency’s trajectory. He believes the chaotic “cowboy era” of the industry—marked by unregulated players and high-profile scandals—has largely faded, giving way to a more structured and mature phase.

With problematic actors now sidelined, he anticipates a wave of regulation that will pave the way for crypto to integrate seamlessly with traditional financial institutions. This evolution, he predicted, could position cryptocurrency as the twelfth sector of the U.S. economy, joining the ranks of established industries like technology and healthcare.

O’Leary also highlighted the current administration’s embrace of this sector, a stark contrast to what he called the “atrocious” and “aggressive” stance of its predecessor. This shift, he suggested, signals a commitment to fostering innovation and maintaining America’s leadership in the global financial space.

Safety remains a priority in O’Leary’s outlook. He urged newcomers to steer clear of decentralized, do-it-yourself approaches, warning that without proper knowledge, individuals risk falling victim to hacks. Instead, he recommended sticking to accredited centralized exchanges, for example Gemini, which are platforms with robust infrastructure and millions of users that offer a secure entry into the market.

For O’Leary, the staying power of blockchain technology, particularly Bitcoin’s unhackable foundation, underscores its long-term viability. He envisions a future where digital currencies, including a digitized U.S. dollar, streamline global transactions at a fraction of the cost, challenging traditional banks that rely on hefty fees.

O’Leary’s enthusiasm extends to the community aspect of crypto as well. He noted the resilience of this space, pointing to its ability to rebound from setbacks like the FTX collapse. Newcomers, he said, can find welcoming spaces to ask questions, engage with others, and even enjoy the novelty of using Bitcoin. This blend of education and experience, coupled with what he calls the “cool” factor of crypto, adds a tangible allure to the technology.