Kanye West Launches YZY Token on Solana Sparking Market Frenzy

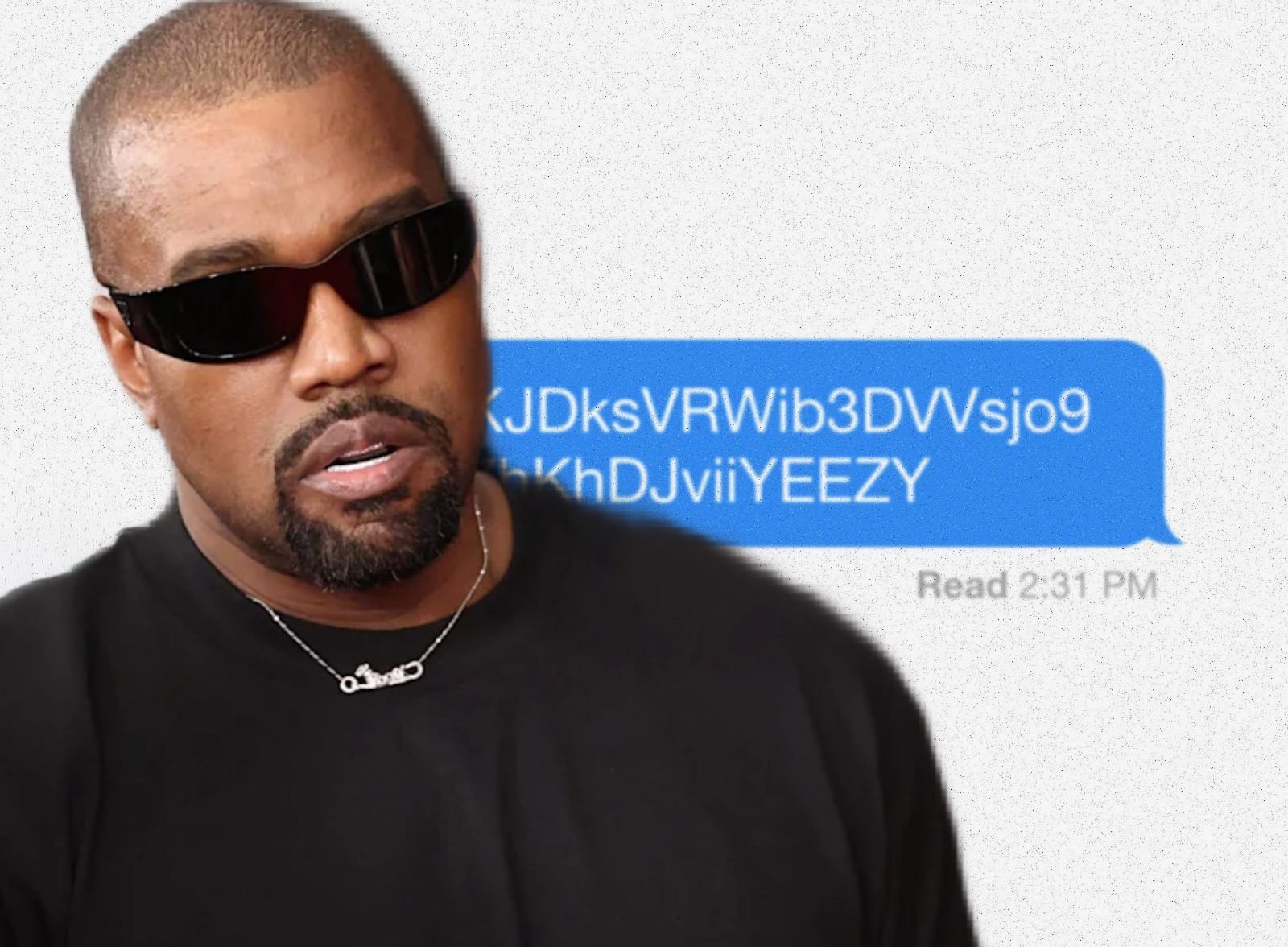

Kanye West has entered the crypto market with the launch of his YZY token on the Solana blockchain, a move that has generated significant buzz and skepticism. Announced today through a self-filmed video on X, Ye introduced the YZY token as part of a broader financial ecosystem called YZY Money, aimed at creating a decentralized payment system. The token saw a meteoric rise, briefly hitting $3.16 and a $3 billion market cap within hours, only to plummet to around $1 shortly after. This volatile debut has drawn both excitement and concern, with analysts pointing to potential insider trading and centralization issues as red flags.

Ye’s foray into cryptocurrency follows a trend of celebrity-backed digital assets, with mixed outcomes from figures like Caitlyn Jenner and Donald Trump. The YZY token, named after Ye’s iconic Yeezy brand, is designed to integrate with his e-commerce platform, bypassing traditional systems like Shopify, which severed ties with him after controversial statements in 2022. The project’s ambitious vision includes Ye Pay, a payment processor offering 3.5% lower merchant fees, and YZY Card, a non-custodial debit card for direct crypto spending. However, the token’s structure and early trading patterns have raised questions about its long-term viability and fairness.

Check it out — Kanye West launches official YZY token on Solana 👇🔥 https://t.co/PPBfv0qGTF

— Bitcoin & Crypto Alerts 🚨 (@bitcoinxalerts) August 21, 2025

YZY Money Ecosystem and Market Dynamics

The YZY Money ecosystem aims to merge cryptocurrency with everyday financial transactions, positioning itself as a competitor to traditional fintech platforms. Ye Pay enables merchants to accept both crypto and credit card payments with reduced fees, while YZY Card allows users to spend tokens like YZY and USDC stablecoin globally without fiat conversion. The token’s total supply is split with 20% allocated to the public, 10% for liquidity, and 70% vested to Yeezy Investments LLC, managed through Jupiter Lock with a 24-month vesting schedule. To combat sniping, the project deployed 25 contract addresses, with only one randomly selected as the official token, aiming to ensure fairer trading access.

Despite these measures, the launch has been marred by allegations of insider activity. Blockchain analytics firms have been reporting that certain wallets, such as one labeled 6MNWV8, had prior knowledge of the official contract address, enabling them to buy early and profit significantly. One whale reportedly turned $450,611 into $1.39 million, while another gained $6 million from a $2.28 million investment. The single-sided liquidity pool, seeded only with YZY tokens and no stablecoin like USDC, has drawn comparisons to the controversial LIBRA token, raising concerns about potential manipulation by developers or large holders.

The token’s rapid surge to a $3 billion market cap, followed by a sharp decline to $1.3 billion, underscores the speculative nature of celebrity-driven memecoins. Trading volumes spiked on decentralized exchanges like Meteora, and platforms like Bitget listed the token, amplifying its visibility. However, the concentration of 90% of the supply among the top six wallets, with 70% controlled by Ye’s Yeezy Investments LLC, has sparked fears of centralization. Critics argue this structure could allow Ye to influence price movements, echoing patterns seen in other celebrity tokens like TRUMP.

Ye’s pivot to crypto marks a shift from his earlier stance, where he criticized memecoins as exploitative and rejected a $2 million offer to promote a fraudulent project. His decision to launch YZY, inspired partly by the TRUMP token’s success, reflects an attempt to rebuild financial autonomy after losing major brand partnerships. Yet, the crypto community remains divided, with some praising the token’s potential to disrupt traditional finance, while others warn of risks akin to past celebrity coin failures. The absence of YZY on major centralized exchanges and the presence of fake tokens mimicking its ticker further complicate its adoption.

The YZY token’s future hinges on its ability to deliver on promised utilities, such as widespread merchant adoption of Ye Pay and YZY Card. While Ye’s global influence drives initial hype, the project’s high centralization and volatile trading patterns raise doubts about its sustainability. As the crypto market watches, YZY’s trajectory will test whether celebrity-backed tokens can evolve beyond speculative frenzies into meaningful financial tools.