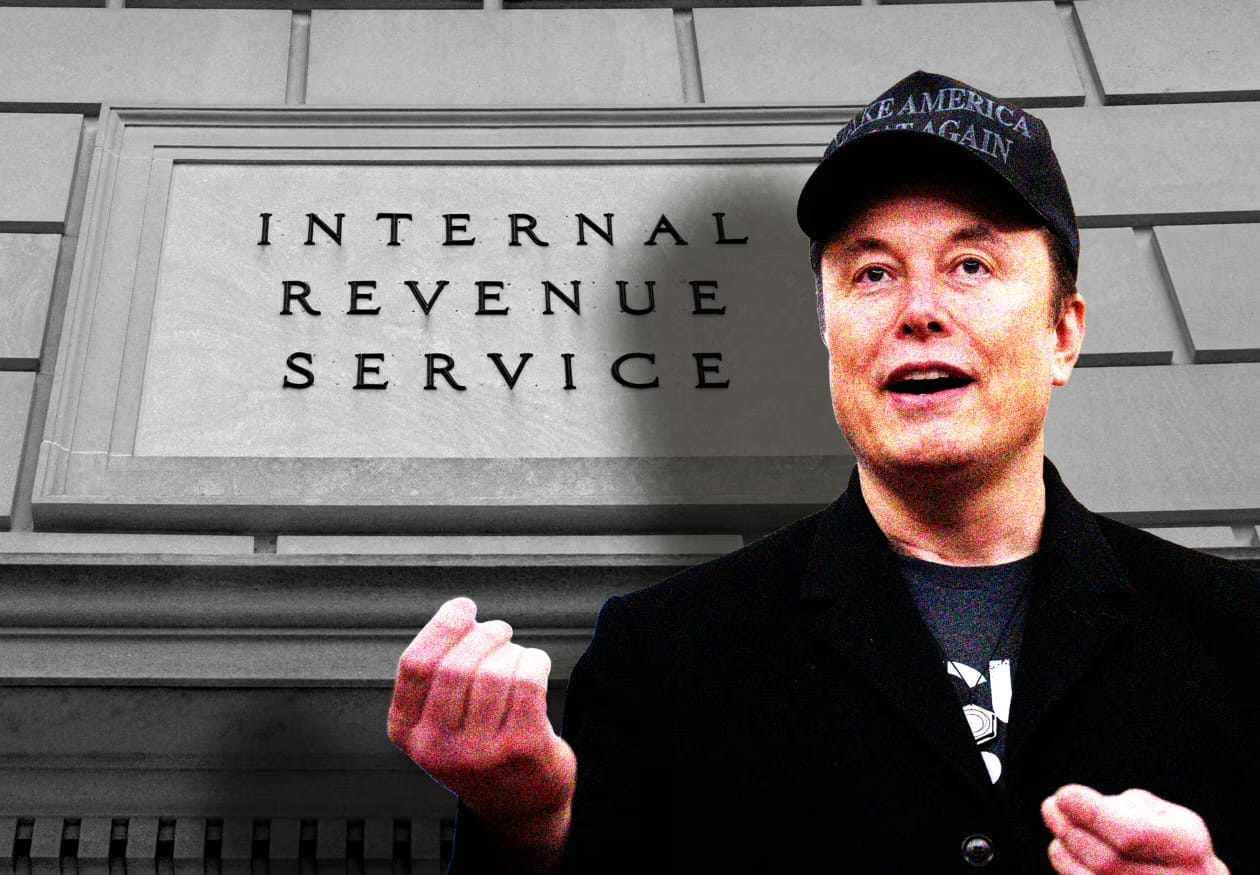

IRS Crypto Directors Depart Agency Following DOGE Resignation Offers

In a significant shift for the Internal Revenue Service’s crypto oversight, two key directors, Seth Wilks and Raj Mukherjee, have accepted deferred resignation offers orchestrated by the Department of Government Efficiency (DOGE) which is current headed up by Elon Musk.

As of Friday, both officials, instrumental in shaping the IRS’ approach to digital asset taxation, have transitioned to paid administrative leave while remaining technically employed for the coming months. This development, confirmed by two sources familiar with the matter, marks a notable change in the agency’s crypto initiatives amid broader federal workforce adjustments under President Donald Trump’s administration.

Wilks, formerly a vice president at TaxBit, and Mukherjee, who previously led tax operations at ConsenSys and Binance.US, joined the IRS Digital Asset Initiative in February 2024. Tasked with enhancing the agency’s framework for crypto taxation, they spearheaded efforts to develop reporting, compliance, and enforcement programs. Their work included collaborating with industry stakeholders and refining the 1099-DA tax form, released last summer to streamline tax filings for digital asset transactions. Additionally, they played pivotal roles in drafting tax regulations for the crypto sector, navigating the complex intersection of innovation and compliance.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishImpact of Regulatory Shifts and Workforce Changes

The departure of Wilks and Mukherjee coincides with broader changes in federal policy and IRS operations. One of their overseen rules, which mandated data collection for decentralized finance (DeFi) brokers, was finalized during the final days of the Biden administration. However, Congress overturned this regulation earlier this year through a joint resolution under the Congressional Review Act, signed by President Trump. This reversal reflects the evolving regulatory landscape for cryptocurrencies, which continues to challenge federal agencies.

The resignations are part of a larger wave of workforce reductions at the IRS, with over 20,000 employees reportedly opting into the DOGE deferred resignation program. This initiative, aimed at streamlining federal operations, places participating employees on administrative leave through September. For Wilks, who served as the IRS’ executive director of digital asset strategy and development, and Mukherjee, the executive director of the digital assets office, the decision to accept voluntary buyouts precedes anticipated staff cuts at the agency.